The biggest one-day drop in the history of the Dow Jones Industrial Average occurred Sept. 29, 2008, when Congress ganked on its first attempt to pass the Troubled Asset Relief Program bailout bill. That day, the DJIA fell by 777.28.

On Tuesday, the Dow Jones Industrial Average experienced a far more quotidian drop of 89.24 points. According to CNBC, this is all Rep. Raul Grijalva's fault. Here's Evan McMorris-Santoro, with this absurd story:

At around 3:30 PM Eastern Tuesday, CNBC anchor Michelle Caruso-Cabrera noted a sell-off in the stock market, an entirely unremarkable occurrence in the course of the financial network’s daily coverage. But what separated this particular sell-off from others, according to Caruso-Cabrera, was that it could be traced directly to the appearance of one of the House’s top progressives on her show.

Rep. Raul Grijalva (D-AZ) tanked the market, she said, by refusing to budge on his contention that Medicare cuts should be off the table in negotiations surrounding the so-called fiscal cliff.

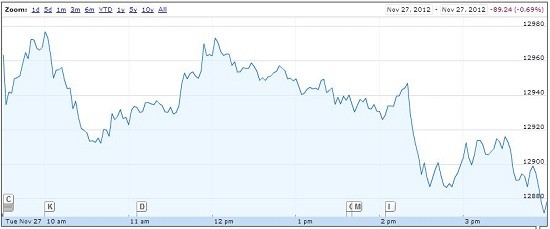

Just for the sake of edification, here is Tuesday's Dow Jones performance, rendered graphically. As you can see, the net losses that occurred during Grijalva's segment were about 20 points. (By means of comparison, the Dow closed Wednesday at 12,985.11.)

Caruso-Cabrera, however, was pretty sure that Grijalva, who leads a minority caucus in the minority party in the U.S. House of Representatives, had precisely the sort of clout in the grand scheme of things to make her precious market misbehave:

“Representative? You know what, as we’re talking the market is selling off once again,” she told Grijalva. “Every time members of Congress come on, and I’ve got to tell you, sir, I think you’re contributing to the fears that we’re going off the fiscal cliff because it doesn’t sound like there’s any compromise in what you’re saying. Do you care that markets are selling off dramatically when it looks like you guys can’t come to a deal?”

Chances are that the markets are going to expand and contract somewhat, based upon the various "fiscal cliff" negotiations that transpire. But Griljalva's position on Medicare (which he's had for many, many years, and thus should not surprise anyone) is not going to be a prime mover of economic markets -- yesterday, tomorrow, or ever. And no one's particular position is going to tip the financial markets by nearly 800 points, like they did during the TARP negotiations, when the prevailing factor was that the entire economy was on the verge of imminent collapse.

Here's Matt Yglesias on the whole matter of market-watching during the "fiscal cliff" negotiations:

Financial markets are important both substantively and as a useful source of information. But it would be absurd for policymakers to try to target short-term fluctuations in financial markets. They should try to enact decent economic policy...Sparing CNBC obsessives 48 hours of antsiness isn't a good reason to do anything.

I think that Matt would agree that Tuesday's 80-point sell-off was, at worst, really nothing more than "a net transfer of wealth from panicky people to sensible people." Wednesday, the Dow has closed up over 100 points, and as near as anyone knows, Grijalva has the exact same policy position on Medicare as he did Tuesday, as well as the exact same bargaining position at the negotiating table.

I suppose if CNBC wants to stem the harm that Grijalva and his well-known support of Medicare is doing to the market, they can simply stop booking Grijalva on their channel. But the larger problem -- the fact that CNBC actually believes Grijalva's position on Medicare has a dramatic effect on the market, and that there are gullible CNBC viewers that believe that as well -- would nevertheless remain.

And that's how you get "a net transfer of wealth from panicky people to sensible people."

(In a wonderfully synergistic bit of serendipity, I have an article in the current issue of The Baffler on CNBC's kooky market televangelism, so why not pick up a copy?)

[Would you like to follow me on Twitter? Because why not?]