In an effort to maintain access to lucrative federal student aid dollars, some for-profit colleges have used aggressive efforts to manage the statistics showing how many of their students default on federal loans, according to internal documents released at a Senate hearing Tuesday.

Some colleges have hired private investigators and dedicated entire departments toward driving down the student loan default rates at their schools –- though often just long enough to avoid penalties from the federal government that would prevent them from receiving student loan and grant money. Critics have likened such a practice to banks keeping bad loans off their books from quarter to quarter.

The goal, according to numerous e-mails obtained by the Senate Health Education, Labor and Pensions committee, is to push as many potential loan defaults outside the two-year window that the federal government uses to evaluate eligibility for federal student aid. In some cases, schools have paid outside firms $1,000 per head to put a student in loan deferment or forbearance, in which payments are delayed but the loan balance continues to increase over time, according to documents referenced during Tuesday’s hearing.

“They are not counseling the student on what is in their best interest,” said Pauline Abernathy, the vice president of the Institute for College Access and Success, who testified at Tuesday’s hearing on student debt at for-profit colleges. “They are simply paid a thousand dollars per head; they really are bounty hunters.”

Student loan default rates are a key factor in any college’s eligibility for federal higher education aid dollars. But loan default numbers are a life-and-death statistic at for-profit colleges, where schools rely on those federal student aid dollars for a vast majority of revenues.

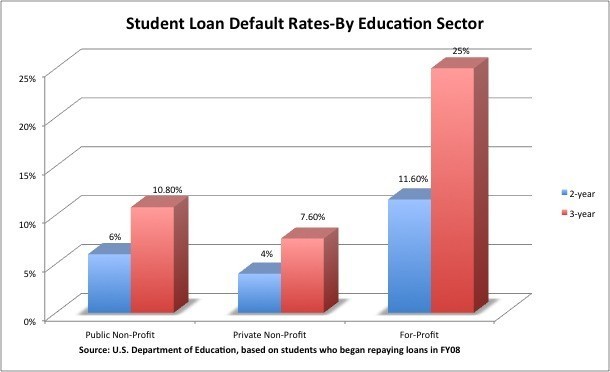

In addition, students at for-profit colleges default on loans at more than twice the rate of their peers at public institutions. And for-profit schools charge twice as much as public colleges, even though for-profit schools devote less than a third of the money toward education.

Statistics from the Department of Education have shown that the student loan default rates at for-profit colleges jump dramatically after the two-year window the government uses to track them. But the e-mails released Tuesday shed light for the first time on internal deliberations showing the central importance of such default rates.

Kaplan Higher Education, for example, entered into an agreement with a private investigative firm in 2008 to persuade students to sign agreements to go into forbearance on student loans. The agreement said the firm should make a "reasonable attempt" to get students to sign the form, including telephone calls, up to three visits to the student’s address and seeking any forwarding addresses.

Other Kaplan emails from the company’s “director of default management and strategy” show employees actively searching death certificates to see if borrowers have died and checking jail and prison logs to see if those loans could be discharged.

A spokeswoman for Kaplan said in an email that the company had not seen the documents released by the Senate committee. But she said the outside company was hired to find students whose contact information was out of date and could be at risk of default without knowing.

"We undertake numerous efforts to prevent students from defaulting on their loans –- a challenge for any institution that has served a population of working-class adults during an economic recession," she said.

Industry groups have long defended such “default management” strategies, arguing that they are an attempt to give students relief from debts they cannot pay. Kent Jenkins, a spokesman for Corinthian Colleges, said the company has dedicated significant resources to student loan defaults in order to keep students informed about their options with student loan debt, and to prevent them from going into default.

An email from a regional director in charge of defaults at Corinthian Colleges Inc. congratulated employees, saying, “We cured 243 students on Wednesday … our Division is leading (Corinthian) and that is a direct reflection of your daily efforts to drive down our (default rate).”

"First you're criticized for having a problem and not doing something about it, and then when you do something about it, they say, 'Well, we don't like the way they're doing it, and we don't think they're sincere,'" Jenkins said. "The level of resources we’ve invested, the time and energy we’ve invested and the results were getting demonstrate that we're quite serious about addressing this problem."

Critics often agree with default management tactics in the case of deferment, where the loan balance is put off until a borrower is employed or better able to handle the debt.

But they disagree with programs that push for forbearance, where the loan balance continues to accrue despite a temporary reprieve in payments.

"If (students) really are in a situation where they can’t pay long term, then we need to prevent those balances from increasing so that we protect students who are put into these programs," said Sandy Baum, a policy analyst for the College Board and a senior associate at the Institute for Higher Education Policy. "And we need to get measures that cannot be so easily manipulated by the institutions."

Sen. Tom Harkin, D-Iowa, who chaired Tuesday's committee hearing, said managing default rates "Merely delays default for some students and can result in a higher debt when that default occurs."

The Department of Education's "gainful employment" regulation, released last week, would crack down on schools that put inordinate amounts of students in loan deferment programs. The new regulations measure how many students are repaying federal loans, meaning deferment and forbearance programs would count against that statistic.