The 1040 has been the primary American tax form since the introduction of the personal income tax in 1913. That’s even been the form’s name since the very beginning. But what started as a simple document with 27 lines of information to fill out has grown ever more complex: the current 1040 has 77 line items—plus a 189-page appendix of instructions. The image above is an animation of the first page of every 1040 from 1913 to 2011.

The 1040 is in the news as American politicians debate changes to income tax rates and deductions to head off austerity measures, known as the fiscal cliff, set to take effect in the new year. Capping or eliminating some credits and deductions could, in theory, simplify the tax code—and, in turn, the 1040. But if the changes only apply to some taxpayers, as seems likely, the form could actually get even more unwieldy.

More from Quartz:

-- How To Get More Hours Out Of Your Day, Look At Something Awesome

-- Citigroup Keeps Chugging Along

-- Five Reason For Gold's Sudden, Violent Collapse

-- KFC’s Boneless Chicken Is Supposed To Please American Millennials. Here’s Why It Won’t

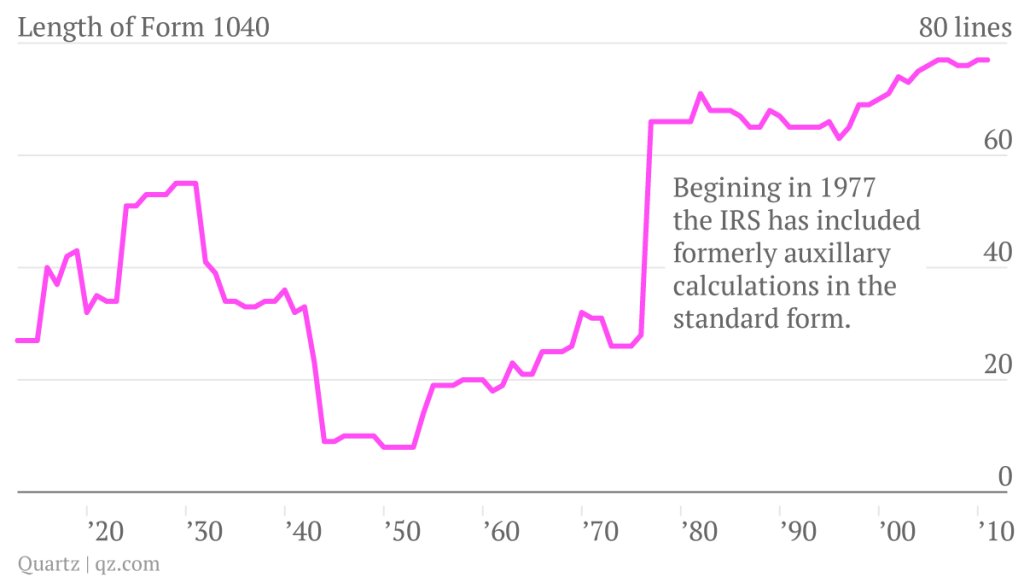

There are many ways to measure the complexity of the tax code, but the most straightforward approach is simply to measure the length of the 1040. Here’s a look at how the form has grown over time, according to our analysis:

The 77 numbered lines on the current version of Internal Revenue Service Form 1040 range from filing status (single, married, etc.) to the filer’s residential energy credit (attach form 5695!). In just the last 20 years, the length of the form has increased 21%, up from 65 lines in 1991.

The original 1040 was created in 1913 after the federal income tax was enacted by the 16th Amendment to the US Constitution. It started at 27 lines, but redesigns of the document got it down to 8—the lowest ever—in 1950 by rearranging, combining, and moving lines onto auxiliary sections and documents.

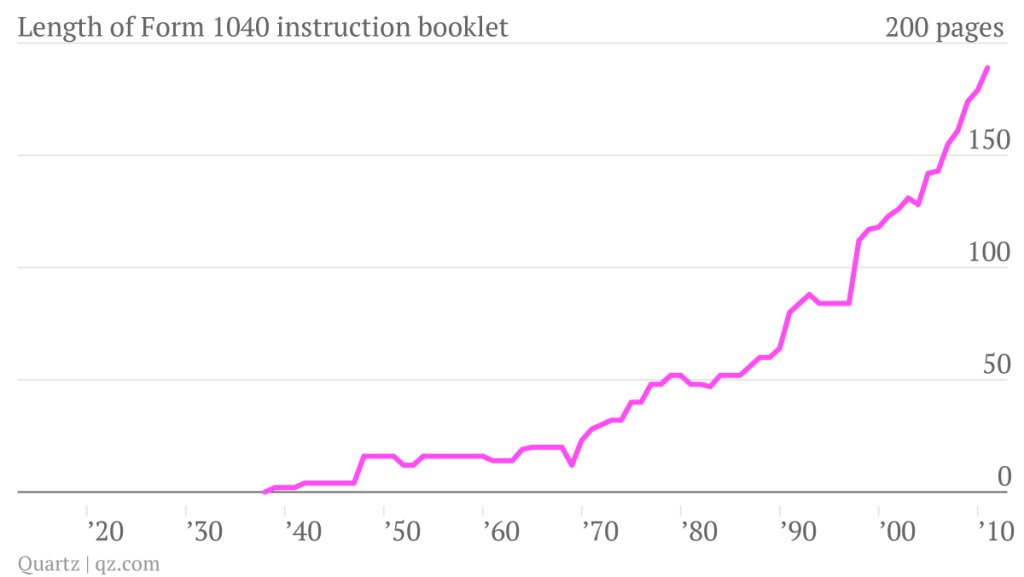

Of course, just because early forms had fewer entries doesn’t mean that they were shorter. In 1935, a standard 1040 was eight pages long, including a duplicate form to submit to the IRS along with computational worksheets and instructions. Duplication forms were discontinued in 1940. Three years before, in 1937, the filing instructions were removed, leading the way for what is now known as the 1040i.

First published in 1939, the instruction booklet for the 1040 and its related documents, started at just 2 pages long. It’s now 189 pages, having more than doubled in size over the last 15 years.

Most taxpayers will never fill out every line of a 1040 nor read every page of the instruction booklet—unless, perhaps, they are stock-trading business owners with student loans and farm income, who received unemployment benefits and alimony payments.

The IRS tries to keep the filing process simple. In 1982, when the standard 1040 had 71 lines to fill out, the IRS introduced Form 1040EZ as an alternative for certain filers with simple taxes. It had 11 lines. Last year the 1040EZ had 12 lines.

Methodology: We looked at every 1040 from 1913 to 2011 and tabulated how many numbered line items a filer would confront if they didn’t need to use another form or calculation area. Line items requiring another form or tabulation on a separate part of the 1040 were counted as one line item. We did not count sub-line items separately. That is, 3a, 3b, and 3c all count as one line item. All of the historical tax forms can be downloaded here.

Read this next: Check your US tax rate for 2012—and every year since 1913