Evidently the message the GOP wants to run on in the waning months of this campaign season is this: Don't raise taxes on job creators or else you won't get any new jobs. I try to consider both sides in any argument before passing judgment, so I decided to give this particular message a closer look.

Let's start with terms. It seems that for Republican candidates and spokespeople, "job creators," are those people and corporations who would do less hiring if the top marginal tax rate in America were as high as it were under, say, Bill Clinton. They're called "job creators" because "Don't tax rich people" tested poorly with focus groups. And in point of fact, over the past several months the Republican message has focused on redefining its own term, shading and twisting the term "job creator" so that when we hear it we think not of McDonald's or the Koch Brothers, but of small businesses and smiling merchants, the kind of entrepreneurial go-getters we all respect no matter how we might feel about corporate behemoths and billionaires.

My wife works for a small business owner, a private practice physician, the kind of guy we are told would create fewer jobs if his taxes -- business or personal -- were allowed to increase to their pre-2003 levels. My wife's boss employs 10 people. He has been in business for decades. I asked him; he has no intention of hiring or firing anyone regardless of his 2013 tax bracket.

My daughter also works for a small business, a family-owned nursery that has been around for generations. It employs about three dozen people and when sales were good it employed a few more. At one bleak point not long ago it employed a few less. At the moment, it's around its historical average in terms of overall staff complement.

In a sense, I myself am a small business. I'm a freelancer. I have no employer. This means, among other things, that I don't qualify for unemployment benefits, I have to buy a crappy individual health insurance policy, I have no worker's compensation coverage and I'm on my own for retirement planning. But while those things might suck (and they do), I'm feeling pretty smug about being a "job creator," at least according to Mitt Romney and his ilk. It's an odd label for me to bear, however, insofar as I've not created a real job even for myself!

Despite how Republicans wish to use the term, and despite how much Democrats trying to find the middle will buy into Republican word tricks, the fact is that America's real job creators (for better or worse) are not small businesses but enormous corporations whose hiring and firing affects people by the tens of thousands. In the past, America's major job creators included General Motors, U.S. Steel, General Electric and other familiar bastions of a bygone time. Today, the country's largest employers are Walmart, with 2.1 million employees, IBM, with 436,000 and UPS, with 400,000.

It's worth noting that at certain times in American history, the United States government itself was a job creator. Take for instance Franklin Roosevelt's Works Progress Administration, which, at its peak in 1938 provided jobs for 3 million adults in addition to the youth employed through a a separate division, the National Youth Administration. Between 1935 and 1943, the WPA provided almost 8 million jobs.

There's also the Tennessee Valley Authority, another Roosevelt creation, which exists even to this day, although in a less employment-intensive capacity. As of the present, the TVA owns 11 coal-powered plants, 29 hydroelectric dams, three nuclear power plants (with six operating reactors), nine combustion turbine plants and three gas-fueled combined cycle plants. TVA is one of the largest producers of electricity in the United States and acts as a regional grid reliability coordinator and it takes a whole bunch of workers to keep it all running.

And lest you think job creation by government fiat is a Democrat-only phenomenon, consider the Interstate Highway System, conceived and authorized by Dwight Eisenhower and generally conceded to be the "largest public works program since the Pyramids." The project spanned 35 years, and employed tens of thousands of workers at a total public cost of $484 billion in 2012 dollars. Who knew Ike was a socialist?!

Say what you will about public works projects of the past -- they damn sure created jobs.

But today's "job creators," not the big corporations but those middle-sized and small businesses the Rominee keeps pandering to, we're told they can't be expected to create jobs as long as we keep taxing them. That's what we're told, at any rate.

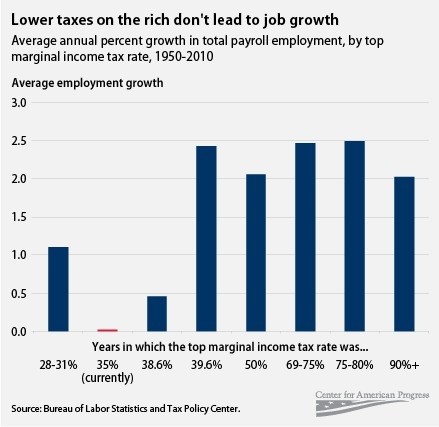

I wanted to find out if there's any historical correlation between top marginal tax rates and the rates of growth for both jobs and the GDP and it turns out there is in fact a correlation between lower top tax rates and job growth and that correlation is a negative one. It's the truth no matter what a presidential candidate might say to the contrary. Job creators create more jobs when their tax rates are higher.

I went back to 1925, the first year in which reliable numbers in three categories can be lined up year-by-year; top marginal tax rates from the Internal Revenue Service, GDP growth from the Bureau of Economic Analysis, and job growth numbers from the Bureau of Labor Statistics.

In 86 years, from 1925 through 2010, the average top marginal income tax rate was 61.31 percent, which is three-quarters higher than today's top rate of 35 percent. In fact, the top tax rate has been 50 percent or lower since 1982, a run of nearly three decades that dramatically distinguishes our era from the preceding norm. In the prior 50-year stretch, from 1932 through 1981, the top tax rate averaged almost 80 percent. The whole period in question, 1925 to 2010, includes a top marginal tax rate that reached as high as 94 percent and as low as 24 percent, and that's a big spread. For most of a century the tax pendulum has swung from high to low, seldom pausing anywhere near the center.

From Michael Linden, Center for American Progress

During the period in question the top marginal tax rate was 70 percent or higher in 45 years and 40 percent or lower in 31. Those years together account for three-fourths of the period in question and taken as a whole, both job growth and GDP growth are vastly higher in high tax years than low ones.

In years with a top marginal tax rate of 70 percent or higher, job growth averaged 2.61 percent and GDP growth averaged a whopping 8.59 percent. By contrast, in years with a top tax rate of 40 percent or lower, job growth averaged an anemic .94 percent and GDP growth averaged just 3.6 percent. Thus high tax years saw job growth rates 2.77 times higher and GDP growth rates 2.39 times higher than low tax years. In other words, the argument that high top marginal tax rates are bad for jobs and the economy is less of an argument and more of a... I was going to say platitude, but the correct word is lie.

It's a whole different thing to say that high top tax brackets have no net effect on overall taxation than to say that high brackets will kill jobs, doom the economy and unleash some Marxist hell hound upon us all. If a candidate told me, "I don't think a tax increase on the rich by itself would make much difference," that's at least possibly true. But if a candidate tells me, "Taxing the rich would be the ruination of this country," please.

Back in 1980, the last time America's top marginal income tax rate was 70 percent, that rate applied to earners with incomes of $215,400 or more. In today's dollars, that equals $590,000. Under a 1980 scheme, only a tiny fraction of Americans today would pay the top marginal tax rate. Such a scheme might be "bad" for them, but at the moment, who cares? If you make more than $590,000 a year, I'm sorry but I'm not interested in your tax burden.

Here's a little historical factoid I gleaned from the Bureau of Labor Statistics' database. During Ronald Reagan's eight years in the White House, the average annual rate of U.S. jobs growth was just 2.06 percent. Under Bill Clinton it was 2.38 percent. Under Jimmy Carter it was 3.06 percent, a full percentage point higher than the Reagan years. So much for trickling down. Democrats don't kill job growth and neither do high taxes on rich people.

However, it's a dismally obvious induction from the past several years that something does kill job growth. I'm willing to point the finger at a number of likely suspects -- deregulation, anti-union legislation, globalization and some others. I can't know for sure which of those is the biggest culprit, but I know one thing for certain, all the mom-and-pop, industrious little start-up entrepreneur "job creators" in this country put together can't create enough jobs to matter and since all we really have to go on is the incontrovertible truth of history, I say tax the rich and then tax them some more.