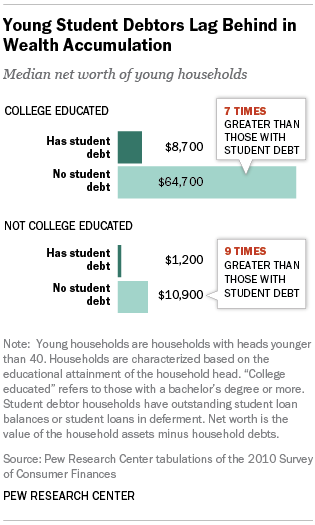

Nearly 40 percent of younger Americans are carrying some amount of student debt and the Pew Research Center's research shows that an inability to manage and pay off that debt can impact future earning potential. The center's 2014 Young Adults, Student Debt and Economic Well-being Study released earlier this year shows that those without student debt earn as much as seven times those with student debt.

For medical students, the burden is even more staggering. The average medical student is dealing with between $200,000 and $300,000 in debt when they graduate. As approximately 18,000 physicians graduate per year, the total debt generated by this medical track alone is $36 to $54 million. Some people hold the incorrect preconception that medical students will easily be able to pay back their loans when they enter a high-paying career as a physician or a medical specialist. After all, according to a report from Medscape, the average primary care physician earned about $170,000 per year in 2013.

Jason Doshi, the co-founder of Loanscribe, an online platform that consolidates and refinances medical student loan debt, says the concept of "manageable" medical student debt is a myth that's out of synch with students' financial realities. "Unlike any other graduate profession, post-graduation doctors go through a 3- to 5-year residency period which is low-paying and focuses on job training," Doshi says. "It's one of the unique financial situations that doctors face that make paying back loans more difficult than it seems to outsiders."

In 2010, the Wall Street Journal's Mary Pilon profiled one family practitioner in Ohio whose student loan debt ballooned while she completed her residency. When she completed medical school in 2003, "Her student loan debt amounted to roughly $250,000," Pilon reports, "since then, it has ballooned to $555,000." As practitioner Michelle Bisutti deferred loan payments during her residency period, she experienced "default charges and relentlessly compounding interest rates" including "a single $53,870 fee for when her loan was turned over to a collection agency." Pilon noted that "ditching a student loan debt is virtually impossible, especially once a collection agency gets involved."

And four years after the article was written, students can attest to the challenges they face when dealing with mounting debt, deferment fees, and 'waived fines' that are frequently promised by lenders but seldom delivered. As a medical student facing an intimidating debt load, what are the best steps to take to stave off costly penalties and deferment options?

First Tip: Understand the What Debt Means

The Project on Student Debt notes that "ignoring your student loans has serious consequences that can last a lifetime." Mentally postponing your debts is simply not an option. Don't view defaulting as an easy way out. As the Project states, "When you default, your total loan balance becomes due, your credit score is ruined, the total amount you owe increases dramatically, and the government can garnish your wages and seize your tax refunds." Be realistic about your loans, not reactionary.

Second Tip: Keep Up-to-Date On Industry Developments

The medical industry's approach to mounting student debt is constantly changing. Loanscribe co-founders Jason Doshi and Sam Joshi note that clever ideas are already in the works to address the issue.

The College of the Ozarks is offering free tuition in exchange for students working 15 hours a week or more on campus. Groups like the National Health Service Corp will help a doctor pay off his or her loans in exchange for work in underserved international areas. New options are constantly emerging, so look for opportunities that may work for your debt situation.

Third Tip: Keep Track of Everything

The Project on Student Debt notes that "lender, balance, and repayment status...determine your options for loan repayment or forgiveness." You need to have this information readily available. If you can't get it from your lender, you may be dealing with private loans -- contact your school if you don't have recent billing statements or paperwork available.

New technology is emerging every day to help students manage and repay their debt. Sam Joshi of Loanscribe notes, "My sister recently became a board-certified doctor, and she's going through this very problem we're working to correct. There is a clear need and demand for technology that helps medical students address their debt. We're excited to be there to help." If the idea of paying back your debt seems overwhelming, take advantage of newly-emerging tech that makes the process easier and more efficient.

Fourth Tip: Don't Panic -- You Can Get Through This

Experts agree on this essential tip: don't panic and don't give up. Though your debt may feel overwhelming, ultimately there are resources and options emerging every day to help students like you overcome their financial burdens. If you stay organized, plan, and use the resources that are available to you, you can face and conquer your medical student loan debt.