If you're looking into refinancing your student loans, one of the big decisions to make is choosing between variable and fixed rate loans. There are several factors to keep in mind when making that choice that aren't immediately obvious, so let's break them down one at a time.

Variable Rates

A variable rate loan is exactly what you might expect: a loan where the interest rate can move up or down over time. But what exactly causes them to be variable? Variable rates are generally pegged to LIBOR, (the London Interbank Offered Rate) which is the average interest rate one major bank will charge another major bank when borrowing.

As it happens, LIBOR has been at near-historic lows for the last few years since the financial crisis in 2009 translating into correspondingly low variable rates you'll see when refinancing your student loan. If you look at the offerings of major student lenders, variable interest rate loans are often set a couple of percentage points lower than fixed rate loans because borrowers are taking on an interest rate risk in the event that LIBOR rates rise. This means that if you choose a longer repayment term, there's no guarantee that whatever excellent rate you get today will stay the same in 15 years or even 5 years. It's difficult to imagine that rates will drop much lower than they are now, meaning that interest rates will most likely rise in the future. The longer a repayment term you select, the larger the risk that your variable rate will rise during the term of your loan. Some variable rate loans have caps on how high the interest rate can reach, and it's definitely worth taking that into account when making your decision.

Fixed Rates

Compare that to a fixed rate loan. In a scenario where you choose a fixed rate loan, you accept a slightly higher interest rate now, but are guaranteed that no matter how much those variable interest rates might fluctuate, your rate will not change for the life of your loan. It's a more conservative option than a variable rate and can be a solid choice in certain situations.

What Does It All Mean?

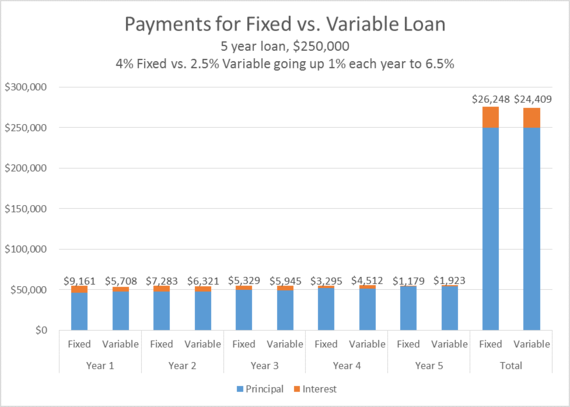

The next step is taking all of this into account and figuring out how it should affect your own student loan refinancing. Since variable rates are so low now and are likely to rise in the future, a variable loan is probably a good choice if you are planning on repaying your loan quickly and if you are in a good position to take on some interest rate risk. Let's take a look at the case of a newly minted anesthesiologist (with an average starting salary of around $250,000). She opts to devote the first few years post-residency to paying off her medical school student loans as quickly as possible. After exploring her options, the best fixed rate she is offered for a 5 year term is 4.0% compared to a 2.5% variable starting rate she could also choose. For the purposes of this illustrative example, let's assume rates move up very quickly such that her variable rate would rise by 1% each year eventually reaching 6.5% in year 5:

The chart above illustrates how much the borrower pays each year, broken up into interest and principal (orange and blue). As you can see from the last bar, the borrower paid $1,800 more in interest on the fixed than on the variable, meaning that a variable rate is the better choice even if we assume rates go up 1% each year all the way up to 6.5%.

Let's go through the details to see why. In year 1 of the loan, interest makes up a much larger percent of the payment-the principal remaining is high and so is the interest. Over time, however, as principal is paid down, the amount of interest owed goes down such that the interest has a smaller impact to the borrower and to the total amount paid. While this borrower is paying a higher interest rate in years 4 and 5 on the variable rate plan, the bulk of her original loan has already been paid off and so the interest makes up a smaller percent of her payments this late in the loan. The real savings from choosing the variable rate come at the beginning of the loan when the lower variable interest rates in years 1 and 2 results in high interest savings that are only partially negated by the higher rates in years 3, 4, and 5. Ultimately, our anesthesiologist saves almost $2k by selecting the variable rate plan because of the lower rates when the loan balance was at its highest. In addition, if rates do not move up as much or are slower to rise than the above example, the interest savings could be even higher for this anesthesiologist.

So what's the conclusion of all this? With rates as low as they currently are, there has never been a better time to refinance for many borrowers looking to repay their loans. A variable rate may be a good way to save even more, even if rates go up significantly over time. One big note of caution, however, is that the payments on variable rate loans could go even higher than projected in the chart above, and as such a variable loan should only be taken on by borrowers who expect to have future income that will allow them to make higher payments if rates do go up very high and very fast. When making a decision about what type of interest rate to choose, you need to consider how aggressive you can be in repayment, how much risk you are willing to tolerate, and your overall financial situation both now and in the future. If all of those do not align, a fixed rate student loan refi might be a better option for you.

About Aryea Aranoff

Aryea works on strategy and operations at DRB Student Loan, a market leader in student lending. FDIC insured and established in 2006, DRB has helped thousands of professionals with graduate and undergraduate degrees across the country refinance over $1.1 billion in federal and private school loans saving borrowers thousands of dollars each.

For more information about DRB, visit https://student.drbank.com/.