Part 3 of a Three-Part Series

As I've discussed in the first two blogs of this three-part series, retirement as our parents experienced it is being retired. (If you'd like to read the two preceding blogs, click here for part 1 and here for part 2). As tens of millions of us now ponder whether and how we might work as well as play in retirement -- for the money and/or the stimulation -- it can be helpful to follow the lead of the trailblazers who are already shaping this new retirement workscape.

In analyzing the data from our just-completed study Work in Retirement: Myths and Motivation--which involved more than 7,000 pre-retirees and retirees and was conducted in partnership with Merrill Lynch -- we were able to extract seven helpful steps that many of those already working successfully in retirement reported following:

1. Start thinking about and planning for a retirement careerbefore you retire from your core career. Keep in mind that this is an opportunity to explore new paths, so think about what you would really enjoy doing. Would you like to turn your hobby into a career? Do you want to expand your relationship with a nonprofit you have felt passionate about for years? Do you want to pursue an entirely new line of work? Talk to retirees who are successfully working to better understand the paths they took. Remember, even if you are motivated primarily by money, working in retirement can still present an opportunity to reinvent your work life into something simultaneously productive and fulfilling.

2. Be open to reinventing yourself with new priorities. When we asked for advice from those retirees already working successfully in their retirement, the top two tips were "be open to trying something new" and "be willing to earn less doing something you truly enjoy."

"Although income from work can play an important role in maintaining and/or providing financial security in retirement, many retirees identify the non-financial reasons to work as even more important," explains Cyndi Hutchins, Director of Financial Gerontology at Merrill Lynch. "It's not just about the money, but what kind of lifestyle you want and how work in retirement fits into your overall retirement plan."

3. Talk candidly with your spouse/partner about each of your retirement dreams and how work fits into the picture. Working retirees told us that this was a top priority to prepare for successfully working in retirement. They emphasized that these conversations should occur early in the planning process. Try to understand each other's expectations and concerns, and discuss how you'll balance work with other retirement priorities. Keep in mind, this ongoing dialogue will require honesty, generosity of spirit, love, and a strong sense of partnership.

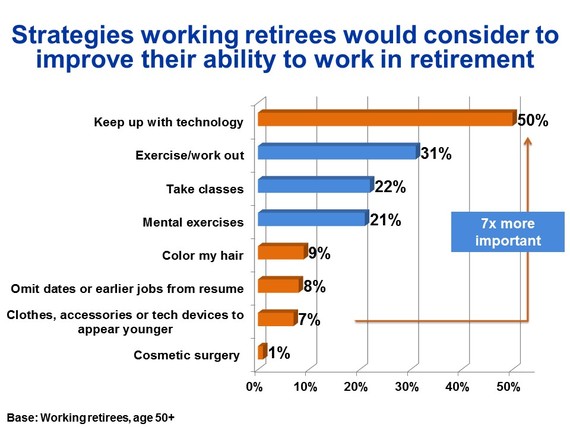

4. Take some practical steps to explore or even try out your options. For instance, if you're interested in a particular career path that requires some new knowledge or training, take a class at night or on weekends to see if it's something you'd really enjoy. Try volunteering, interning, or working part-time in a new field to see what it feels like. Attend conferences or association meetings to network and explore potential opportunities. As one focus group participant told us, "You've got to put your fears aside and just get out there and explore different options." Those already working in retirement also said it was seven times more important to keep up with technology than to try to appear younger as a means of improving your encore job prospects.

5. Talk with your employer. It's possible that taking a career intermission or sabbatical and then continuing to work for your present employer after retirement could be a win-win. Your employer may be willing to consider options that enable you to work more on your own terms, such as phased retirement, part-time or seasonal work, sabbaticals, and mentorship positions. If those options don't yet exist within your organization, approach your employer with some suggestions and try to negotiate a more flexible term of encore employment that is advantageous to you both.

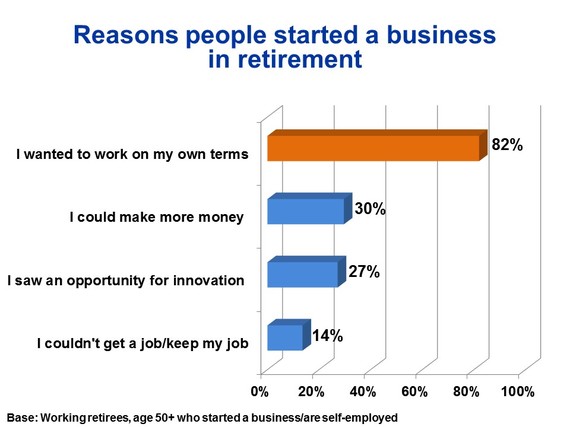

6. Consider working for yourself or starting a business in retirement. According to Kerry Hannon, AARP's job expert, "Right now, entrepreneurship is hot with retirees. As a group, they have been growing far faster than 20-something entrepreneurs." Our study told us that the primary motivation to do so is to "work on my own terms." If this seems like something you'd like to pursue, talk to others who have taken this path to figure out what's really involved. Seriously consider speaking with a financial professional to clarify the necessary steps to prepare and identify how best to manage any financial risks.

7. Understand the financial implications of working in retirement. Estimate your potential income from continued work in retirement as part of your overall retirement plan, remembering that income from working can help you keep pace with inflation. Importantly, make sure you understand how working in retirement can affect your Social Security, Medicare, and other benefits. This is an area where a knowledgeable financial professional can help you clear up any uncertainties.

I hope these seven steps, and all the information in this three-part blog series, will give you a new way of thinking about retirement and offer a tangible place to start as you envision your new retirement workscape. Remember, our study showed that those who work in retirement, even part-time, feel more youthful and energetic and seem to be enjoying life in retirement even more than those who do not work. You can download the entire study report here.

I'd like to know what you think about working in retirement. What would you like to do? Why? If you'll "need to work" rather than "want to work," what can you do to make this more satisfying with less stress? If you're already working in retirement, what were some strategies that have worked well for you in discovering your new retirement career path? I'd like to know your success stories as well as any mistakes you feel you've made that others can avoid.

And I wish you the best of luck!

Earlier on Huff/Post50: