The breakdown of S&P 500 returns by sector is once again telling us something. This time the breakdown is confirming what the incoming economic data over the past several weeks has been saying all along: global economic growth is slowing.

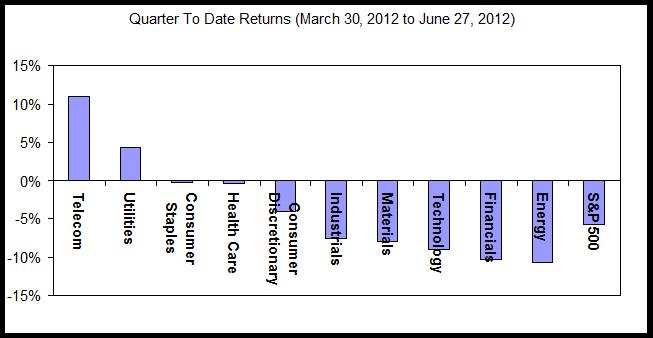

In the table below, we show the performance of the ten S&P 500 sectors for the quarter-to-date (March 30-June 27). While the overall index has performed poorly for the quarter (down 6%), the most defensive sectors have not done too bad. Telecom and Utilities stocks posted solid gains, while Consumer Staples and Health Care stocks well outperformed the overall index with relatively flat performance. The trouble has come from the highly cyclical and economically sensitive sectors, including Energy, Financials, Materials and Industrials. Each of these sectors posted losses ranging from 8% to 11%. The Technology sector has also performed poorly (-9%), and we would attribute these declines to receding hopes of global economic recovery as well.

Why is it important to periodically look at returns by sector? Because the stock market is a discounting mechanism, offering us clues about the future direction of the economy. In other words, stock investors base their decisions on factors that will influence the future earnings power of companies. The aggregate sentiment about these factors is generally a pretty good indicator of future economic developments (if you believe the Efficient Market Hypothesis). On the other hand, the economic data we receive daily from various government and other sources generally covers past periods of time.

One quarter's stock market performance is not enough to formulate an economic forecast. However, the stark contrast in performance among S&P 500 sectors is a pretty good indication to us that market participants believe the global economic malaise will continue for a while. This conclusion confirms our long-held belief that we are in for a long period of slow growth as consumers and governments in the developed economies reduce debt and repair balance sheets. As such, we remain committed to high-quality, blue chip companies that generally hold up better in times of economic uncertainty.

Graph generated by Michael Farr using from data from Bloomberg/Standard & Poor's.