I know we're all up to our necks in the spectacle of the Republican candidate debates and the last gasps of the super committee (hmm, is it possible some put kryptonite in their meeting room? Not sure that the Secret Service scans for that). But there is still an economy out there so let's (too) briefly take its temperature.

GDP growth and employment remain pretty much in slog mode; we're adding enough growth and jobs to keep the unemployment rate stuck at the much too high level of 9%. What will it take to knock it off that ugly perch? Fiscal policies that appear out of reach to our gridlocked politics. And, as shown here, the combo of high unemployment and inflation running at around a yearly rate of around 4% means real wages have been trending down, which is a problem for:

Consumer confidence and retail sales: Confidence remains low but at least in some surveys is climbing off the bottom. Still, it's shaky and could head south again if things worsen. Retail sales have actually been pretty steady, but there's a disconnect, as the figure below reveals, between, earnings and sales growth. Hmmm...spending out of savings when earnings are weak...where have I seen that before?

Source: Marketwatch

Housing: Most recent GDP reports show investment in residential homes remains at historically low levels (around 2% instead of its normal range of around 5%) but remember, this measure is bound by zero and so it's unlikely to get much worse. So the question is: have home prices finished their swoon? And the answer is probably not, at least not in areas with significant foreclosures in the pipeline. So put this down as a major slog contributor, though not everywhere across the nation.

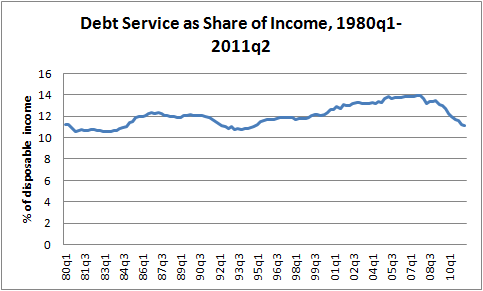

Deleveraging: We live in a 70% consumption economy -- quite different from Europe, where they consume about 55% of GDP. So if consumers are servicing debt as opposed to spending, it's hard to gain much growth traction. The sales figure above shows that you just can't keep the American consumer down, but this isn't the go-go 2000s in terms of credit markets -- and, in fact, the figure below shows household debt service continues to fall, i.e., deleveraging (the figure shows debt service as a share of after-tax income). It will take more than this one indicator to get a handle on the deleveraging cycle, but until this trend changes course, it probably means ongoing deleveraging and inconsistent, subpar consumption.

Source: Federal Reserve

Europe: I'm headed for the UK next week, so I'll have a more granular feel for this then. But for now, the problem with contagion is that it's contagious. The more the debt crisis spreads to the large economies of Italy and France, the more we're exposed in lots of ways, including our banks (which hold little southern European debt but a good deal more of France's and Italy's), exports, equity markets, and the general loss of confidence that anybody who works for an advanced economy can intelligently and purposefully attack the problems we face.

Final analysis: It's the job market that matters most -- and not just jobs, but earnings. If real GDP remains at 2.5% or less, we won't see much improvement there. Most forecasts expect growth in that range at best... very few are higher, most are lower. On the plus side, I guess, I think it's more likely we slog along than we hit an official recession, but I worry less about double dips into official recession territory than about the growth recession in which we're stuck. That, and the absence of political will to enact policy solutions are our worst economic enemies right now.

And, also on the plus side, at least we didn't talk about the supercommittee for a few minutes.

This post originally appeared at Jared Bernstein's On The Economy blog.