Friday's news that retail sales were better than expected was good news for the US economy. But if employment has stalled, where is this money coming from? There is a possible dark explanation. With the slowdown in bank enforcement of mortgage defaults over the past year, people have simply been spending the money that they formerly used to pay their mortgages.

This is a dismal conclusion, but things could get worse quite soon. Foreclosure rates are increasing. Now that the banks have put their compliance issues in order, home foreclosures are on the rise for the first time in 12 months. Realty Trac estimates that a million foreclosures that would have taken place in 2011 are being pushed into 2012. This means more pain and lower house prices are around the corner. The year of forbearance is over.

There is a social element to all of this as well. There is a lack of trust and a broken social contract between borrowers and the banks, as recent demonstrations across the US have shown. It has become almost politically correct to default, and economically rational if your mortgage is under water. If the jobs outlook does not improve, more homeowners will decide to mail their keys to the bank. With a looming addition to the current oversupply of housing, how can this end happily?

The fact is that any increase in US employment must be tied to the construction and housing industry, which has bled jobs over the past few years. The jobs crisis cannot be solved without solving the housing crisis. Federal Reserve Chairman Ben Bernanke, in testimony before Congress recently, admitted that since World War II, construction employment has led the US out of recession. The US economy seems to be brightening, but is this sustainable if the housing market again falters? According to Bernanke:

This time, however, a number of factors, including the overhang of distressed and foreclosed properties, tight credit conditions for builders and potential home buyers and the large number of underwater mortgages have left the rate of new home construction at only about one-third of its average level in recent decades.

A 66% decline in housing starts is huge. So what can be done?

It is hard to make a case for easing credit conditions for homebuyers and builders, given the role that easy credit played in creating the crisis in the first place. Interest rates are at historic lows, so monetary easing would have little impact. There is only one point at which the problem can be directly tackled, and that is the overhang of existing housing that has already been foreclosed and now stands vacant. Much of this property has been damaged and vandalized, either by fleeing owners, looters, or simply the elements. The banks are out of their depth and outside the zone of their core competence: they never intended to become landlords, or to provide physical security for their real estate assets. There are costs they now bear which they did not foresee. Once banks become the default owners of a home, they become responsible for paying both insurance and property taxes, in addition to legal fees.

I have a radical proposition to increase housing demand through creative destruction--tear down these walls. Housing starts are at record low levels in the US, so that particular source of supply is already constrained. The supply of existing housing is the only available fulcrum. As a matter of law or Congressional edict, demolish all foreclosed single-family properties. Only the land would be left, but at least open land would not be a neighborhood eyesore dragging down property values. There would be little or no insurance to deal with, and property taxes would also be de minimus. Going further, the land could be put into either an investment or government trust, and bonds could be issued for development of properties in desirable areas.

This has actually already been done in Cleveland. In 2009, the county government formed a land trust. Banks have donated more than 1200 derelict properties to the trust, and even paid for the demolition costs. Community gardens have taken the place of some of these former neighborhood eyesores.

Foreclosed properties are by nature deteriorating assets. Moreover, foreclosure is an agonizingly slow and expensive process in the US. Currently, it takes 986 days for a lender to foreclose on a home in the state of New York. The process is quickest in Texas, the state of swift justice, averaging only 92 days. From that point, the national average is 193 days for the banks to find a new buyer, so these properties experience a long period of neglect. Amazingly, the federal government has deterioration-friendly policies in place. Under a program called 'Cash for Keys' renters of foreclosed properties are given sizable amounts of taxpayer money to vacate properties ahead of their lease termination dates, ensuring that even desirable properties remain vacant and unprotected.

Why would the destruction of millions of homes make things better? Residential housing contributes about 25% to our GDP, and the construction industry accounts for more than 7 million jobs. According the National Association of Homebuilders, building a new subdivision of 100 homes creates 305 jobs for carpenters, roofers, real estate agents and others. About 15 million homes in the US will have been through the foreclosure process from 2006- 2016. About half are multifamily units. It won't be possible to selectively destroy individual condominium units, although these could be turned into reasonably priced rental housing for those who have been displaced from single-family homes.

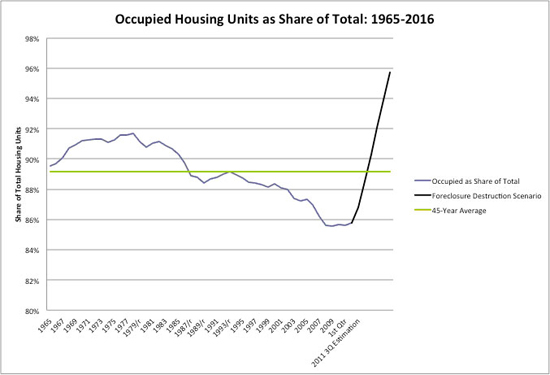

That leaves about 7.5M empty single-family homes. Leaving aside 1.5M foreclosed homes sold to new owners, a quick calculation is that this process would remove about 6 million homes from existing housing stock over the next five years. According to the Congressional Budget Office, there are approximately 2.4 M excess vacant units of all kinds, so about 1.2M single-family homes. Projected demand is also held back by weak household formation due to adverse economic conditions. The CBO estimates that the current imbalance is 2.8M excess homes in their pessimistic scenario. Tearing down 6 million houses would create positive demand therefore over current levels of an additional 3.2M homes by 2016.

The net job gain would then be more about 10 million jobs in construction and related industries over five years. Occupancy rates would climb to 96%, which would of course set the stage for an increase in housing prices. Household formations would also revert to more normal levels, as young adults are employed and move into homes of their own.

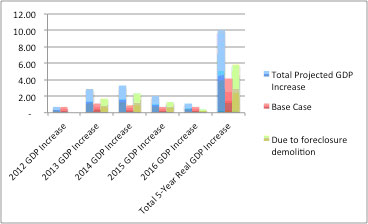

How much would this cost? Probably about half a trillion dollars. The positive impact on GDP growth over the next five years would be enormous, as much as 10% over five years. Some of this is back of the envelope estimation. However, the numbers are so compelling that even taken at half their total expected impact, and double the cost, this is a policy option that should be thoroughly vetted.

Charts: Mark Zoff, David Hale Global Economics, Chicago

There is another psychological aspect to this counter-intuitive approach. Sometimes trying to hold on to value actually leads to its diminution over time. By wisely ignoring sunk costs, a new broom becomes visible in communities nationwide as these homes are destroyed. Defaulters who do not have to default will be able to see that something tangible will happen to their homes, not just something on a piece of paper owned by someone in Iceland. The problem with Wall Street and the banks, and the government right now, is that their actions seem quite abstract in the land of non-recourse mortgages. A bulldozer is the real deal when it comes to wiping the slate clean.

This post originally appeared at the Yale Books blog.