The stock market surged Tuesday after a big jump in consumer confidence, despite word of a 19.1 percent drop in housing prices over the past year and a jobless rate likely to surpass that of Europe. Who are those confident consumers, and why are they jumping?

Consumer confidence is a number measured by the Conference Board, a nonprofit that bases its data on a survey of 5,000 U.S. households. The confidence measure is based on consumers' answers to five questions on current business and employment conditions and expected conditions six months down the road. Confidence rose from 40.8 to 59.4 in April. The benchmark number for consumer confidence, set in 1985, is 100.

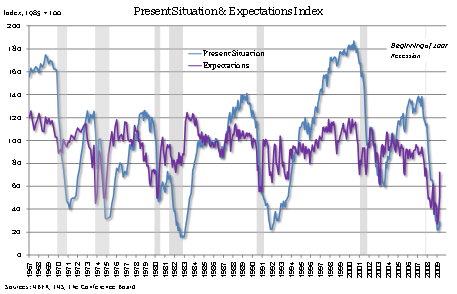

The April gains were carried by future expectations, which jumped from 51 to over 72, whereas respondents put current conditions at 28.9, up from 25.5 last month.

Dean Baker, co-director of the Center for Economic and Policy Research, is skeptical that the sunny expectations index carries much significance.

"This jumps all over the place and is almost meaningless," said Baker in an email to the Huffington Post. "This is no doubt being driven by the happy talk in the media pronouncing the recession over." Baker said the current conditions index, which "does reasonably well reflect current consumption patterns," is "still at an extremely low level."

In an interview with the Huffington Post, the Conference Board's Lynn Franco confirmed that consumers report "sharp increases in expectations as the recession seems behind them."

But Franco cautioned that even though "the worst may be behind us," positive expectations don't mean consumer spending is about to power the economy forward. "Consumers, in spending terms, are still facing a lot of headwind," Franco said.

The graph below, provided by the Conference Board, shows how consumers' expectations and assessments of current conditions tend to diverge and fluctuate when the economy hits a trough.

The Economic Policy Institute's Larry Mishel told the Huffington Post that bad times will continue, with "high and prolonged unemployment that's going to have a tremendous amount of hurt."