Like a bad penny, this tax repatriation idea just keeps coming back.

You know, the one where you offer a bribe to multinational corporations in the form of a big tax cut to "repatriate" their foreign earnings. In this case, members on both sides of the aisle are conspiring to use this gimmick to replenish the nearly exhausted highway trust fund.

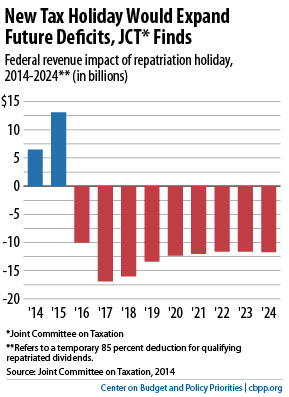

My CBPP colleagues have pointed out many times over why this doesn't work, but simply put: Repatriation can't pay for anything because it's a big, fat revenue loser. The figure below shows the score of such a plan by the bi-partisan Joint Tax Committee. The first two bars show something like $20 billion initially flowing into the Treasury as foreign earnings are brought home at an 85 percent discount on the 35 percent corporate tax rate (that's a tax rate around five percent: (1-.85)*.35).

But after that, the temporary tax cut starts losing revenue, and for an interesting reason: Multinationals ramp up their deferrals of foreign earnings (holding them overseas) in advance of the next tax holiday. The "holiday" terminology is interesting, btw, because a bunch of these alleged revenues have already been on holiday, sunning themselves in Caribbean tax havens. From the second link above:

The evidence indicates that a significant share of the profits that multinational corporations book in low-tax foreign jurisdictions is, in economic terms, attributable to domestic economic activity -- that these "overseas profits" were, through complicated accounting maneuvers, shifted overseas on paper specifically to avoid U.S. corporate taxes. A valuable new report... shows that, during the first repatriation holiday in 2004, seven of the 19 surveyed corporations received over 90 percent of their repatriations from tax haven countries. A second holiday for repatriated profits would enable firms that have avoided U.S. taxes in this way to bring sheltered earnings back at a greatly reduced tax rate -- encouraging them and other firms to shift more income earned from investments in the United States and other non-low-tax countries to offshore tax havens.

By 2024, the Treasury is out at cumulative total of $96 billion.

I'm gonna go out on a limb here and assume you agree that you can't pay for something with something else that loses almost $100 billion in revenues. Yet, clearly our transportation infrastructure needs some serious upkeep, and just as clearly, we really don't want states to start laying off construction workers (from the New York Times):

...by the week of July 18, the [highway] trust fund's nest egg would dip below $4 billion, the 'prudent balance' trigger that would force the Department of Transportation to tell states to begin slowing construction projects. By next year, every cent of fuel tax receipts would have to go to projects already underway, blocking any new repair or construction projects, and possibly slowing an already incremental economic recovery.

That line about fuel receipts refers to the funding source of the highway trust fund: the 18.4 cent/gallon federal gas tax, about 85 percent of which is spent on highways. That tax has been frozen at that level for over twenty years, with no adjustment for either inflation or the improved mileage of the fleet of cars and trucks on the road.

This nice bit of work from ITEP suggests that such adjustments, had they begun in 1997, would by now have led to increase of just under 11 cents, with 80 percent of that coming from the price increases of building materials and the rest from improved mileage. They calculate that by 2013, this phase-in would have added about $4.70/month to the spending at the pump by the average driver.

Here's the thing: to believe you can pay for essential public goods by cutting taxes on multinational corporations is a fantasy that no responsible grownup should maintain. Whether it's roads or anything else, we cannot pay for something with a tax cut that loses $100 billion over 10 years. I know I'm not running for office but how radical is it to assert that if we want infrastructure, we have to pay for it? Raising the gas tax is the obvious solution, but if you want to find the revenues somewhere else, be my guest. Just don't kid yourself that a "holiday" for overseas corporate profits will do the trick.

This post originally appeared at Jared Bernstein's On The Economy blog.