Saying nothing about the quality of the candidate himself, I'm increasingly struck by the economic issues the Mitt Romney brings to the table. Because of his professional background, in no small part amplified by the caustic primary debates (and OWS, and partisan dysfunction, and more), the national echo chamber is filled with debates about the bloated income share of the top 1%, the favorable tax treatment of investment income over paychecks, and whether debt-leveraged private equity firms actually add net value to the economy.

In this regard, I wanted to return to one of the points I made here yesterday: the increase in the use of "pass-through" income. One reason multi-millionaire investors like Gov. Romney face 15% tax rates is because they engage in corporate activities but avoid corporate taxes. They do so by taking advantage of policy changes that have made it easier to pass capital gains through the corporation to their personal income, where, in the case of private equity managers, they tap a double loophole. First, capital gains are taxed at less than half the rate of normal income, and second, even though these gains are really earnings for the fund managers, they get to claim them as capital gains (this is the notorious "carried interest" loophole).

As my Center on Budget and Policy Priorities colleagues Chuck Marr and Brian Highsmith wrote here:

Although businesses operating through C corporations [standard corporations] are subject to corporate taxes, the capital income of non-incorporated businesses is "passed through" to the business owners. These owners benefit from the same tax deductions and credits as do corporations, but are taxed only at the individual level. Over the past half century, and particularly during the 1980s and 1990s, states and the federal government significantly expanded the legal benefits of pass-through entities. These changes have made it easier for firms to operate through such legal structures as S corporations, partnerships, limited liability companies, and sole proprietorships -- while also benefiting from limited liability and other provisions that formerly were available only to corporations.

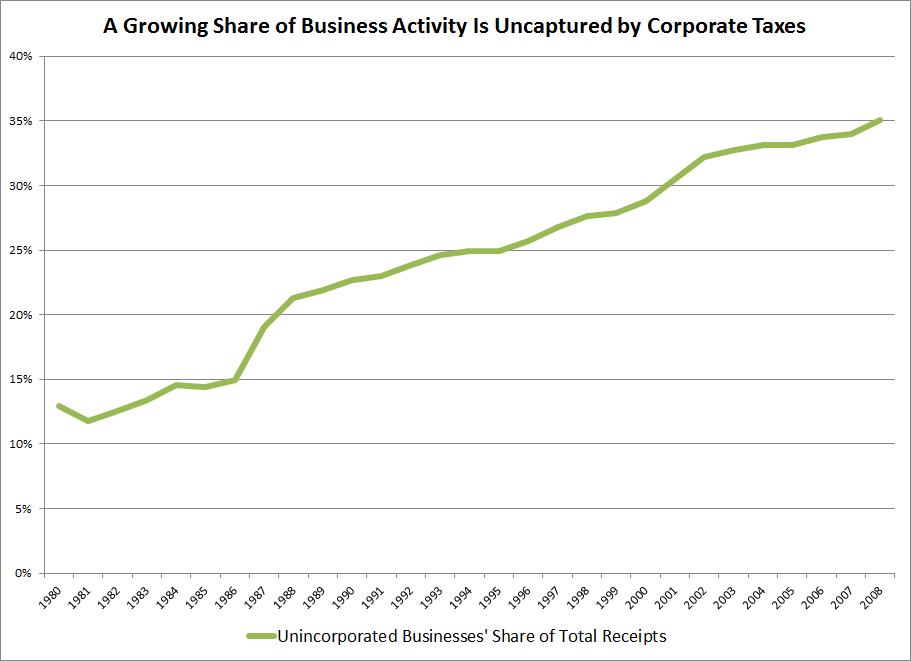

As you see in the figure, the share of receipts passed through to non-incorporated business has almost tripled since 1980s, up from 13% to 35%.

Source: IRS, (h/t: BH)

Moreover, it's a good example of what happens when you open up these loopholes. The elasticities attached to changes in tax rates are wildly exaggerated by conservatives and trickle downers who argue that the slightest increase will end the economy while any decrease will trigger boom times. The evidence belies their view in terms of jobs, investments, and growth.

But when it comes to sheltering your income (e.g., passing through corporate income to the personal side to tap loopholes like carried interest), how you structure your investment vehicles, your preference for debt over equity financing (debt financing is very much favored by the tax code) -- there you see very significant responses.

The question is, as posed above, does any of this add value -- real value -- to the economy beyond further enriching the rich? It's not a simple question and the answer is probably less obvious than it sounds. There are unquestionably examples of private equity firms that have taken over companies and discovered new efficiencies.

But neither is it a coincidence that the ascendency of this type of economic activity and the policies that support it have occurred during a period of sharply increasing inequality, weak job creation, and stagnant incomes for the middle class.

These are the type of dots we need to keep connecting as this debate progresses and we can thank the former MA governor and his opponents for introducing them so effectively.