Investing in new entrepreneurial ventures operating within The Creative Economy may be the best option for creating future progress. Startups have the advantage of beginning with a blank slate and their key strategic advantage lies in creating breakthrough innovative offerings while mitigating exposure to the disproportionately large risk.

To support startups in the execution of this momentous task, we devised an evidence-based four-step Design Driven Startup method comprised of: "Where to play," "How to play," "What role to play" and "Can we win?" Applying this process effectively aligns organizational capabilities with, as yet unidentified, user needs:

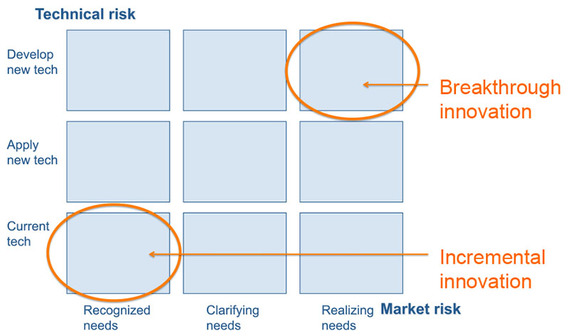

"Where to play" - Market - Technology Risk matrix

First, select a promising position in the market - technology space, since this will determine the potential revenue stream as well as the associated risk. Positioning potential offerings in a Market - Technology Risk matrix establishes one's level of innovation ambition, as well as, the risk design has to mitigate.

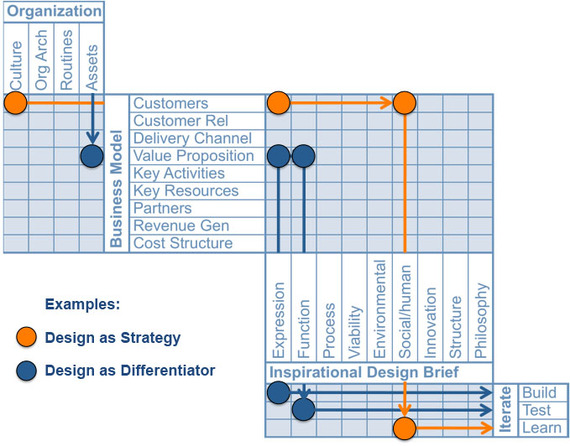

"How to play" - Bridging Business & Design

Successful implementation of an offering then requires connecting organizational capabilities to user needs through a business model, then a design brief and finally, iterative design execution. The "Bridging Business & Design" model is an 80/20-rule approach to establishing the most important of these connections.

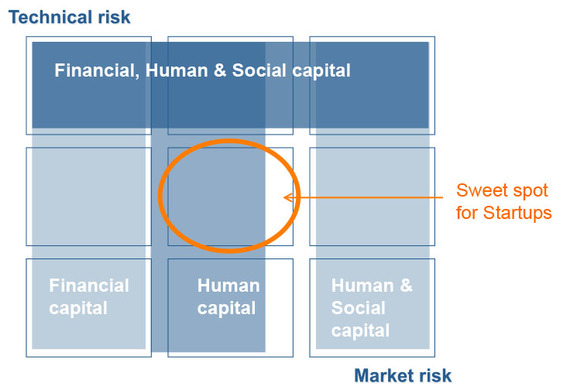

"What role to play" - Capital Model

Knowing "where to play" and "how to play" one can then ask, "Is the right team in place to play successfully?" There are three types of capital key to the success of a startup: financial, human and social and the following zones have been applied from Design Driven Startups, by Søren Petersen, 2015.

The upper level of technology risk, where new technology is developed, requires vast financial, human and social capital to succeed. This area is occupied by incumbents and is an almost impossible area of competition for startups.

The area to the left, addressing recognized needs, requires vast financial capital and is also an area where incumbents thrive. Huge investments in marketing and incremental development of well-established brands and products make this area nearly impenetrable for startups.

The area defined by realizing needs; combined with applying current or new technology, requires human capital and social capital. This area is less attractive to incumbent firms, since the payback time on investments is long, resulting in a low Net Present Value (NPV). The long time horizon prevents startups from mining this area, as well, together with the need for social capital, which a small entrepreneurial team is unlikely to possess.

This leaves the area of clarifying needs and current technology or applying new technology. In this area, incumbents will often mine clarifying needs and current technology when looking for relatively quick market expansions. The area of clarifying needs and applying new technology can be lucrative for startups, if they possess the unique human capital for mining a specific market segment and the technical skills necessary for implementation.

"Can we win?" - Prediction Model

Having established the premises of the startup, the question then becomes, "Can we win?" As Sun Tzu, proclaimed in The Art of War: "Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win." To assess the probabilities of success, we applied the Business Opportunity Strength (BOS) prediction model to establish the execution risk and then calculated the combined risk by multiplying market, technology and execution risk.

If the combined market, technology and execution risk has a twenty percent probability of success, the venture falls within the risk profile of venture capitalists. If the probability of success is less than five percent - one is operating in Kamikaze Country where obtaining funding becomes nearly impossible unless the potential return is also perceived to be astronomical.

Startups still remain one of the best vehicles for future progress, however it is important not to be blind to the market, technology and execution risk and to establish the most important connections between capabilities and user needs (job yet to be done.)

One also needs to know the types of capital required to succeed (financial, human and social) because, without a clear idea of the probability of success, one can easily step off the plank into shark-infested waters. So, when answering the clarion call of that sweet startup opportunity, be prepared with where, how and, most importantly, what role your startup will play and luck may yet smile upon you and your intrepid team.