If you ask any parent about some of the craziest things their kids have said about money, you'll get a range of humorous answers. Some of my favorites include children who think an ATM is a "magic money wall" that gives out free money or kids who think people have money if they have pockets.

But what would you do if a child came back with an answer like "boys are smarter about money" or "only boys need to know about money"? You would be pretty alarmed, right? I know I was.

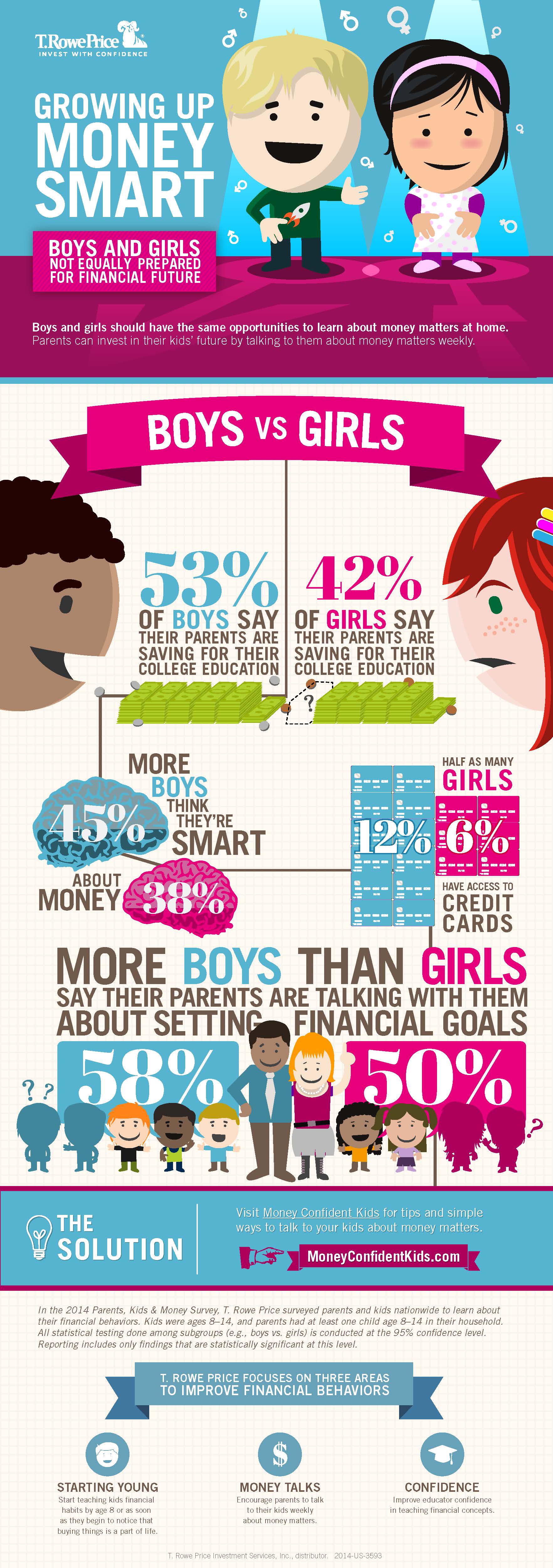

In a recent survey by T. Rowe Price, we found that, across the board, boys feel they are better prepared for their financial future.

The 2014 Parents, Kids & Money survey showed that 45 percent of boys say they are very or extremely smart about money, compared with only 38 percent of girls. And there's some evidence that their parents agree: 80 percent of parents with a son say that their child "understands the value of a dollar," but only 69 percent of parents with a daughter agree.

This surprising data should serve as a wakeup call for all parents, especially those with daughters.

As the mother of two adult children -- a son and a daughter -- I find myself looking back on the way I talked to them about money matters while they were growing up. Did I inadvertently favor my son over my daughter? Should I have talked to both of them more?

Here are some tips to make sure our sons and daughters have equal opportunities to be money savvy.

1. Have conversations with kids even if they aren't asking:

Fifty-eight percent of boys and 50 percent of girls reported their parents talk with them about setting financial goals. It's unlikely that parents are intentionally talking with boys more than girls. Perhaps boys are approaching parents with money questions more.

Regardless of whether or not that is the case, when kids aren't asking questions, parents need to proactively bring up money matters. The impact of these conversations is undeniable: 60 percent of kids whose parents talk to them about setting financial goals identify themselves as "savers" versus "spenders," compared with only 46 percent whose parents do not discuss setting goals.

2. Use everyday occurrences as teachable money moments:

Parents often miss the opportunity to talk with kids about money because they overlook everyday moments.

For instance, if you're grocery shopping with your kids, rather than just looking at the shelf and choosing the most cost-effective item, share the price comparison you make with your child. When looking for pasta sauce, maybe the brand you usually buy is $2.49 per jar, but another brand is on sale for two for $4.

Talk with your kids about the savings and why you are buying the sale item over your usual brand. Maybe this little bit of savings is going into an account for vacation -- sharing your purpose for budgeting helps kids relate to money decisions and maybe even get excited about saving for a family goal.

3. Explain "invisible" purchases to take the mystery away:

More often than you may realize, your kids are watching you make purchases in the store or online using credit or debit cards and without the exchange of cash. This can make the concept of budgeting and spending more abstract.

The Parents, Kids & Money survey showed that twice as many boys as girls report having access to credit cards -- 12 percent and 6 percent, respectively. And only a small percentage of kids pay for purchases made with their credit card, mobile device, or computer (yep, it's mostly the parents picking up the tab).

Without proper explanation, they may think that things bought with credit are free. When you get a credit card statement, show it to your kids and help them understand the "buy now, pay later" nature of credit cards.

4. Empower kids to feel smarter by talking about finance frequently:

You may be quick to have a talk with kids about making smart decisions when it comes to drugs, drinking, or sex, but what about finances?

While talking with kids about money might feel uncomfortable at first, parents should prioritize these conversations and make them a regular occurrence. Unlike discussing these hot-button topics (remember "the talk"?), money conversations aren't a one-and-done endeavor.

Parents can invest in their kids' future by talking to them about money matters weekly.

Simple conversations about the family finances can go a long way: 66 percent of kids whose parents talk about family finances say they feel smart about money, as opposed to 37 percent of kids whose parents don't frequently talk about family finances.

By opening the lines of communication and encouraging kids to ask and talk about money, you won't have to look back and wonder if you helped your kids develop a solid foundation of financial understanding. Follow these easy tips and you can help create financially smart and independent kids -- of either gender.