Back in the early 1990's investment advisor Joseph (Jay) Bragdon noticed the emergence of a new genre of company that was more adept at learning and more profitable than the corporate mainstream. Rather than following the corporate norm of prioritizing the growth of capital assets, the new model placed a higher value on living assets (people and Nature) on the premise that living assets are the source of capital assets.

To determine whether this difference in corporate philosophy and culture had meaningful advantages over the older system he created an investment research "learning lab" of 60 companies. In constructing the lab he aimed to identify firms in every major industry/sector that modeled best practices of living asset stewardship.

From the beginning his goal was to determine whether the sixty selected for such stewardship and higher purpose would outperform their peers. The short answer to this is 'Yes!' As his research progressed he found these leadership companies had attributes that mimicked life, and the deeper they went into modeling those attributes, the more profitable they became. This was a revolutionary discovery and it is the theme of his new book: Companies That Mimic Life: Leaders of the Emerging Corporate Renaissance.

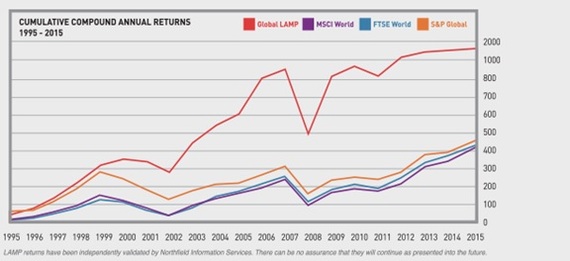

As with his first book, Profit For Life, which introduced the 60-company learning lab -called the Global Living Asset Management Performance (LAMP) Index - all investment results have been verified by the consultancy Northfield Information Services. Beyond producing outstanding returns, LAMP60 companies are also recognized sustainability leaders whose average lives exceed a century. (By contrast, the average life of companies on the S&P 500 Index is only 18 years.)

As can be seen on this graph, there is a significant difference between returns on the Global LAMP index (the research learning lab) and conventional global equity indices such as the Morgan Stanley Capital International (MSCI) World Index, the Financial Times Stock Exchange (FTSE) World Index and the S&P Global.

Companies That Mimic Life looks deeply into the core practices of the LAMP60 through seven companies that represent the best of the best in embedding Nature's life-affirming principles. Astonishingly, their cumulative compounded returns are 60 percent higher than those shown above. The book explains why this is so and invites further research into the linkages between bio-mimicry and profit.

What makes the difference?

- Values-driven decision making. Companies that mimic life value life over 'stuff'. Capital assets aren't of much use without the people to run them, optimize functionality, and invent better ways to meet customer values.

- Employees bring their whole selves to work. A wider and more diverse set of perspectives and intelligence translates into higher performance. As neuroscientist David Rock put it: 'Diverse teams are smarter and more creative.' By extension, so is the company. Heart and mind are engaged resulting in a learning mindset focused on growth, service and innovation. In contrast, companies that claim they are blocked by resistance to change are creating that resistance. Companies that live by learning are naturally adaptive.

- Social and ecological impacts are incorporated into decision making, widening the scope of positive impact and profitability well beyond conventional thinking.

- Investors (typically institutional) understand the subtle differences in how these large companies are managed. They gain less risk and significantly higher returns over time.

Managing by Means (MBM)

By putting their primary focus on life-mimicking cultures and living asset stewardship, LAMP60 companies manage by means - a practice that looks on people and Nature as the means to generating sustainable profit. In concept and practice this is radically different from the bottom-line-first method of managing by results (MBR). This is not to say that the bottom line is unimportant to companies that mimic life. Rather, as Peter Drucker famously said "Profit is not the explanation, cause or rationale of business behavior and business decisions, but rather the test of their validity."

From MBM to Regenerating Health

Fundamentally the leaders of companies that mimic life know that by regenerating Nature and society, by renewing and restoring systemic health, the health of the firm will symbiotically benefit. While this outcome may be difficult to prove by linear cause and effect reasoning, it is amply proved by shareholder returns (which inherently recognize the non-linear synergies and multiplier effects that occur in healthy systems).

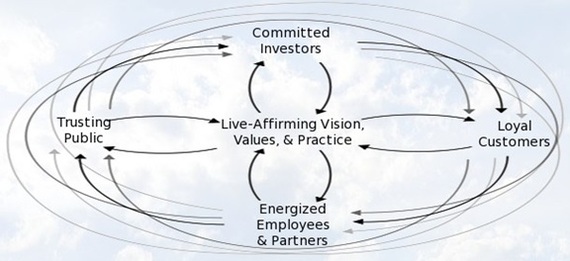

The operational lever here is a reinforcing cycle of living asset stewardship (care), whereby uplifting corporate values and goals inspire employees to learn and innovate, and where such innovation, in turn, generates incremental sales and profit. The cycle repeats as profit returns to reinforce living asset stewardship.

What are the common features of companies that mimic life?

According to Bragdon's research, six qualities set these companies apart. Like all life, they are:

- Highly networked and decentralized (like the cells in our bodies)

- Regenerative in the ways they pass on their cultural DNA

- Frugal in their use of energy and resources (to avoid waste and entropy)

- Open to feedback as a means of learning and adapting to new conditions

- Symbiotic in their relationships with the ecological and social systems in which they exist

- Highly conscious of the limits and possibilities within those larger systems

The seven company Focus Group

The seven companies profiled in Companies that Mimic Life were selected for being living asset stewardship exemplars in industries that are usually associated with the older practices of industrial capitalism and bottom-line-first management.

By taking this counter-intuitive approach, readers will discover that life-mimicking cultures often work best where reform is most needed. With that in mind, the following seven companies make fascinating stories:

- Nucor is cited for reinventing the steel industry. By treating employees, rather than corporate executives, as the creative center of the company, it has become the innovation and green leader of the industry with no R&D department. With no layoffs due to lack of work, it has been profitable in all but one of the last 50 years - an unprecedented achievement in its sector.

- United Technologies, an industrial conglomerate, is cited for its MBM practices and its visionary goal of reducing the carbon footprint of urban living and travel. To realize its systems thinking capacity, it pays for full tuition and books for all employees who wish to pursue a university degree with no strings attached. Degrees in philosophy and the arts are as valid as those in business and engineering.

- Novo Nordisk, a pharmaceutical company in an industry renowned for price gouging and tax avoidance, is a global leader in corporate ethics that charges ethical prices and pays taxes wherever revenues are earned. With its environmental profit and loss (P&L) statements, it has become a corporate leader in industrial ecology and a pioneer in industrial symbiosis.

- Westpac Banking, a global top-50 bank, is an exemplar of enlightened corporate consciousness in an industry renowned for self-interest. Unlike so many of its mega-bank corporate peers, it didn't require a public bailout in 2008. In 2014 it was named the world's most sustainable company for its ethical practices - an unheard of honor in the financial sector.

- Nike, a company rocked by ethical challenges in the past, has emerged as a global sustainability leader for reducing its global ecological footprint and for widely sharing its process knowledge through open source platforms.

- Henkel, a specialty chemical company that operates on open, sharing partnership principles, is committed to a factor-3 goal of producing three times greater value from its energy and natural resources by 2030.

- Unilever, a manufacturer of household products that is committed to "double our business and outperform market growth, whilst at the same time reducing our overall environmental impact" and helping to raise the living standards of over a billion people in the developing world where it sources its raw materials.

Each of these companies conduct themselves knowing that, without caring about the planet and the people who live on it, neither life nor they can flourish. While intuitively sensible, the research summarized in Companies that Mimic Life provides the empirical evidence needed to support his thesis that working in harmony with Nature and society is not only necessary for the future of life on earth, but is also the most profitable way forward. Not only is this reassuring, it also offers a clear direction for companies who know their success is dependent on the quality of the relationships with their customers, the communities they serve and the environment.

Dawna Jones sees the underlying forces impacting what you see on the surface. She works with leaders and decision-makers to update skills and expand access to their wider intelligences. Working with individuals, teams, companies or at a global level gives Dawna insights into scaling mindset, innovation and transformation through leadership and decision-making. Contact Dawna on her website or follow her on Twitter.