This article comes to us courtesy of California Watch.

A new report finds that it's taking increasingly more student debt to produce a degree in this country - meaning that while students are collectively paying more for an education, the nation's colleges and universities aren't producing a proportionate increase in degrees and certificates.

The report from the Washington, D.C.-based research group Education Sector created a new measurement of colleges' success based on publicly available data on student debt and graduation. The figure, called the borrowing-to-credential ratio, looks at the total amount of student borrowing at a university during a three-year period and divides it by the number of people who earn degrees in that period.

Nationally, the average amount of debt it takes to produce a degree increased steadily during the three years studied, from $13,334 per credential in 2006-07 to $18,102 in 2008-09.

"It's taking more and more debt to produce each degree," said Erin Dillon, senior policy analyst for Education Sector and co-author of the report. "States ... have had to lower their investment in higher education. But that doesn't mean lower prices; it just means students are paying more. At the same time, we're not doing a good job of graduating students."

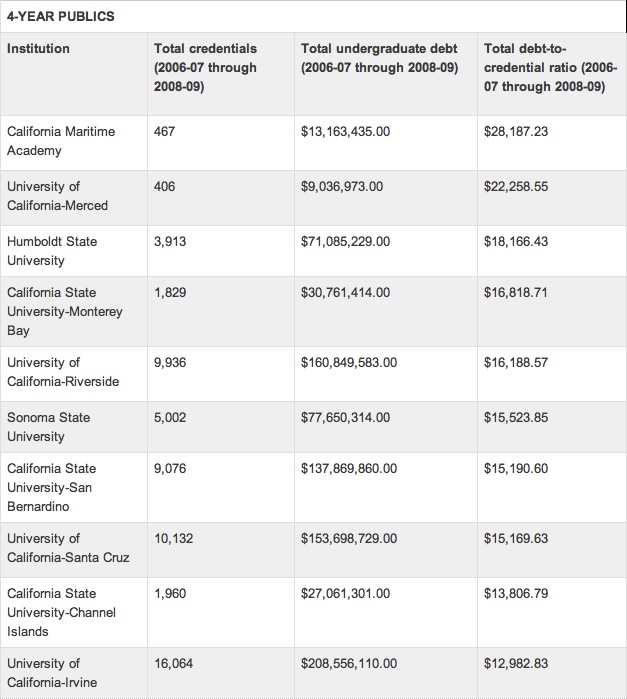

The figures show that during the three-year period ending in 2008-09, California had the lowest debt-to-degree ratio of any state. Colleges and universities in the Golden State produced $6,008 in student debt for every degree issued.

That might come as a surprise to students at four-year public universities in California. Students at the University of California will pay more than three times what they paid a decade ago for the upcoming school year. At California State University, tuition has doubled since 2007.

Dillon said that because the data Education Sector studied only goes up to 2008-09, it may not accurately reflect California's current position in relation to other states. Also, community colleges are included in the study, and California's community college system - where 58 percent of first-time freshmen start out - still has very affordable rates at $26 per unit.

During the period studied by Education Sector, California ranked 20th out of 50 states for spending per full-time equivalent student. But the figure has been declining, from $6,450 in 2005 to $5,941 in 2010, according to a recent report [PDF] by the State Higher Education Executive Officers.

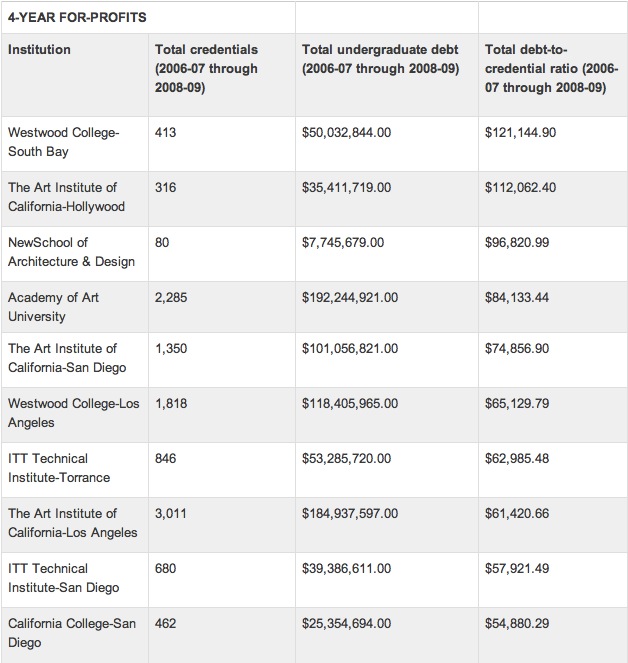

The Education Sector report found that among four-year universities, for-profit institutions had the highest borrowing-to-credential ratios. The average ratio at public four-year universities was $16,247. At private nonprofit colleges and universities, it was $21,827. For-profit universities, by contrast, produced $43,383 in debt for every degree.

In California, that pattern holds true as well. The top 20 four-year colleges with the highest ratios were for-profits, with Westwood College's South Bay campus topping the list. The university produced $121,145 in debt per degree. Other schools with high ratios in California's four-year for-profit sector (see chart below) include the Art Institute of California in Hollywood and the NewSchool of Architecture & Design in San Diego.

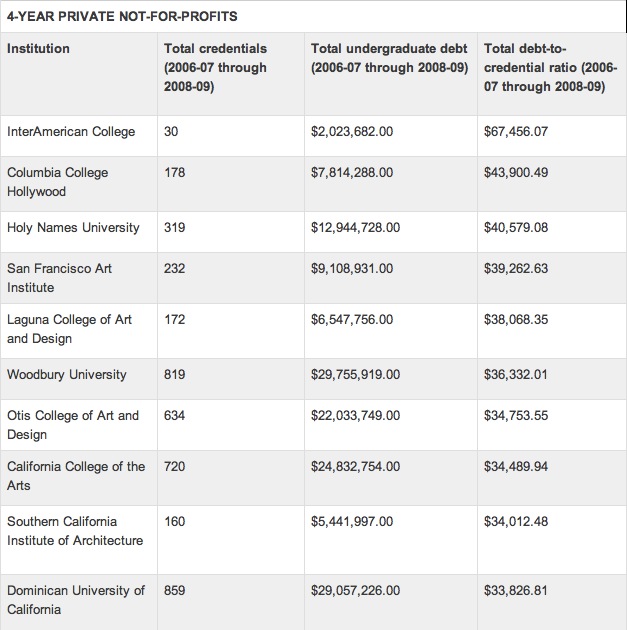

Dillon said culinary and art schools saw some of the largest debt-to-degree ratios nationally, and that matches up with California's data, too. Among the four-year, private nonprofit universities (see chart below), the schools with the highest debt ratios include the San Francisco Art Institute, Laguna College of Art and Design, and Otis College of Art and Design.

One nonprofit university had a high ratio, rivaling some of the for-profits with the biggest borrowing-to-credential ratios: United States University in National City produced $67,456 in debt per degree. That could be due to a sharp rise in enrollment. The college, which used to be named InterAmerican College, doubled undergraduate enrollment from 39 students in 2006-07 to 82 in 2008-09.

The Education Sector report recommends that states take urgent action to focus financial aid policies on the most needy students, while also bolstering programs to help students at risk of dropping out. Also, the Department of Education's forthcoming regulations on the for-profit sector could help decrease the debt-to-degree ratios among proprietary colleges. In particular, the federal government's new rules on gainful employment will require career colleges to better prepare students for the workforce or risk losing federal financial aid.

The charts below show the highest borrowing-to-credential ratios for three types of universities in California.

Erica Perez is an investigative reporter for California Watch, a project of the non-profit Center for Investigative Reporting. Find more California Watch stories here.