Part II: New Retirement Lifescape: Work and Leisure -- a Revolving Door

This is the second in a three-part series exploring findings from "Americans' Perspectives on New Retirement Realities and the Longevity Bonus," a landmark national study just completed by my firm, Age Wave, in partnership with Merrill Lynch. The study was conducted by research firm Harris Interactive among representative samples of more than 6,000 respondents age 45 and older.

Retiring Retirement

It used to be that when you reached age 60 or 65, you expected to gracefully (and perhaps enthusiastically) leave your career behind and never work again. In fact, if you retired at an even younger age, it was a sign of success and achievement. Being free of all work obligations and entering into the "leisure class" was viewed as a great accomplishment.

Of course, previous generations had lower life expectancies, and so retirement was pretty short, spanning only five or ten years. Having this brief time to rest and relax at the end of life seemed sensible and fair --an "entitlement." But with rising life expectancy, retirement today can span twenty or thirty years or more. And that raises some very important questions.

I know that everyone needs and wants a break, but do you really want to be disengaged from productive activities for the rest of your life? Can you afford not to work at all for so many decades? Can our society afford to pay for so many retired people for so long? Are there some things about work that you will really miss? Is it possible to find a new career--maybe even a more satisfying one -- in retirement? Can retirement be a time to pursue work more on your own terms?

Work in Retirement? What For?

In our study, pre-retirees told us that not working in retirement is no longer the ideal. In fact, seven out of ten indicated they would like to include some work in their retirement years. I believe there are four important forces behind this desire to work a bit longer into retirement.

The first is financial. Many of us recognize that not working at all in retirement is truly unaffordable, and that continuing to earn some income for even a few years longer can help us be more financially secure for the rest of our lives. In fact, employment earnings now account for more than a third of retirees' incomes. And the truth is that many men and women, hurt by the volatile economy and financial markets, or who are a bit behind with their retirement savings, will have no choice but to work longer than expected.

The second is the desire to be productive. For many aging baby boomers, imagining a life of no work at all simply doesn't feel challenging or interesting enough. Our study found that almost half of pre-retirees say continued "stimulation and satisfaction" is the main reason they want to work in retirement. Research shows that people who continue to work in retirement maintain sharper minds than those who don't work. Four out of ten retirees say that work makes retirement more enjoyable, and retirees who work are almost 40% more likely to report being in good health. And, of course, since most work situations keep us connected to the attitudes and interests of multiple generations, continuing to work a bit longer is a good antidote to what I call "psychosclerosis" -- a hardening of the attitudes!

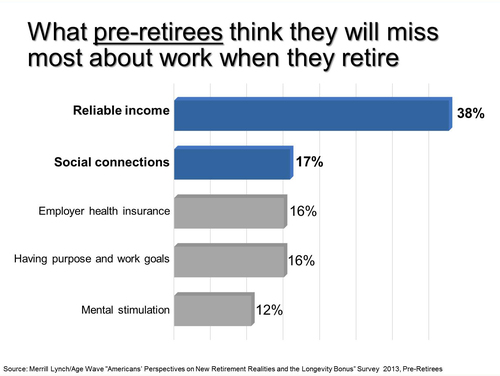

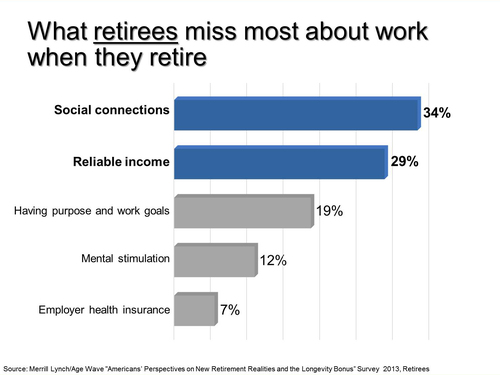

The third is friendship. It turns out that one of the most important benefits of continued work is something many of us may not even think about. When we asked pre-retirees what they thought they'd miss most about work, they said "a reliable income." However, when we asked retirees what they actually missed the most, the "social connections" trumped all other variables! (See the charts below.)

The fourth is demography. As the massive boomer generation moves into their retirement years, many employers are getting uneasy about the potential "brain drain" and are beginning to do what they can to keep the best and the brightest on their payroll -- on more flexible terms. This will trigger a growing number of innovations in the workplace that will increasingly enable us to find work that meets both our financial and lifestyle needs in later life.

A New Retirement Lifescape of Work and Leisure

Our study showed that hardly anyone wants to work full-time in their retirement years, and most people prefer a better lifelong balance between work and leisure. (I'm not so sure that my kids' generation is so fond of full-time work either!) Instead, today's pre-retirees are seeking a "revolving door" of flexible work arrangements, such as part-time work (39%) or going back and forth between periods of work and leisure (24%). Many also now view retirement as an opportunity for career reinvention, with half saying they want to try something different rather than continuing the same line of work they did in their pre-retirement years.

According to Andy Sieg, who is head of Global Wealth & Retirement Solutions for Bank of America Merrill Lynch, which commissioned this research, "Our financial advisors are increasingly finding that their clients are envisioning and planning for a retirement that is more engaged, productive and active than earlier generations. And they want to discuss not only the financial dimensions of this new stage of life but also the social, lifestyle, and health-related aspects. And an increasing number are exploring encore careers."

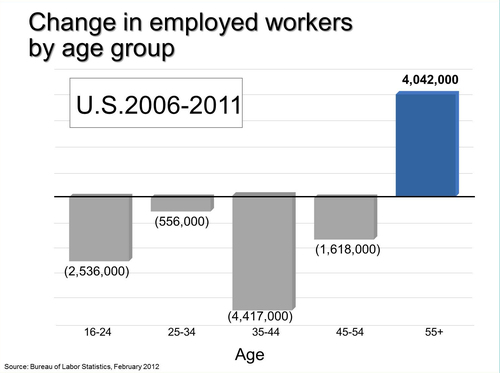

I'm sure that many of you are thinking that this all sounds just fine, but since so many employers aren't interested in older workers, it can be a bear to find a job -- any job -- if you've got a bit of gray in your hair. Well, you might be surprised to learn that between 2006 and 2011, the only age group that actually gained in employment numbers were men and women 55+, with a net growth of over four million (as you can see in the following chart from the U.S. Bureau of Labor Statistics). During the same time period, every younger cohort lost ground in the employment ranks.

Just as employers loosened up their work/life paradigm when tens of millions of enormously talented boomer women entered the workforce in the 1970s, employers are now responding to demands for greater flexibility from their maturing workers (which, by the way, are often the same cohort of pioneering women, now a few decades older and more experienced).

Are you seeking reduced work hours, or would you like to work only part of the year? Four out of five large employers now allow employees to adjust their work schedules to better fit their lifestyle needs. Want to retire gradually, instead of quitting work completely on retirement day? Half of employers now offer "phased retirement," a gradual decrease in working hours as employees transition to retirement. Are you looking to take more breaks along the way? Almost a third of employers have taken a lesson from academia and now allow employees to go on sabbaticals, get off the grid and re-charge their batteries.

Or perhaps you are tired of "working for the man (or woman)" and have a passion to start your own business in retirement. While many think starting a business is for the young, you might be surprised to learn that there are twice as many entrepreneurs over age 50 than under age 25, and nearly one-third of people who switched careers in midlife started working for themselves.

Undoubtedly, working in retirement is not for everyone, and many people will work only because they have to. But I think we are approaching a turning point where many of us are rethinking the costs/benefits of twenty years of 24/7 leisure. And honestly, you'd have to be very, very wealthy to afford it. Perhaps staying more involved and productive can help us have a more fulfilling, enjoyable, and secure retirement.

Sigmund Freud once said, "The two things that matter most in life are love and work." What do you think?

This is the second in a three-part series based on this new research. In case you missed yesterday's blog about "The #1 Retirement Wildcard," here's the link: http://www.huffingtonpost.com/ken-dychtwald/retirement-planning-new-retirement-realities_b_3211973.html. Tomorrow, I'll be writing about "Retirement in a New Era of Family Interdependencies." And, if you like, you can download the entire report at www.ml.com/2013retirementstudy/.

In addition, in case you'd like to watch me giving a presentation on the transformation of retirement (or you've got a family member or friend who's sorting their way through the challenges and opportunities of this stage of life), here's a link: http://www.huffingtonpost.com/ken-dychtwald/the-transformation-of-ret_b_3048327.html

Earlier on Huff/Post50: