In the 10 years since the beginning of the Iraq war, the costs of war have been compared to the benefits of freedom at a near constant rate. Thanks to its large-scale impact on the country's federal debt, it's a debate with no end in sight.

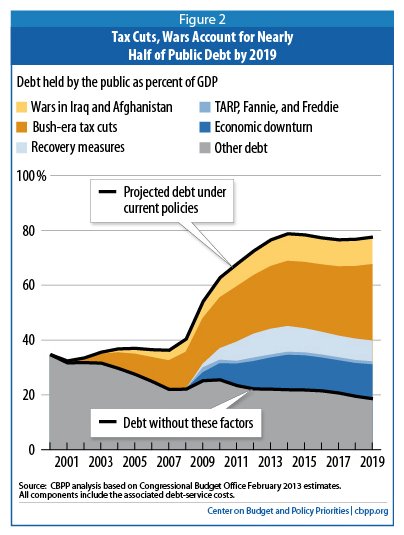

The Iraq war has so far cost the U.S. about $800 billion -- not including continuing payments to veterans -- and it’s poised to be major driver of the deficit for years to come. Add to that the costs of the Afghanistan war and the Bush-era tax cuts for the wealthy, and you'll account for almost half of the debt that the nation is set to owe by 2019, according to the Center on Budget Policy and Priorities, a left-leaning think tank.

(THE CHART BELOW HELPS EXPLAIN WAR-DEBT RELATIONSHIP)

Over the past few years, lawmakers have been wrangling over the best way to cut the deficit and curb its growth. Some proposals include cutting spending on social safety net programs, while others have called for a boost in taxes. The CBPP analysis indicates that without the Iraq War, lawmakers might have had some more wiggling room before being forced to make such tough choices.

As a Tuesday editorial in the Boston Globe notes:

The United States spent $800 billion in Iraq, not counting our ongoing obligations to veterans. That’s roughly the amount of this year’s federal budget deficit, which is causing such angst and gridlock on Capitol Hill. It is impossible to fight two resource-sapping wars at the same time, and not feel the pinch on Medicare and education.

And just because the war is over doesn’t mean that it’s done costing America money or pushing the U.S. further into debt. Continued costs of the war are expected to total between $4 and $6 trillion, according to MarketWatch. That’s about $80 billion per year for the next 50 years, or the same amount the U.S. spends each year on the Justice Department, the Department of Homeland Security and the Environmental Protection Agency.

Check out CBPP's chart on what's driving the deficit below: