The recession has forced many struggling families across the country to confront a difficult decision: pay off credit card bills or make mortgage payments.

Before the downturn, Americans predominately opted to stay current on their mortgages before tackling other nagging debts. This pattern, however, has changed. More U.S. borrowers are choosing to pay credit card bills and let mortgage payments run delinquent, according to reports by TransUnion, a credit management company.

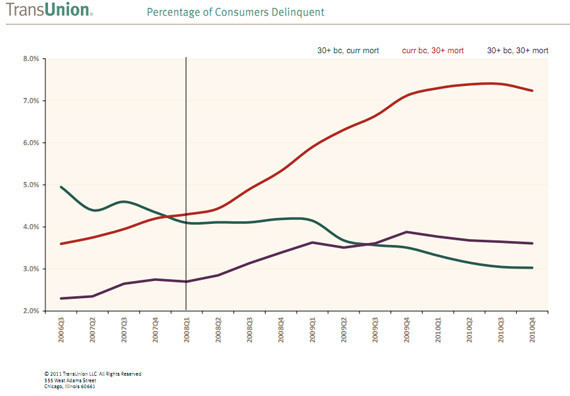

In the fourth quarter of 2010, 7.24 percent of U.S. homeowners were mortgage-delinquent and credit card-current. While that's down from 7.40 percent in the third quarter, it remains "72 percent higher than it was at the beginning of the Great Recession," notes Sean Reardon, the author of the study and a consultant in TransUnion's analytics and decisioning services business unit.

Only 3.03 percent of Americans in TransUnion's report fell behind on credit card payment in favor of making mortgage payments in the fourth quarter of 2010, the lowest percentage on record.

The report compares three groups: those 30-plus days delinquent on mortgages but current on credit cards; those current on mortgages but 30-plus days delinquent on credit cards; and those 30-plus days delinquent on both their mortgage and credit cards.

TransUnion found Americans first switched their "payment hierarchy" over to credit cards from mortgages just months after the 2007 financial collapse. High unemployment and a sagging housing market that left many borrowers owing more than their home is worth, Reardon says, were the two primary drivers in making the U.S. "less cash dependent and more credit dependent."

Increasing numbers of Americans have fallen underwater on their mortgages since the recession first began. By the final quarter of 2010, 23 percent of all U.S. homeowners owed more on their mortgages than their homes were actually worth, according to business information provider CoreLogic.

A simultaneous decision by the credit card industry to tighten lines of credit only intensified pressure on consumers to stay current. Missed mortgage payments might have more dire consequences down the road, Reardon noted in an interview, but struggling consumers quickly realized that a good credit line keeps food on the table today.

Despite the behavioral switch, Americans as a whole still say when asked that they care more about mortgages. In a February Zogby International survey by Transion, 79 percent said they would pay their mortgage first if forced to make one payment. Only 9 percent said they'd choose the credit card bill.

So-called "highest risk" homeowners -- often subprime borrowers -- are most likely to choose credit card payments over mortgage payments, the study finds. Of that demographic, which collectively switched their "payment hierarchy" earlier than the nation as a whole, 30.4 percent were mortgage-delinquent, credit card-current in the last quarter of 2010.

This is far from just a subprime issue, however. "Initially it was," Reardon says, "but it spread across all risk segments. It's now an issue at the national level."

In the chart below, the red curve denotes delinquent mortgages, current credit cards. The green curve denotes current mortgages, delinquent credit cards. The purple curve denotes delinquency on both: