This just in: AUSTERITY DOESN'T WORK!

It doesn't work here, it doesn't work in Europe, it doesn't work for state and local governments. I'm tempted to ask how many data points we need to recognize this crucial economic truth, but I'm afraid data points don't have much to do with it.

Another weak jobs report for April, with only 115,000 jobs added -- 130,000 in the private sector -- and a lower-labor-force-induced tick down in unemployment, from 8.2% to 8.1%.

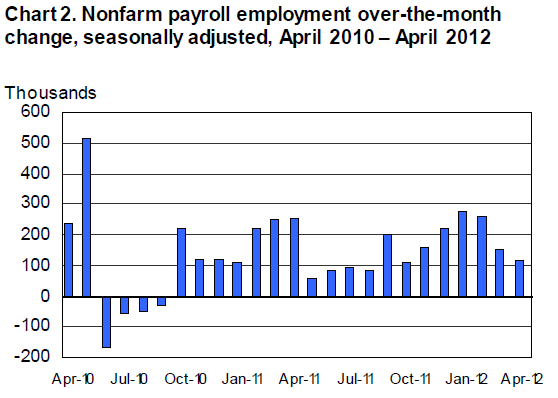

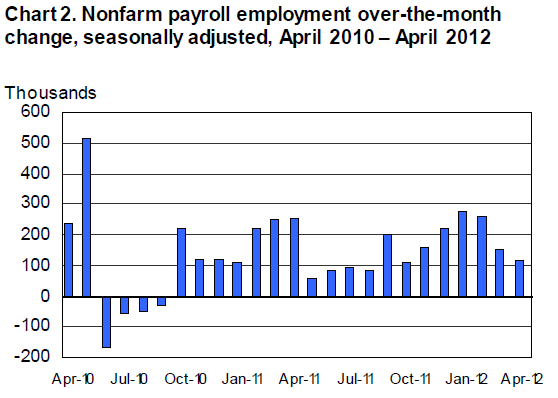

You can see the trend in payrolls in the figure below, with acceleration toward the end of last year morphing to deceleration over the past few months. After last month's disappointing report, I was careful to point out that "one month does not a trend make" and there are some technical reasons -- mostly seasonal adjustments that haven't caught up with unusually warm weather -- to consider as well.

Source: BLS

Well, two months doesn't quite a trend make either, but it's getting closer. Average out some of the monthly noise, payrolls are up 176,000 per month over the past three months, compared to 218,000 over the prior three months. So, somewhat of a deceleration on a more reliable quarterly basis. But remember, the 200k trend was just okay -- typically coming out of such a deep trough as was the Great Recession, you'd like to see much bigger monthly numbers than that.

Key points for now with more to come later:

- State and local governments continue to shed jobs. They would be my first target for stimulus in a sane world. Last month, local education jobs were down 11,000 and they're down about 100,000 over the last year. Next time your friendly politician is jawboning about a) the benefits of austerity and spending cuts, and b) the importance of education, please point out the hypocrisy.

A few bright spots worth noting: upward revisions of 53,000 to payrolls March and April and manufacturing keeps on trucking, up 15,000 last month and about 230,000 over the past year. The labor force contracted by 342,000 last month -- that's a volatile monthly number so I wouldn't make a big deal about it, but the low growth in the labor force of late and the low participation rates we've been posting are also indicative of weak demand. Wage growth remains weak, with paychecks for most workers falling behind inflation. That's the punchline, I'm afraid. Weak labor demand is upon the land, and no one in power seems willing to do anything about it.

Update: A few more observations:

- One of CBPP's Unemployment Insurance experts, Hannah Shaw, tells me the following: since the beginning of the year 17 states with unemployment rates above 6.5% have triggered off of EB (extended benefits: extra weeks of UI in high unemployment states -- learn about it here), 8 of those states have unemployment rates of 8% or higher. It's possible that some of these folks leave the job market after their benefits run out and that could be playing a role in the low and stagnant participation rate.

Hourly and weekly earnings are growing more slowly: 1.8% over the past year for average hourly earnings and 2.1% for weekly earnings. The most recent inflation reading is 2.7%, Mar11-Mar12, meaning paychecks are not going as far as they were a year ago. Nominal hourly earnings have been hovering around 2% for awhile, but increased hours of work were goosing weekly earnings for awhile, which were up around 3% a year ago. That's fading; that's bad for family budgets and for a macro-economy that's 70% consumption. I always like to take a look at the diffusion index in the monthly jobs report. It's a measure of the percent of private sector industries adding jobs, so it provides a quick look at the question of how broad-based hiring has been. Last month, about 57% of firms added jobs, compared to 65% last month, 70% in January, and less than 20% in the heart of the Great Recession. So, a lot more industries are expanding than in the worst of times, but there's been a pretty broad pullback of late.This post originally appeared at Jared Bernstein's On The Economy blog.

Support HuffPost

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

At HuffPost, we believe that everyone needs high-quality journalism, but we understand that not everyone can afford to pay for expensive news subscriptions. That is why we are committed to providing deeply reported, carefully fact-checked news that is freely accessible to everyone.

Whether you come to HuffPost for updates on the 2024 presidential race, hard-hitting investigations into critical issues facing our country today, or trending stories that make you laugh, we appreciate you. The truth is, news costs money to produce, and we are proud that we have never put our stories behind an expensive paywall.

Would you join us to help keep our stories free for all? Your contribution of as little as $2 will go a long way.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you’ll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.