Journeys of a Taoist in the Business World: The Process of Change

I apologize for my absence as time slips quickly. Much has happened since our last visit, some of which you will now hear. In this session, I want to report the beginning of change. Taoists believe large movements come from small steps. A famous Taoist saying is, "The great is based on the small much begins with nothing." It is the understanding of how to enact change that is the focus of the strategist. The strategist enacts change by finding ways to get others to change their behavior. People are more likely to behave differently if they see the value in doing so.

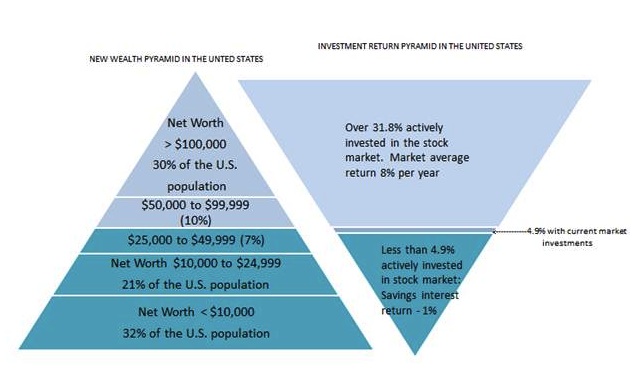

The goal of the Building Bridges to Wealth Program is to increase the investment returns of the disadvantaged. As previously reported, there is an increasing wealth gap in the U.S. between white and minority families. One reason for this increase is the nature of investments. The current nature is shown in the Figure below.

As you can see, those with a low net worth are more likely to invest in low return assets. Families with a net worth less than $49,999 comprise 60 percent of the U.S. population. Only 4.9 percent of these families are currently invested in the stock market. Of the 95.1 percent of the low net worth families who are not invested in the market, most receive interest from savings or money market accounts. Currently, the average interest paid on the 50 highest yielding savings and money market accounts is less than 1 percent. Families with a net worth of $50,000 or higher are significantly more likely invest in assets with historical returns of 8 percent or more. The wealthy are more likely to invest in assets with higher returns because of knowledge and opportunity.

The strategy of Building Bridges to Wealth is to give the disadvantaged greater access to higher return investments. We implement this by giving our graduates the choice to join our investing and savings groups. These groups give participants the opportunity to use newly acquired knowledge to increase wealth. We designed our investing strategy to reflect the four rules of investing taught in the financial literacy course. Many people are led to believe that investing is too complicated to handle on one's own. We believe this is not true. Investing can get complicated but it can also stay simple. As Musashi notes, "You must walk down the path of a thousand miles step by step."

- Use low-cost investing

- Save early

- Invest regularly

- Diversify holdings

In our last visit I described the forming of investing groups. I can now tell you of our progress in these past months. In total, our current groups have over 80 participants. They have contributed more than $15,000 across seven mutual funds. For five funds we recommend contributions stay invested for at least three years, while two funds are for investments of less than three years. All fund returns are reinvested.

Risk is a difficult concept for most individuals to quickly grasp. We help our participants by operationalizing risk as time invested. Of the five funds with a recommended minimum investment period of three years, four are equity funds and one is a real estate investment trust fund. The two funds recommended for up to three years are bond funds.

Groups meet together every other Saturday for roughly 90 minutes. We generally start with a 25 minute discussion on a selected investing topic such as budgeting or market metrics. We then tell participants how much money was contributed to each fund. We give them an updated spreadsheet showing how many shares they currently own. We do not tell them the current value of their holdings because we want them to focus on the long-term.

We conducted a pilot survey to assess the effectiveness of the Building Bridges Program. The survey was completed by 41 members of our investing groups. Most survey questions used a 5-point scale ranging from "strongly agree" to "strongly disagree." Most members had belonged to the group for roughly two months. Survey findings include the following. Percentages are based on those participants who either agreed or strongly agreed with the question:

98 percent said the program changed how they make investment decisions.

91 percent reported the program helps them better understand the stock market.

90 percent are saving more money than they were 12 months ago.

83 percent have increased the dollars invested in the stock market.

82 percent feel more comfortable with their investment decisions when investing as part of a group.

74 percent are first-time investors of mutual funds.

64 percent feel more secure about their financial future.

We interpret these results as indicating our Building Bridges to Wealth Program is influencing the knowledge, attitudes, and behavior of our participants in terms of financial literacy. This in turn is increasing the wealth they accumulate. It is the beginning of change.

In Memoriam:

Taoists believe that individuals are composed of a human body and a soul. The body is a rental of sorts since it has a finite life. Souls however live longer, so when a person dies the soul exits the body and seeks residence elsewhere. Life is a journey interacting with assorted other souls you encounter on your path.

My good friend, Robert "Bob" Cook recently passed this life. I knew Bob for over 43 years after meeting him in college. Without a doubt, Bob was the most delightful soul I have had the pleasure to spend time with. No matter how dreary the journey seemed Bob was always able to provide support and optimism. He shall be missed. I can only hope our paths cross again in the future.