An attempt nearly two decades ago to limit executive pay instead encouraged it to skyrocket, according to a new report by the Roosevelt Institute, a progressive think tank.

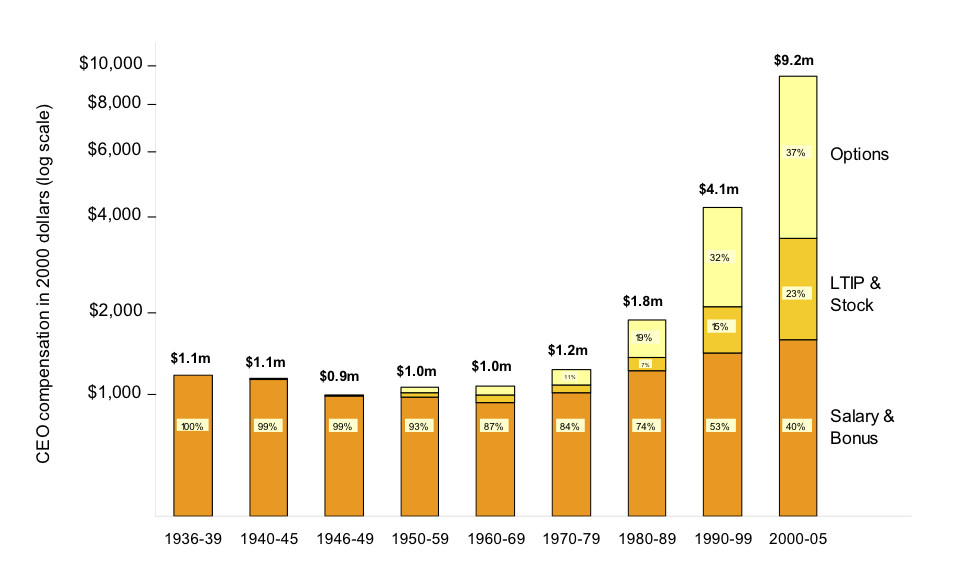

From 1936 through 1950, executive pay barely changed and was made up simply of a salary and a bonus. Then around 1950, CEO pay started to include a small amount of stocks and options in the company. That trend grew more noticeable over the next 40 years, only to begin skyrocketing during the 1990s.

Why the big change? In 1993, a change to the U.S. tax code capped deductions for executive pay at $1 million. But a loophole to the change allows “performance-based" income (pay packages like stocks that are directly tied to company's share performance, earnings or market share) to exceed the $1 million limit.

This exception encouraged companies to compensate their CEOs outside of their base salary -- a decision that the Roosevelt Institute argues hurts the economy in the process.

A chart, originally from a 2010 study conducted by Boston University's Carola Frydman and Stanford's Dirk Jenter, shows how CEO compensation has changed from 1935 to 2005:

Expanding CEO pay packages in the form of stock options and long-term incentive plans -- pay executives get after they hit a specific performance target or work a certain number of years -- has further increased the disparity between executive and worker compensation. Since 1978, executive pay at American firms has grown 127 times faster that worker pay, according to Roosevelt. In fact, the ratio of CEO-to-worker pay has increased 1,000 percent since 1950, according to Bloomberg.