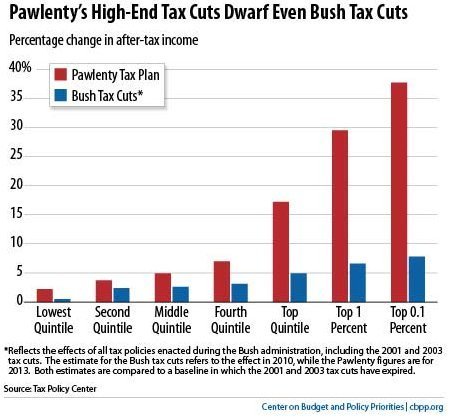

Move over Bush and Obama, there's a new king of tax cuts in town.

A recently-proposed tax plan by Republican presidential candidate Tim Pawlenty, which includes several major tax cuts, would dramatically favor the wealthiest 0.1 percent of Americans, according to the non-partisan Center on Budget and Policy Priorities, who used previous analysis by The Urban-Brookings Tax Policy Center.

Indeed, the cuts proposed by Pawlenty would quadruple cuts received by the wealthiest 0.1 percent last year saving them an annual average of $1.8 million.

Specifically, Pawlenty's proposal would simplify the entire tax code by having only two rates for individuals: Americans would be taxed 10 percent for their first $50,000 of income and then 25 percent for all wages earned beyond that. In addition, corporate taxes would be cut to 15 percent from 35 percent.

It's estimated that the cuts would result in tax revenue of only 13.5 percent of the national GDP, according to the Center For American Progress cited by Business Week. That's less than the annual 18 percent average since World War II. It's lesser still than government spending last year, which equated to 25 percent of GDP.

Pawlenty says the cuts, among other things, will spur businesses to hire and provide the solution to what he views to be a failing recovery. "These changes will make American companies immediately more competitive," he said in a speech outlining his plan at the University Of Chicago last week. "Investment from around the world will pour into our suddenly inviting market. Creating desperately needed jobs -- and opportunities."

At least some Democrats disagree. Democratic National Committee Chairwoman Debbie Wasserman Schultz said in a statement "Mr. Pawlenty would take the Republican policies of the last decade, which exploded our deficit and debt and nearly sank our economy into a second Great Depression, and inject them with steroids."

Below graph compares percentage change in after-tax income of the two plans: