We know how fragile is the U.S. economic recovery just from the past 48 hours, because both U.S. and Japanese stock prices plummeted and interest rates jumped, on a seemingly offhand remark made by Fed Chairman Bernanke in congressional testimony that a reduction in the Fed's QE bond purchases could begin as early as June.

Bernanke has said earlier in his testimony that

"A premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further."

It's just that such a seemingly offhand shouldn't upset markets both here and in Japan, if there was confidence that stronger recoveries were in hand. Instead, it seems there is little confidence that the U.S. in particular will maintain its stimulus programs for a long enough period--at least until the unemployment rate drops to the Fed's stated goal of 6.5 percent from its current 7.5 percent. That would bring the U.S. closer to full employment, though still a long way from the 5 percent rate that is considered to be full employment by most economists.

And prematurely ending government stimulus of any kind after what Paul Krugman calls the Lesser Depression (rather than Great Recession) is a lesson we have learned in the past, then seemingly unlearned when so-called 'Austerians', small government conservatives who believe cutting government spending is the way to cure a recession, grab the spotlight.

The 'greatest' lesson was learned in 1937, when Roosevelt listened to a newly elected Republican Congress that demanded a balanced budget and end to government spending. The result was the U.S. economy plunged back into what became the Great Depression that lasted until World War II defense spending ended it.

It has also been unlearned in Europe, where today small government Austerians are in control, having slashed government spending, causing unemployment to soar and plunging the euro zone back into recession.

So the danger is that history might repeat itself in the good old U.S. of A., if the minority of Federal Reserve Governors mentioned in the latest release of Federal Open Market Committee minutes that favor an earlier demise of QE purchases get their way.

Why is the U.S. recovery still so fragile? It's not only because 18 million workers either have no job or work part time. It is because prices are not rising. And when companies can't raise their prices, they don't hire more employees. That is to say, our inflation rate is too low and continuing to fall.

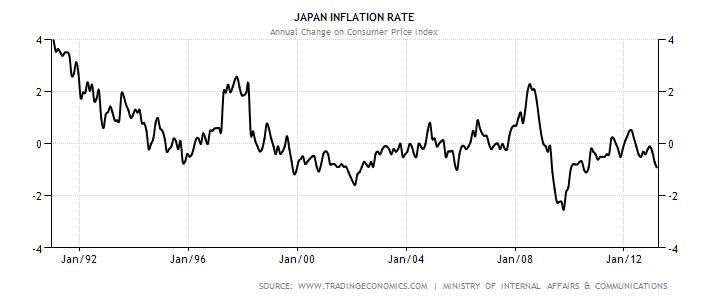

The danger of falling prices is the other lesson 'unlearned' that has been experienced by Japan over the past 2 decades. Japan has been in a deflationary spiral where wages as well as prices have been falling, the result of prematurely ending its own stimulus programs. The result is the Japanese standard of living has fallen as its economy has been shrinking.

Only now under new Prime Minister Shinzō Abe is Japan practicing Quantitative Easing, or the purchasing of its own securities by its Central Bank. Paul Krugman says those in Europe and the U.S. who continually call for less government intervention during weak recoveries believe in what he calls the "confidence fairies", magical beings who instill confidence in future economic growth only when government budgets are balanced and inflation is low.

But that means they have unlearned the lessons of our past. For such ideal conditions only happen after an economy has recovered and government has the means to pay down its debts, having fully employed its citizens.

Harlan Green © 2013