Chairman Ben Bernanke attempted to answer that question today at his post-FOMC press conference. He said economic growth has slowed and so the Fed has reduced its growth projection to 2.0 to 2.30 percent for the year. But the real reason is much of the country is still in recession, with elevated unemployment rates and the lowest labor participation rates since World War II.

But another reason may be that Janet Yellen is now Bernanke's heir apparent as Fed Chairman, since Larry Summers dropped out of the running. And Dr. Yellen has been his strongest supporter of the QE programs as Vice Chairman. Professor Bernanke looked relieved at his press conference with a 9-1 vote supporting the decision to maintain QE3 purchase levels, referring several times to the success of QE3 and earlier easing programs that have boosted the real estate and the automotive industries, in particular.

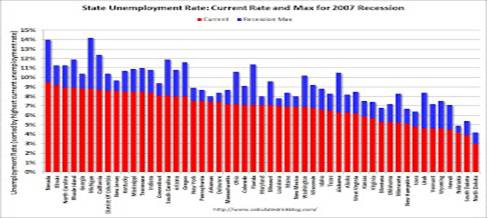

Basically, 21 of the 52 states are still above the national 7.3 percent unemployment rate, according to the U.S. Census Bureau. In fact, 28 states and the District of Columbia had unemployment rate increases, eight states had decreases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today.

Nevada had the highest unemployment rate among the states in July, 9.5 percent. The next highest rate was in Illinois, 9.2 percent. North Dakota continued to have the lowest jobless rate, 3.0 percent.

The Fed now predicts inflation will remain under 2 percent until 2016, well below its 2.5 percent threshold, as measured by the PCE index. In its latest economist forecast, the Fed predicts an inflation rate of no higher than 1.2 percent in 2013, rising to a range of 1.7 percent to 2 percent by 2016, said Bernanke.

Bernanke also gave another reason to maintain QE3 in response to a question whether such programs had harmed emerging market economies with such cheap U.S. dollars fuelling some of their own asset bubbles. He said that boosting U.S. growth would boost growth worldwide, since a healthy U.S. economy was still the main engine of growth for the world economy, while the White House and Congress were doing nothing to boost growth or create jobs. So he and the Fed had no choice to continue as the only engine of U.S. growth.

Harlan Green © 2013