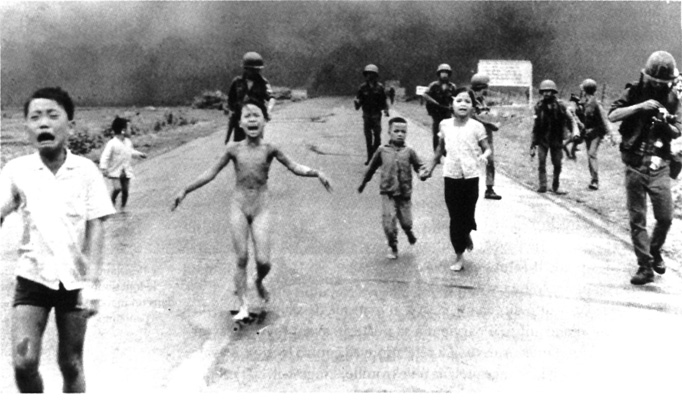

The modern era of fire as a weapon of war came with jellied gasoline, or napalm, dropped from bombers in the late days of WWII. The bombing of Tokyo created a firestorm that incinerated more people than the nuclear bombing of Hiroshima.

The modern era of corporate shareholder activism was born during the Vietnam War when the Medical Committee for Human Rights and its leader Dr. Quentin Young were given shares in Dow Chemical Company, infamous for manufacturing the napalm used in Vietnam. In 1968 Dr. Young submitted a resolution to Dow "that napalm shall not be sold to any buyer unless that buyer gives reasonable assurances that the substance will not be used on or against human beings."

In 1968 Dr. Young submitted a resolution to Dow "that napalm shall not be sold to any buyer unless that buyer gives reasonable assurances that the substance will not be used on or against human beings."

Dow fought inclusion of the proposal in its proxy statement and the Securities and Exchange Commission (SEC) initially sided with the company. Dr. Young appealed and the DC District Court ruled that part of the original intent of Congress in creating the SEC was "to give true vitality to the concept of corporate democracy [emphasis added]," and the resolution made it onto the proxy.

Isn't "Corporate Democracy" an oxymoron? What are the effects of corporations on our democracy?

The corrosive effect of corporate influence on democracy was recognized by Abraham Lincoln in a letter to Col. William Elkins, November 21, 1864:

"I see in the near future a crisis approaching that unnerves me and causes me to tremble for the safety of my country. . . . corporations have been enthroned and an era of corruption in high places will follow, and the money power of the country will endeavor to prolong its reign by working upon the prejudices of the people until all wealth is aggregated in a few hands and the Republic is destroyed."

Nobel Economics Prizewinner and Conservative icon Milton Friedman (Capitalism and Freedom, 1962) framed the crisis very differently from Lincoln:

"Few trends could undermine the very foundations of our free society as the acceptance by corporate officials of a social responsibility other than to make as much money for their shareholders as possible."

While Lincoln felt corporations could destroy the Republic, Friedman felt that free society itself was threatened by the idea of any corporate responsibility other than making a profit.

The health insurance industry has been profitable for its investors. The five largest health insurance companies sailed through the worst economic downturn since the great Depression to set new industry profit records in 2009. WellPoint, UnitedHealth, Aetna, Humana, and CIGNA enjoyed combined profits of $12.2 billion, up 56 percent from 2008. It was the best year ever for Big Insurance.

You can argue for a robust profit motive for flat screen TV's, but health insurance companies don't even make a product. The only thing they make is money.

In 2007 WellPoint convinced the Federal Deposit Insurance Corporation to allow the company to incorporate as a bank in Utah. WellPoint chose Utah, a state where they sell no health insurance, because Utah has such loose banking regulations. Even Utah's regulators balked at first, arguing that WellPoint was an insurance company, not a bank. But WellPoint succeeded in being reclassified as a financial institution.

When John McCain was running for president he drew this parallel between banking and health insurance (Washington Post 9/21/08)

"Opening up the health insurance market ... as we have done over the last decade in banking, would provide more choices of innovative products less burdened by regulation."

We know where financial deregulation got us.

Support for healthcare reform ran strong through most of 2009 with polls showing backing for the public option consistently over 60 percent through September. Now the consensus post-passage seems to be that the reform bill is unpopular. An April public opinion poll sheds light on how confused and frustrated people are. Although 58 percent supported repealing the bill, 67 percent still felt it was important that Congress work on "establishment of a public option that would give individuals a choice between government-provided health insurance or private health insurance," and they wanted it done in the current legislative session!

How do you reconcile 58 percent in favor of repealing the bill but 67 percent still favoring a public option? People aren't as stupid as politicians make them out to be. They understand that this bill doesn't go nearly far enough. They resent having no choice but to buy private insurance.

That's why we say, Healthcare Reform, We're STILL FOR It... and we're not done yet.

Have no doubt - the lobbyists for Big Insurance aren't done yet.

Why do we need health insurance companies? We know that they raise premiums with no justification and cancel policies with the flimsiest of excuses. They notified their investors that they will spend billions of their record profits this year, not on anything to improve our lives, but to buy back their stock to bolster the share price, which increases executive compensation.

We know Big Insurance spent millions to influence Congress, and it resulted in a bill with some tissue paper handcuffs of new regulation, but a program that has the potential to bring them huge profits. Insurance corporations will be handed at least $447 billion in taxpayer money to subsidize the purchase of their shoddy products. This money will enhance their financial and political power and their ability to block future reform.

Before he died, Ted Kennedy wrote President Obama about healthcare reform, which he called "the great unfinished business of our society." He made it clear that "what we face is above all a moral issue; that at stake are not just the details of policy, but fundamental principles of social justice and the character of our country."

This is about justice and the character of our country. To care about such things would not fulfill the fiduciary responsibility of Big Insurance's executives and boards of directors. They are wedded to a business model that we can no longer afford, financially or morally. They profit by collecting premiums from healthy people and avoiding by any means possible paying for the care of the sick. I went to medical school so that I could take care of sick people.

Dr. Quentin Young is still going strong at 87. He is the National Coordinator of Physicians for a National Health Program and recently had this to say, "The grave crisis engulfing the American health system is fundamentally the work product of the for-profit health insurance industry, which is driving up medical costs relentlessly."

When his resolution calling on Dow to stop selling napalm was finally voted on, it went down in flames. Dow won that battle, but has never escaped the tarnish of napalm.

I am sponsoring a resolution on the WellPoint/Anthem proxy calling on the company to study the feasibility of returning to its Blue Cross, charitable, non-profit roots (HuffingtonPost 4/12/10). My prediction is that even if it passes, WellPoint is incapable of reforming itself.

We need to move beyond shareholder resolutions and begin building a divestment campaign like the one aimed at American corporations doing business with South Africa's apartheid government. From 1985 to 1990, over 200 U.S. companies cut all ties with South Africa, resulting in a loss of $1 billion in direct American investment. (May 4 was the 16th anniversary of Nelson Mandela's election as president of South Africa, after spending 27 years in prison.)

The health insurance industry is the poster child for the corrosive effect huge corporations have on our Democracy. Their growing, unchecked power threatens our economy and our very health. Divestment opens a new avenue to expose them for the parasitic middlemen they are.

Will this reform bill be a step in the right direction, or a bail out for the insurance industry? Can we break the death grip Big Insurance has on Congress? Will we ever achieve affordable, universal coverage, like a single-payer Medicare for All program?

Burning questions remain. We're not done yet.

Join Quentin Young, Rob Stone, and Wendell Potter at our rally in Indianapolis on Monument Circle, across the street from WellPoint corporate headquarters, Tuesday May 18th at 11:00 AM EDT. The rally follows the annual shareholders meeting. A printable flyer for the rally is available here.