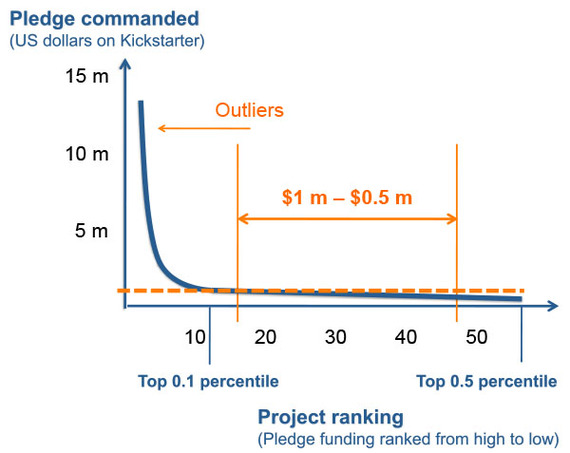

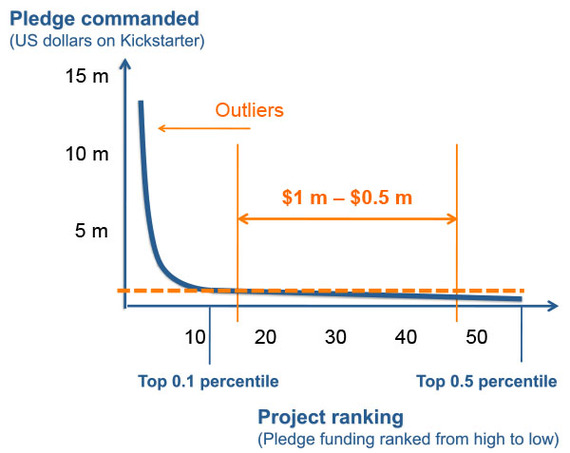

Design Driven Startups are ideal for attracting funding on crowdfunding platforms, such as Kickstarter, Indiegogo and Crowdfunder. However, competition for funds is fierce and only the top percentile receives significant funding. For example for Kickstarter "Design" projects only the top half percentile receive funding in excess of half a million and the average funding is $7,500. Thus, funding on Kickstarter follows the Power Law where the top percentile receives the bulk of the pledges and the funding then dwindles down to nothing.

Even so, these crowdfunding platforms offer a way of securing pre-orders to finance upfront investments in engineering and in the marketing of a business idea, especially for consumer products with a high degree of user interface and design.

When seeking funding for scaling one's business, an added advantage is that Angel Investors and Venture Capitalists see Kickstart backing as a good indicator of an offering's sales potential. A proven track record of launching a product, together with the level of pledges achieved, can thus assist in establishing and increasing a new venture's valuation. In effect, one has proven the existence of a reachable market for creating profit.

How does one design a funding campaign so as to increase the probabilities of reaching or exceeding the funding goals? The answer is to focus on proven offerings and technologies combined with a strong public relations campaign.

Analyzing the top fifty funded Kickstarter projects, shows a winning strategy of formulating a unique offering that piggy-backs onto established offerings with a recognized need and proven new technology. These offerings could be products such as smart phones, cameras or bicycles. The next step is to promote the project with a strong entrepreneurial story using an attractive, visually appealing and believable concept.

When deciding to launch a campaign, a good predictor of its success is the combination of Market, Technology and Design Execution risk. This combination contains seventy-two percent of the variability for predicting a campaign's success. However, "building a better mouse trap," while necessary, is not a sufficient requirement.

Launching and completing successful an online fundraising campaign typically requires months of preparation and three to four months of daily promotion. When launched, the buzz online, as measured by the number of Web Citations, becomes an even stronger predictor than combined Market, Technology and Design Execution risk, thus accounting for ninety-two percent of the variability.

Two things entrepreneurs do not have to worry about are where they set the pledge goal and how this influences backers' behavior. We found no link between the pledge goal and the amount pledged or the average amount each backer pledged.

Thus, a good game strategy seems to be to set a goal that realistically reflects what it will take to get the offerings in the backers' hands and to set the price so one can generate a reasonable profit.

Besides early stage financing, online crowdfunding platforms offer design driven startups new and unique opportunities for establishing the profitability of a market before large investments are made in marketing, engineering and production. An idea, which seems good can thus be tested and killed early if the combined market, technology and design execution risk is too high and if an insufficient number of innovators or early adopters exist.

A successful crowdfunding campaign leads to a concept that can then be developed with a strongly reduced risk. This increases the valuation of the startup and the share of the company that the founders can retain when seeking funding to scale up. Crowdfunding thus offers a win-win-win for startups, investors and end users, who can then benefit from a wider variety of useful products.