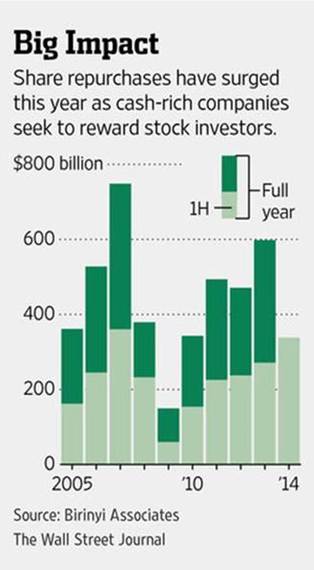

A September 15th article in The Wall Street Journal (Companies' Stock Buybacks Help Buoy the Market, by Dan Strumpf) discussed the surging volume of share repurchases in recent years and especially in the first half of 2014. "Corporations bought back $338.3 billion of stock in the first half of the year, the most for any six-month period since 2007, according to research from Birinyi Associates." This may come as a surprise given the fact that the S&P 500 has risen nearly 200% since its March, 2009 lows. Aren't investors supposed to buy low and sell high? In any event, the article goes on to quote a study by analysts at Barclay's PLC, which says that "companies with the largest buyback programs by dollar value have outperformed the broader market by 20% since 2008".

Stock buybacks have traditionally been perceived as a shareholder-friendly and tax-efficient vote of confidence in future business prospects. In normal times, many corporate Boards issue authorizations to buy back enough shares, at the very least, to cover the dilution caused by share-based compensation plans. Larger buybacks are generally authorized if a company is carrying more cash than can be put to productive use. In recent years, however, the sheer magnitude and breadth of buyback programs is definitely raising some red flags. It seems like everyone is getting in on the action, whether or not it is in the best long-term interest of the company. In no particular order, here are our thoughts/concerns with regard to the increasing volume of buybacks:

- We are over five years into the economic "recovery." Should we be concerned that at this stage in the recovery management teams are unable to find better investments than their own stock (at inflated prices)? Is "investing" in buybacks rather than spending on new productive capacity (R&D, plant and equipment, new employees) a good sign for the long-term health of the economy?

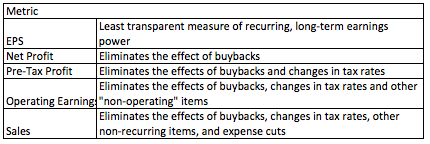

- Buybacks boost stock prices through both 1) EPS accretion (lower share counts lead to higher earnings per share) and 2) increased demand for a stock. While these drivers of stock prices have been reliably predictable over the past five years, buybacks tend to dry up during economic slowdowns. Given the magnitude of buybacks during this bull market, the effect on earnings may be especially pronounced during the next market down-cycle.

- Companies have become much more beholden to activist investors who are more concerned with a short-term pop in stock price than the long-term health of the company. Is it a healthy thing that investors have become increasingly more short-term focused? Who is making sure that the right decisions are made for the long-term health of the company?

- A surge in corporate buybacks has served as a contrary indicator in the past. In fact, the last time that buyback levels were this high was 2007. During the financial crisis (particularly in 2009), buyback activity all but dried up. As we all now know, it turned out that 2009 was the buying opportunity of a lifetime.

- Buybacks, especially when done using debt, cause a deterioration of corporate balance sheets that reduces company defensiveness in times of economic weakness.

At the very least, the surge in stock buybacks represents a deterioration in the quality of earnings that should not be ignored by investment analysts. Astute investors are best served by utilizing metrics that eliminate the effects of non-recurring stock buybacks, expense cuts, lower tax rates, and other items. Metrics such as the price-to-sales ratio, which is currently running significantly higher than historical averages, provide a truer valuation picture and represent yet another reason for us to remain defensive and cautious in client accounts.

Our valuation concerns are not some sudden revelation. We have been talking about high corporate margins and accretive stock buybacks for quite some time. And stocks have risen sharply in the face of such concerns. My point is that stocks tend to climb a wall of worry, but investors should never get complacent about the risks inherent to stock investing. Stocks have been the place to be for the past five years, but periods of weakness will inevitably occur. Stocks can and will go down at some point. Long-term investors are best served by sticking to their disciplines and avoiding market-timing. Nobody can effectively time the markets with any degree of consistency.

Remember, markets go down from time to time, and it's normal. Cool heads and steady hands make money over time. Hang in there!

Peace,

Michael