The INDEX: Award inspires designers and business leaders to pursue breakthrough innovations for some of the world's major challenges. However, is the INDEX: Award selection process conducive to identifying breakthrough innovations that will make their way toward successful implementation?

Among the finalists from proven innovative businesses were home batteries from Tesla, cardboard 3-D glasses from Google and a flexible living space from IKEA. Concept finalists representing lesser-known businesses included a man-made leaf by Silk Leaf, a waste credit market by New Hope Ecotech and a cheap paper microscope for identifying illnesses by Foldscope.

The INDEX: Award applies Impact, Context and Form as criteria for first selecting the finalists and successively the winners. Using only three criteria, applicants, by nature, will be very close in performance. The INDEX: Award jury seems to reach an agreement relatively quickly on which designs have the biggest impact and fit within a certain context. However, when it comes to creating consensus on form (styling/aesthetics/expression), the selection process becomes a bit gnarly. This corresponds well to studies at Stanford showing that both design experts and other experts disagree more than laymen on what is good design.

The difference in scores between the fiftieth finalist and the twenty to forty runner-ups vary within the accuracy of the scoring system. Multiple filters are subsequently used, such as novelty, newsworthiness and the desire to have a wide range of different designs in the mix and not simply many similar designs.

How does one translate INDEX: Award worthiness into investor attractiveness? Studies done by the Cass Business School in London of sixteen venture capital (VC) firms from Europe and North America ranked the following six elements, in order of importance, as those most critical to investors:

- Management Team (24%)

- Market Drivers (22%) - Design has direct influence

- Product (17%) - Design has direct influence

- Scalable Business Model (15%)

- Commercial Proof of Concept (14%) - Design has direct influence

- VC specific factors (8%)

Of these six elements, design has a direct influence on three of them, representing fifty-three percent of the overall importance. Therefore, one would expect the design award selection process to be good at identifying candidates for VC investments.

To assess how the INDEX: Award differed from other more business focused global awards we scored a sample of two hundred applicants. This allowed us to estimate the design's business value, as assessed by design quality, market, technology and execution risk.

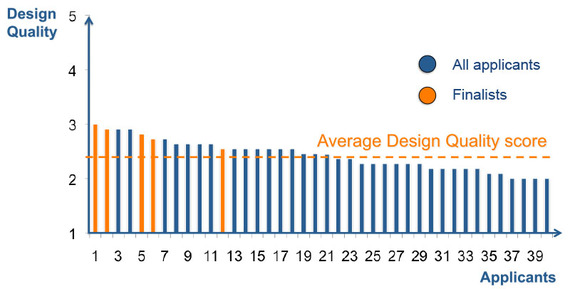

When applying the nine Design Quality Criteria (Strategy, Structure, Innovation, Social/human, Environmental, Process, Function and Expression) the five percent finalists outperform the other applicants and the INDEX: Award, therefore, acts as a good indicator for investment worthiness. However, the difference between the finalists and the closest runner-up were no more than a few percent. This means that when looking for investment worthy designs, expanding the scope of search beyond the top fifty finalists can help to identify more suitable investment candidates.

What really distinguished all applicants and finalists was their appetite for combined market and technology risk. Finalists take on an average of eighty five percent risk, while; in general, other applicants only take on seventy eight percent risk. What makes finalists novel, newsworthy and inspiring is, of course, their breakthrough innovativeness, which corresponds to risk taking.

From an investment point of view, the question is whether this risk is too high for a VC's taste and, as it happens, studies in Design Driven Startups recently conducted with Stanford and Innovate Pasadena show that the finalists are ideally located for the VC investors' risk appetite.

Combining an assessment of design quality and riskiness of an INDEX: Award applicant is thus a good proxy for a design's investment worthiness, addressing over half of the investors' evaluation elements.

What remains to be assessed, is whether the teams behind the finalists' concepts are able to execute their concept and if the designs are scalable. At this stage, a pilot, studying the teams in action would be most informative since studies show investors misread teams fifty-three percent of the time - performing worse than a coin toss.

Technology and execution risk metrics present a strong avenue for identifying venture capital investment opportunities. Turning high impact designs into reality by applying a vetting process consisting of design award, design quality criteria and market-technology risk could offer a significantly more reliable approach to vetting VC investments.