If you are actively at work, then it is likely that you are contributing to a qualified retirement plan, like a 401(k). You select your contribution amount (a percentage of income) and money is systematically deducted from your paycheck on a pre-tax basis into the investments of your choice. As a result, you don't pay taxes on the income that is being saved into the 401(k) plan in the current year. Instead, these taxes are deferred until you start taking withdrawals in retirement. It sounds like a great deal, but is it?

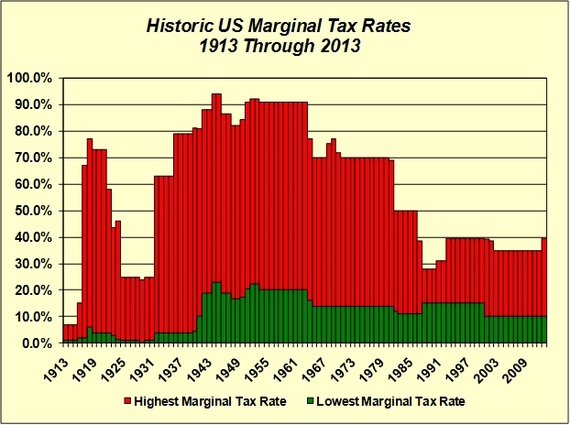

To begin to answer this question, it is important to understand that taxes are a significant variable in any type of planning. The amount of tax that we must pay is determined by the political process, which is highly unpredictable. Federal Income Taxes have been around for 100 years, and when first implemented, the tax only applied to high-income individuals. Few individuals had incomes large enough for even the lowest tax rate to apply. That was until the advent of World War II when exemptions were sharply reduced and graduated tax rates for "regular tax" were sharply increased. The top rate at one point was as high as 94 percent. These maximum marginal tax rates were significantly reduced when President Reagan signed the Economic Recovery Tax Act of 1981, but have since increased from their lows in 1989 to their current level.

Consider why we have taxes. Funding government programs, education, infrastructure, and national defense are a few examples. Consider current government spending and our national debt. With these considerations in mind, which direction you think taxes are heading: up or down? If it is probable that taxes are increasing, then how high they will go?

These questions are important to consider as you determine what percentage of pay you will contribute to your 401(k) plan. If you are contributing money on a pre-tax basis in a relatively low income tax environment today, then is it possible that you could end up withdrawing money during a higher income tax environment in the future? Does that necessarily make sense? Clients often say, "but I will be in a lower tax bracket when I retire." Well, that depends on how you view retirement. Would your income needs be less if every day is a Saturday? Do you desire to travel, enjoy hobbies, go out to dinner, and afford rising health care costs? And, fundamentally what if tax brackets were to change?

One should determine not only their income needs in retirement, but also the impact of taxes upon the distribution of their wealth. Unfortunately, most Americans are not calculating their income needs in retirement, never mind the impact of taxes on the income that they receive. For instance, a $700,000 account value as shown on your 401(k) statement does not accurately represent the $525,000 that you will have to spend in retirement (based on a 25 percent income tax bracket). If you are calculating your income needs, but not factoring in the tax impact, then there is going to be an income gap between what cash flow is available and what is desirable.

So, is contributing to your 401(k) always a great deal?

The maximum contribution that an employee can make to a 401(k) is $17,500/year. Many employers will offer a matching contribution where they contribute a percentage of your pay to the plan on your behalf. In many cases, it is prudent to contribute enough to your 401(k) to get the full matching contribution from your employer. However, considering our current economic environment, it should be noted that most plans have vesting schedules which dictate the percentage of the employer contribution that you can keep upon leaving the company. If, for instance, you lose your job or switch companies before you are fully vested (which often takes 5, 6 or 7 years), then it is possible that you may be leaving a significant portion of your retirement plan behind.

While simply setting up a contribution to your 401(k) and maxing out your deferrals can be "easy," I encourage you to make Financial Balance your top priority. Understand how the financial decisions that you make impact each other over a lifetime. Often times, clients will seek to build wealth for events- like retirement- that may be many years in the future while negating strategies that could protect them in both the short-term and the long-term. That is not balance.

Financial Balance comes from effectively managing your cash flow. It comes from following a hierarchy of rules. First, fully protect your assets. Then, save at least 15-20% of your gross annual income each year. Next, strive to lower your payments on debts and pay less in taxes. Finally, live a budgeted lifestyle with the available cash flow that is left over.

Please don't hesitate to contact me if you would like to move toward greater financial clarity and balance. Together, we can study whether the financial decisions that you make are serving you appropriately and adjust your strategies as necessary.

Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS) and a Financial Representative of The Guardian Life Insurance Company of America, New York, NY. Securities products/services and advisory services offered through PAS, a registered broker-dealer and investment advisor. PAS is an indirect wholly owned subsidiary of Guardian. The Bulfinch Group is not an affiliate or subsidiary of PAS or Guardian. Life insurance offered through The Bulfinch Group Insurance Agency Inc., an affiliate of The Bulfinch Group, Inc. The Bulfinch Group is not licensed to sell insurance. PAS is a member FINRA, SIPC GEAR# 2014-1780