Bloggers and reporters need to stop with the gnashing of teeth over a Fed report that claims Americans lost 40% of their wealth in the Great Recession, mainly due to a decline in housing prices. The reality is: you can't lose 40% of something you don't have.

What Americans really lost was 40% of our national credit line. It wasn't real "wealth." It was merely an expansion of housing-related credit that made us feel wealthy.

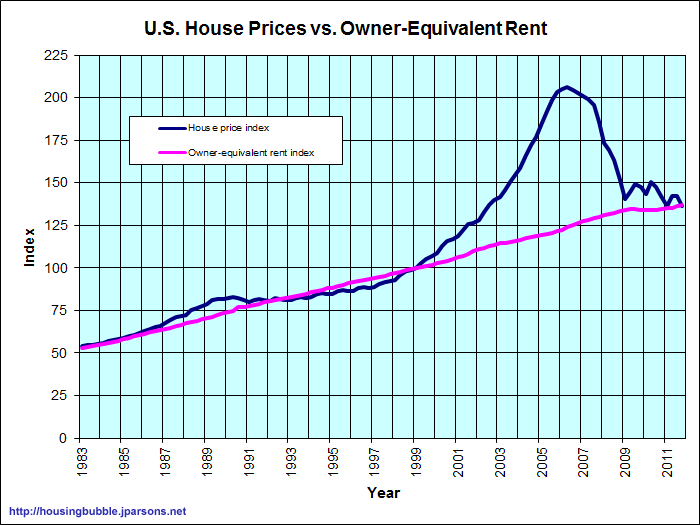

The chart below shows the housing bubble (literally the bubble-looking thing) inflating as purchase prices for houses outpaced historical norms. There are lots of charts that show the same thing in different dimensions. Here is an old one that shows the ups and downs of the well-known Shiller index since 1890 -- together with the eye-popping peak of 2008. And here is one that compares house prices to the consumer price index. I like the one below because it shows how wildly out of whack the value of housing became in the purchase market as opposed to the rental market -- two different markets placing two very different values on houses.

The key thing to take away from this chart is that all the "wealth" the Fed is claiming we lost was never really there. A lot of money flooded the housing market, beginning in around 2000, and pushed prices up. It wasn't real. It was... a bubble! In other words: imaginary, non-existent, illusory, fake, phony, phantasmagorical.

Houses were never worth as much as the "free market" was telling us they were worth -- those were never efficient market prices to begin with; they were based on banks' unquenchable appetite to fund the Securitization Machine, helped along by fraud on the part of appraisers, mortgage originators, and others in the loan production chain.

That wasn't real money, and wasn't ever really our money, even though we spent it like it was.

Bubble Mania: Make People Feel Wealthy, Even When They're Not!

The important question is: Why did the Fed, under Alan Greenspan, feel it was in the national interest to attach the financial equivalent of a bicycle pump to the economy and yell at Wall Street to "PUMP AWAY!" (And pump away they did -- with gusto.)

Why did he do that? Why did Greenspan tell the New York Times matter-of-factly in 2001 that:

"We're also beginning to find that as home ownership rises and as the market value of homes continues to rise, even in a period when stock prices are falling, we're observing a rather remarkable employment of that so-called home equity wealth in all sorts of household decisions.''

Because he was using rising home prices as a "buffer against recession."

When asked whether he was concerned that people were essentially eating their homes, he replied: ''If unrealized capital gains were declining, which is, of course, what happens when you extract equity from homes, yes, it would be a problem. But there is no evidence of that. Instead, despite the fact of the significant extraction of home equity gains, the level of unrealized capital gains in homes continues to rise apace. So it is not a depleting asset, if I may put it that way. It could be, but fortunately it is not.''

In the article, a portfolio manager at PIMCO, one of the nation's largest bond managers, said: "Greenspan is bound and determined that he is going to nurse this thing along by creating a positive wealth effect for housing.''

The Greenspan Housing Bubble

America had a problem: An economy that's about 60% reliant on consumer spending (about 50% if you exclude healthcare) can't afford to let consumer spending slow at the same rate that wage growth is slowing.

So Greenspan proposed a solution: If you can't actually make workers/consumers wealthy enough to drive economic growth, you can at least make them feel wealthy enough to keep spending. How do you do that? Ever-expanding credit linked to an ever-inflating asset. Wow! I'm rich! It's like magic!

The graph below shows wage growth stagnating compared to increases in productivity. (original) American workers are making more and more stuff all the time, but aren't gaining additional compensation for their trouble. A bunch of other charts show the same thing: Americans are producing more but earning less. Real wages for the bottom 60% of wage earners has been flat to declining for the past 40 years. And you can't grow the economy if one of your key growth engines is slowing down -- firing on fewer and fewer cylinders.

Stop Moping Over Mythical "Wealth" That Wasn't

There never was any real housing "boom" and no increase in actual housing "wealth" -- merely a credit boom courtesy of the Magical Mystical Wall Street Securitization Machine. Coming off the bursting of the tech bubble, it was a deliberate ploy by policymakers to disguise the fact that people were earning less and could afford to spend less -- an economic band-aid.

The trouble with the U.S. economy today is that these structural impediments to growth have not been fixed. It's a waste of time whining about Americans reclaiming imaginary wealth that wasn't.

Today, not only are wages still depressed, but now Americans have a mountain of debt to pay down -- owed to banks that are sitting on piles of cash handed to them by the Fed. If you want to gnash your teeth over something, bite into that one.