"Burdened Beginnings" is a series examining the problem of child identity theft. Other stories in the series can be found here.

Ana Ramirez rents a cramped, two-bedroom house in southern California with her husband and three young children. Someday, she hopes to buy a home.

But according to her credit report, the 25-year-old already owns a home. In fact, she has been a delinquent homeowner, at least on paper, since she was 10 years old, she said.

Ramirez said her mother stole her identity to take out a mortgage when she was a child, but failed to make timely payments and nearly fell into foreclosure. When Ramirez became an adult, she discovered her credit was trashed.

So Ramirez had a choice: She could either report her mother to police -- a necessary step to fixing her credit -- or say nothing and enter adulthood with a tarnished financial reputation.

She decided to keep quiet.

Now, her blemished record is preventing Ramirez and her husband from acquiring a home loan, she said. She feels helpless and frustrated, but out of a sense of family loyalty, she refuses to file a police report that would repair her credit.

"I get angry sometimes when I think about it," Ramirez said. "But it's my mom. I wouldn't want to do that to her."

Ramirez said she is a victim of child identity theft, a crime that is capturing the attention of authorities as young adults find their Social Security numbers have been abused for years without detection. When victims turn 18, they encounter a series of financial roadblocks, unable to acquire loans for college, cars or homes due to damaged credit.

But advocates say cases like Ramirez's are the most difficult to detect and resolve because the ones who are supposed to monitor children's credit -- their parents -- are the thieves, and victims are often unwilling to report them. Without a police report, experts say it is nearly impossible to restore a victim's good name.

An estimated 500,000 children have had their identities stolen by a parent, according to ID Analytics, which sells identity fraud protection. It is a crime of opportunity, with the culprits having total access to their children's unused Social Security numbers and the victims unaware they are victims at all.

"Why would a family member do this?" Russell Butler, executive director at the Maryland Crime Victims' Resource Center, said at a July conference on child identity theft. "Well, it's easy -- as easy as taking candy from a baby. Because you have a child, and they don't even want the candy. They don't even know they have credit."

An Unreported Crime

The concern over child identity theft comes as Americans have a greater need for clean sources of credit. Last April, 25 percent of Americans had credit scores of less than 600 -- the least-creditworthy category -- compared to 15 percent before the recession began, according to data compiled by Deutsche Bank. Therefore, the temptation to hijack a child's pristine credit may be greater than ever.

Government efforts to stop child identity theft have only created new problems.

In 1987, the federal government launched a program to encourage parents to apply for their newborn's Social Security numbers at birth so identity thieves didn't apply for them first. But the program had an unintended consequence: By issuing Social Security numbers in a predictable sequence based partly on the year a person was born, identity thieves could infer a child's 9-digit identifier based on public information, according to Alessandro Acquisti, associate professor at Carnegie Mellon University.

In response, the Social Security Administration in June began assigning a randomized series of numbers to children. But some say this may complicate future efforts to prevent child identity theft. The credit card industry, for example, relies on the older, predicable sequence to reject applications linked to Social Security numbers that appear to belong to children.

"I am concerned that it might make it a little easier for children to be victimized," said Doug Johnson, vice president of risk management policy at the American Bankers Association.

In the largest study on child identity theft to date, researchers at Carnegie Mellon University earlier this year found the identity theft rate among children (10.2 percent) was 51 times higher than among adults (0.2 percent) in the same population

The stolen identities of children were used to purchase homes and cars, open credit card accounts, gain employment and obtain driver's licenses, according the report. The study was based on data provided by Debix, which sells identity theft services and offers free scans for parents who want to find out if a credit file exists on their child.

Last year, more than 18,000 identity theft complaints were reported to the Federal Trade Commission by victims 19 and under, making up about 8 percent of all complaints. That number has remained mostly flat over the past three years.

But experts say figures on child identity theft are likely much higher because the crime often goes unreported. ID Analytics estimates more than 140,000 children are victims of identity theft each year, based on a one-year study of children enrolled in the firm's identity protection service.

Advocates say the lack of reporting is most common when parents hijack their children's Social Security numbers. The unwillingness of victims to report these cases can be found in a small survey taken this year by the Identity Theft Resource Center.

Out of 55 identity theft victims who were targeted by family members, 24 percent said they "did not feel right" about filing a police report, the survey found. An additional 13 percent said "my family is ashamed and remains in denial" and 9 percent said "my family will turn against me if I take any action against this person."

"They're really torn about whether they should do something or not," said Gabby Beltran, a spokeswoman for the Identity Theft Resource Center. "They'll say 'It's my mom' or 'It's my dad, and I don't want anything to happen to them.' A good number of them don't do anything."

Some states have stiffened penalties for parents or guardians who steal children's identities. Florida, for example, has made the crime a second-degree felony with a maximum punishment of 15 years in prison.

Still, experts say more should be done to help children sort through the time-consuming and expensive process of repairing credit fraud. Victims of identity theft spend an average of 330 hours fixing their credit and incur more than $850 in expenses, according to the Identity Theft Resource Center.

Police are often unwilling to take a report when parents use their child's Social Security number, viewing it as a domestic matter, experts say. And the child-welfare system is not equipped to handle cases of parents stealing their children's identities because children are not allowed to retain legal assistance on their own, said Butler at the Maryland Crime Victims' Resource Center. Advocates say the law should view these cases like child abuse.

"You don't have a system now that considers the financial abuse of a child as a gateway to needing assistance," Butler said. "There's got to be someone who can step into those shoes and act in the child's best interests."

A Family Secret

Parents use their children's Social Security numbers for a variety of reasons. Some use them to get jobs because they have felony convictions on their records. Others use them to apply for credit cards and utilities because their own credit is tarnished.

Last April, Maryland resident Jimmy Louis Craighead, 40, was convicted of stealing the identities of his three children -- ages 6, 4 and 2. He told a judge he and his wife were not able to get credit in their own names, so they used their children's names to get money for food, fuel and other necessities, according to the Carroll County Times.

"They have maxed out their ability to get credit, so they borrow their child's thinking, 'Oh, it's okay. I'll pay all the bills so by the time they turn 18, they'll have great credit,'" Linda Foley, co-founder of ID Theft Info Source and an expert on child identity theft, said at a conference in July. "Well, they haven't unlearned the bad behaviors that got them in debt in the first place, so at 18, the child ends up in debt."

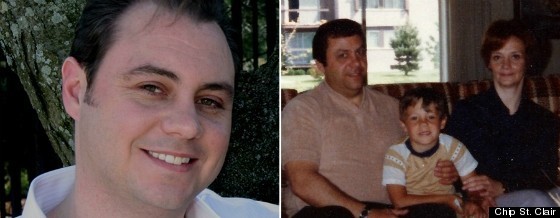

That debt can take years to remove from a credit report. When Chip St. Clair was 15, his parents stole his identity to take out nearly $50,000 in student loans, utilities, apartment leases and car loans over the course of three years, he said. He didn't find out until 1998, when he was 22 and his father was charged with escaping from an Indiana state prison in the 1970s.

He also learned that his father, who went by the name David St. Clair, was actually Michael Dean Grant, a convicted child killer. Grant had used Chip's Social Security number to create a new identity.

After his father's arrest in 1998, Chip's mother wrote a letter for her son to give to his creditors. Written in cursive on stationery with a brown stuffed bear, the letter began "To Whom It May Concern: I am writing this letter in hopes it will straighten out my son's credit and financial problems."

It continued: "Chip is trying to regroup and make something of himself and all this from the past is holding him back. ... He should not be held accountable for the sins of his father. ... Please try to have compassion for Chip's situation and help him clear his good name."

Now 36 and a resident of Rochester, Mich., St. Clair said he has spent the last decade trying to remove fraudulent charges from his credit report while paying high interest rates on loans because of his poor credit. He has still not been able to erase student loans that his parents took out in his name, he said. In October, he tried to open a utility account, but was told he had an outstanding balance of $500 from an address where his parents lived 20 years ago.

"Your credit is your lifeline to society," St. Clair told The Huffington Post. "When it's stolen from you, it creates so many problems in your life. It still haunts me to this day."

Chip St. Clair (left) says his parents stole his identity when he was a child.

Dad Reports Mom

Diamond Daye's credit report shows she has applied for credit cards, cell phones and cable, with some bills so overdue they have been sent to collection agencies, according to her father, Darwin Daye. But Diamond shouldn't have a credit report. She is only 13.

Daye claims Diamond's identity is being used by her mother, Maurine Walter, who has a history of writing bad checks, according to court records. Daye said he found out when Walter's cousin called him a few years ago.

"She said, 'You better check Diamond's credit, because Maurine is using her Social Security number,'" Daye told HuffPost.

Daye, 39, of Clayton, N.C., who separated from Walter in 2005, began contacting Diamond's creditors, trying to remove unpaid bills linked to his daughter's name. Daye provided letters to The Huffington Post that he received from Time Warner Cable, Sprint and Citibank informing him that Diamond's Social Security number was used by someone else. Daye believes it was Walter.

Daye said he recently put a freeze on Diamond's credit report, but remains concerned that other fraudulent accounts may wind up under his daughter's name. So he asked a private investigator to look into Diamond's credit history. For his efforts, Daye said his relationship with his daughter has become strained.

"She thinks Dad has caused a bunch of trouble," he said. "But I'm looking out for my daughter's best interest."

Two years ago, Walter was charged with using Diamond's Social Security number to pass a credit check for an apartment in Winchester, Va., according to court records. Walter pleaded guilty and avoided jail time. She retains custody of Diamond -- a fact that frustrates Diamond's father.

"To me, there was nothing done," Daye said. "How can that happen? You have one parent fighting to protect the child and the other parent messing the child up."

Walter did not return repeated calls seeking comment.

Jeff Ramey once found himself in a similar situation as Darwin Daye, but his story has a different outcome. Eight years ago, creditors began calling Ramey's house in Zephyrhills, Fla., asking to speak with his daughter, Shelbi, who was only 5. That was when Ramey pulled his daughter's credit report and found eight different credit cards in her name dating to when Shelbi was 2, he said.

"My jaw hit the floor," he told The Huffington Post.

Ramey knew the culprit: Shelbi's mother, Shannon Godfrey. Ramey reported her to police and she was arrested in November 2007, according to court records. Godfrey was released the same day after posting $400 bail. As restitution, she was ordered to pay off the credit card debt under her daughter's name -- more than $5,000, records show.

Now 13, Shelbi is old enough to understand what happened.

"I've talked to her," Ramey said. "She kind of understands what her mom did was pretty bad."

To prevent the unpaid debt from damaging Shelbi's credit when she got older, Ramey sent copies of her birth certificates to his daughter's creditors, proving she was too young to acquire a credit card. It took him about three years to remove the fraud from her credit report, but he is relieved to have caught it when he did.

"It was a big pain in the butt to get it all straight," Ramey said, "but I'm glad I found out about it when she was 5 and not when she was older. I can't imagine how bad it would have been."

Swept Under The Rug

Fifteen years ago, Ramirez's mother divorced her father and began looking for a new home to raise her five daughters. Nearly broke, her mother took a job cleaning houses and offices. But with damaged credit, she did not qualify for a home loan.

So she used 10-year-old Ana's Social Security number to take out a mortgage on a four-bedroom house. Over the years, Ramirez said her mother also used her credit to buy a cell phone, a Ford station wagon and some jewelry.

Ramirez said her mother was able to steal her identity because they both have the same name, except for a different middle initial. Ramirez discovered the theft a decade later, when she and her husband were newly married and about to buy a home. Their real estate agent ran a credit check and found Ana's credit score was 300, the lowest possible.

"My mother wanted to do anything to get away from my father and build a whole new life," Ramirez said. "She did it out of desperation, but didn't think about the long-term effects."

Today, Ramirez, a full-time teacher, lives with her husband and three children -- ages 5, 4 and 5 months -- in San Bernardino, Calif., about 65 miles east of Los Angeles. With just two bedrooms, the house is too small and they want to buy a larger one. But while her husband's credit is good, they are applying for a mortgage under both of their incomes, which means credit checks are required on both of them.

Ramirez has started slowly rebuilding her credit by using credit cards with $250 limits -- the only ones she can acquire -- and paying them off immediately.

When Ramirez and her mother are together, they don't bring up the identity theft because it leads to an argument, she said. In Mexican-American families, children do not question their parents, she told HuffPost.

Still, her mother felt so guilty about damaging her daughter's financial reputation that she recently paid $800 to a company called Advantage Plus Credit Reporting, which offered to move the bad debt to her mother's credit report. But after Ramirez's mother sent the money, the company did nothing, and when she called to inquire, the phone number was disconnected, Ramirez said.

"They took her money and didn't do anything about it," Ramirez said.

Ramirez's husband, a barber, wants her to report her mother to police so she can fix her credit and they can buy a home. But Ramirez refuses.

"In our culture, it's always 'family first,'" Ramirez said. "I've just got to bite the bullet and sweep it under the rug."