Morgan Stanley was offering Ford shareholders a highly unusual deal on Monday.

Two days before Ford announced a major debt restructuring that diluted shareholders, TARP-recipient Morgan Stanley was asking its private wealth clients who owned shares in the Detroit car company whether they could use those shares to execute short sales.

In a short sale, the short-seller "borrows" securities, then sells it, on the belief the stock price will fall. The short-seller then repurchases the securities at the new, lower price, and returns it to the lender. In this way, the short-seller profits from selling the borrowed securities for more than he later repurchases them for.

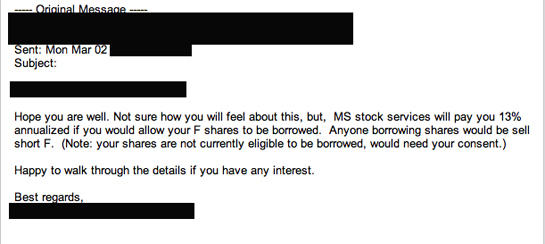

According to an email obtained by the Huffington Post, a Morgan Stanley financial advisor sent a letter to a private wealth management client who owns several thousand shares of Ford stock, asking permission to use the stock for short-sales. In the email, Morgan Stanley Stock Services indicates it would pay the client 13% on the dollar value of the stock borrowed, annualized.

This is unusual for several reasons:

Normally, financial firms can borrow securities to execute short sales without telling their clients, but this client had requested that his securities not be used for this purpose, prompting the email.

In addition, with interest rates so low, the 13% is, according to the client, a pricey fee. Traditionally, financial firms do not pay their clients any fee when they use their shares to execute short sales.

"With T-bills at a half of a percent, they were willing to pay over 20 times what I am getting for my cash," the client said. "This was a major enticement to build a shorting position. They were clear in that intent in the email."

Morgan Stanley had no immediate comment on the story.