Buyers Finance Phones With Lower Resale Values

Phone Finance Encourages Buyers to Purchase More Expensive Models

Consumer Intelligence Research Partners released additional results of its research on mobile phone financing plans. This analysis covering new phone activations from July-December 2013, roughly coinciding with the launch of AT&T Next, Verizon Edge, and Sprint One-Up plans, and T-Mobile's addition of the Jump plan.

CIRP finds that buyers that use phone financing programs purchase more phones with the Google Android operating system. These buyers also favor Samsung phones. Finally, within brands they purchase more expensive models.

Among operating systems, Android phones account for 61% of financed phones. In comparison, Android operating systems have a 51% share of the US market in the survey period. T-Mobile helps increase Android's share, as 71% of T-Mobile activations are Android phones.

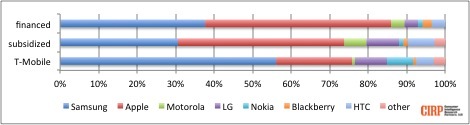

Among phone brands, Samsung accounts for 49% of financed phones, compared to its 31% share of the overall US market in the survey period. As with Android phones, T-Mobile helps boost Samsung's share, as Samsung accounts for 56% of the phones sold at T-Mobile (see chart).

These financing programs now resemble leasing, in which customers pay monthly for a phone. So, customers either own the phone at the end of the lease term, or return it to the carrier for a new phone. Phone financing, especially with early trade-in/upgrade options, appears to have steered customers to Android and Samsung phones, which historically have had a lower value in the secondary market than Apple iPhones. To the extent that consumers consider resale value when they buy new phones, they will lease lower residual-value phones, and buy more valuable ones.

Among phone models, customers that finance a phone purchase buy more expensive models of phones. For Apple, iPhone 5S accounts for 72% of financed iPhones, compared to 60% of all iPhones. For Samsung, the share of Galaxy S 4 relative to the Galaxy S III is 72% for customers that finance their phone. The share of the Galaxy S 4 relative to the Galaxy S III is 69% for all Samsung customers.

Financing also appears to lead customers to purchase more expensive models. The impact is much more evident for Apple than for Samsung, though. The decision process might involve comparing the larger one-time spend for a subsidized phone to smaller monthly payment for the same models under a financing program. Deciding between spending a larger amount now might lead a customer to a less expensive model, while deciding between smaller monthly payments might lead a customer to a more expensive model.

For additional information, please contact CIRP.