Advances in communication, information, transportation and trading technology have helped web together nations into interconnected and interdependent communities. But according to a new OECD report entitled "Future Global Shocks," this interconnectedness helps make the global economy more susceptible to economic shocks and crises.

The report, released on Monday, suggests that because of the world's interconnectedness, what might have in the past been considered to be a local problem can quickly become a global problem. The subprime mortgage crisis, the resulting banking crisis in the U.S., and the Greek Debt Crisis are often used by experts as the quintessential examples of economic contagion.

Prior to the process of globalization, financial crises in any one particular country posed little risk to those of others, according to Forbes. But due to increased international lending and trading that has come about as a result of globalization, this is no longer the case. The health of one nation's financial system is now very much dependent on the health of other nation's banking systems and vice versa.

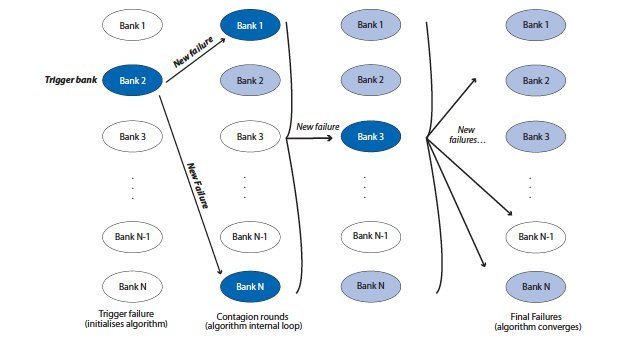

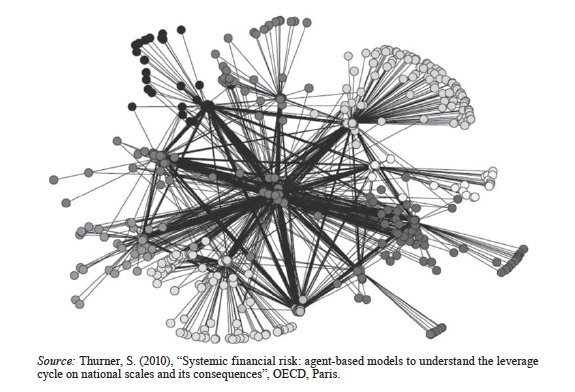

See illustrated OECD examples of how banks are more interconnected here:

But as is noted by the report and its author, Jack Radisch, banking crises are not the only shocks that affect the global community. The report, in fact, identifies four other circumstances -- pandemics, geomagnetic storm, social unrest and infrastructure disruption -- that can now significantly disrupt the global economy.

"We see not only financial crises on the horizon," Radisch told Reuters, "but you have pandemics of course we recently lived through, you have the European ash cloud which had disruptive effects on supply chains."

The main reason why economic shock events will become more regular, suggests Radisch, is that global leaders and businesses haven't considered the new systemic risks that now exist in a more interconnected world. "We are finding out that there are vulnerabilities that we hadn't considered before."

This is not the first time the issue of globalized systemic risk has been brought up. In a speech delivered in 2007 by First Deputy Managing Direct of the IMF John Lipsky at the Chicago Federal Reserve, it was stated that the concept of how the world views systemic risk was too limited. How businesses and nations viewed their exposure to the plights of others needed to radically change in order to meet new challenges, he said.

Indeed, following May's meager employment report, then Obama administration official and Chairman of the Council of Economic Advisers Austan Goolsbee was quick to point to the financial woes over the Atlantic, in Europe, along with higher gas prices and the supply chain disruption caused by the Japan quake as key factors to the slower than expected growth of the American economy.

"I think that the headwinds of gas prices, of the Japanese supply chain, of some of the European financial issues have been serious." Goolsbee told PBS. "They slowed down the growth rate. "

The interconnectedness of banks, illustrated by the OECD: