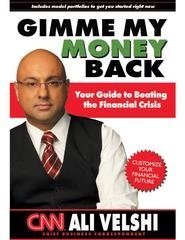

Ali Velshi is CNN's chief business correspondent and host of Your $$$$$, CNN's weekend business roundtable program. During the recent financial crisis he emerged as a leading voice in journalism, being heard regularly on CNN, CNN Headline News, CNN Radio, CNN.com Live, and on his own Podcast. In his new book Gimme My Money Back (buy a copy here), Velshi writes about how to begin earning back the money you lost over the past year. I spoke to him about the book and what it has been like to be a reporter during this financial downturn.

Kuhn: I don't need to tell you what a crazy year it has been for the economy. Looking back, what was it like covering the financial meltdown for CNN?

Velshi: It was truly surreal. Over a 19-day period in September and October things were degenerating at a pace that my colleagues and I had never seen. And the worse it got, the more panicked the calls and emails from our viewers became. So we had to make a concerted effort to maintain an even tone with our reporting; emphasizing how serious the developments in the credit crisis were, while not inciting panicked reactions that could force our viewers into decisions that would hurt them financially. Each day was a mix of decoding complex financial developments, and looking at the detail of how we report them, down to the text that would appear at the bottom of the screen. We made a decision heading into this crisis that we were going to break every development down and explain what was happening.

Covering this crisis from a reporter's standpoint, what have you learned during that you wish you knew in the beginning of this year?

If I had seen the depth of the crisis coming, I would have written Everything You Never Thought You Needed to Know About Money (But Were Afraid to Ask). And by the way, I would have written it for myself. Truthfully, what amazed me, and what I didn't know beforehand was how badly the American consumer would be shaken by this crisis. I have often expressed my amazement at the resilience of the American consumer. But the combination of high gas prices, the freezing of credit and the absolute and utter collapse of confidence in Washington's ability to deal with this crisis sent the consumer into hibernation as we have never seen before. We knew the US economy was dependent on the US consumer; now we know how much of the world has grown dependent on the US consumer.

What do you make of your competitors, such as Fox Business and CNBC, who also cover the same major financial stories? How is your reporting on CNN similar and different?

This was a challenging year for anyone covering business at any outlet. I admire my colleagues from the other networks for shedding any pretense that this was familiar and knowable, working to extract every bit of analysis that could be had to make sense of the crisis, and packaging and sharing that analysis with their audiences. At CNN we left the high-level business analysis to the shops that specialize in that; we focused on making what was happening make sense to our viewers, and then relating that to our viewers so that they could take action to protect their investments, their home or their job. But it was comforting for me to know that, at whatever level Americans wanted to get information about this crisis, it was available.

There are so many voices out there now suggesting different strategies on what people should do with their money during this financial crisis. What makes your book different?

My book speaks directly to the phone calls and emails I took at CNN during the last few months. It addresses the very specific questions and concerns that we were getting from people all over the country. What I learned was that people who had an otherwise solid understanding of current events and the world, had a generally much shakier understanding of the working of the financial world and, in particular, of their own financial situation. This book is not broadly about personal finance; it is specifically about saving and investing. Basic principles. There are many excellent books out there. You'd buy mine so that you can spend three of four hours reading it, then go right to your computer and adjust (or start) your retirement plan.

What is the most important thing you want a reader to take away from Gimmie My Money Back?

You have to invest to beat inflation over time, and you have to understand some basics of investing. Once you do, you can spend just a few hours a year on it, and retire well. But you need to spend a little bit of time thinking about your future, and the earlier the better. About half of all Americans are directly invested in the stock market (most through mutual funds in retirement savings accounts), yet most people don't think of themselves as investors. My goal is that after reading the book, you can identify as an investor, and feel comfortable with the idea.

Cincinnati Enquirer Business Reporter John Eckberg described your book as "upbeat." Is that the message you want to send to your viewers and to those who read your book? Why?

Because it is about opportunity. The losses on the stock market in 2008 are staggering. The Dow was down almost 34%, the S&P 500 almost 39%, and the NASDAQ more than 40%. For most people, even if you invested in mutual funds and followed all the rules and diversified your investments, you would have lost this year, and lost badly. History proves that there is opportunity in this mess. There are still six billion consumers on earth and recessions happen. If you got burned by the markets, you owe it to yourself to participate in the recovery. People who work to overcome their fears will do well in the market ahead.