It has been puzzling many major economists, including Nobelist Paul Krugman, Obama advisor Larry Summers, and Minneapolis Fed Chair Narayan Kacherlakota, why Janet Yellen's Fed is still talking about raising interest rates when current inflation numbers are so poor, as well as future growth projections.

In fact, the numbers are poor enough that the only beneficiaries of a rate rise at present would be Republican Presidential candidates, since past history shows economic growth would slow even more if interest rates were raised at this time of low inflation, and so favor the Republican Presidential candidate, whoever it may be.

And maybe that's the reason Republicans continue to criticize anything the US Federal Reserve does, even though most economic growth since the Great Recession has been due to the Fed's ultra-low low interest rates that has kept the cost of borrowing anything low. It could enhance their chances next November.

But what is the Republican Party these days? In fact, there seem to be very few true conservatives left in the Republican Party. The definition of a conservative, after all, is to preserve the status quo, not to attempt to return to a distant past that never existed. And so what is left for the Republican Party to do if they can no longer agree on a viable policy to govern? Oppose governing itself.

Even former Fed Chair Ben Bernanke has been irked by right wing conservatives for doing just the thing that most conservative economists, such as Martin Feldstein, and even arch-free market theorist Milton Friedman, said was the right thing to do during recessions--inject more money into the economy.

""[T]he increasing hostility of the Republicans to the Fed and to me personally troubled me, particularly since I had been appointed by a Republican president who had supported our actions during the crisis," he said in his new book, The Courage To Act. "I tried to listen carefully and accept thoughtful criticisms. But it seemed to me that the crisis had helped to radicalize large parts of the Republican Party."

"An aggressive Fed policy was the conservative alternative to the Keynesian idea that government spending and deficits were needed to counteract a severe economic recession," says former George HW Bush Treasury official Bruce Bartlett. "But what happened is that the conservatives rejected both monetary and fiscal stimulus, in effect endorsing the "Austrian" view propounded by Friedrich Hayek and others that the government should do nothing and just let economic imbalances right themselves."

Conservatives continue to blame the Fed as well as President Obama for the huge budget deficit from the Great Recession. They blame the wrong policies, however. A 'deficits-don't-matter' rehash of Reagan economic policies (i.e., trickle-down, or supply-side policies) injected record amounts of monetary and fiscal stimulus into the economy (via low interest rates and record tax cuts) during the Bush-Cheney Presidency, but then the Bush Administration allowed financial institutions to run amok, lending with no regard for equity or credit ratings.

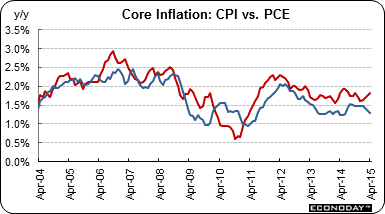

Janet Yellen's Fed delayed their announced rate raise in September because their growth projections for the rest of 2015 and beyond have been downgraded, in part because inflation is still too low for sustained growth. And now both the Fed and IMF are projecting a worldwide economic slowdown.

The Fed staff's view was already gloomy. A mistaken leak this summer by the U.S. central bank revealed, before the Fed's June policy committee meeting, potential growth averaging just 1.74 percent over 2015-2020, according to the document now on the Fed's website. That's down from an average growth rate of 3.1 percent over the past 50 years. Ordinarily, those predictions would not be released for 5 years, says the Fed.

In fact, Minnesota Fed President Kacherlakota believes interest rates could be dropped further to stimulate more growth in a recent speech.

"I don't see raising the target range for the fed funds rate above its current low level in 2015 or 2016 as being consistent with the pursuit of the kind of labor market outcomes that we are charged with delivering," Kocherlakota said Thursday in remarks prepared for a speech in Mankato, Minnesota. "Indeed, I would be open to the possibility of reducing the fed funds target funds range even further, as a way of producing better labor market outcomes."

Does future growth look so bad? We think not, since cheaper goods and energy prices should help households and most businesses. Signs of slower growth would please Republicans, of course, who continue to maintain Democrats have done a lousy job of governing (in spite of a 5.1 percent US unemployment rate). How so, when the Republican alternative is not to govern at all?

Harlan Green © 2015