A day after President Barack Obama gave us all permission to go ahead and freak out about the debt ceiling, Wall Street is still taking its sweet time.

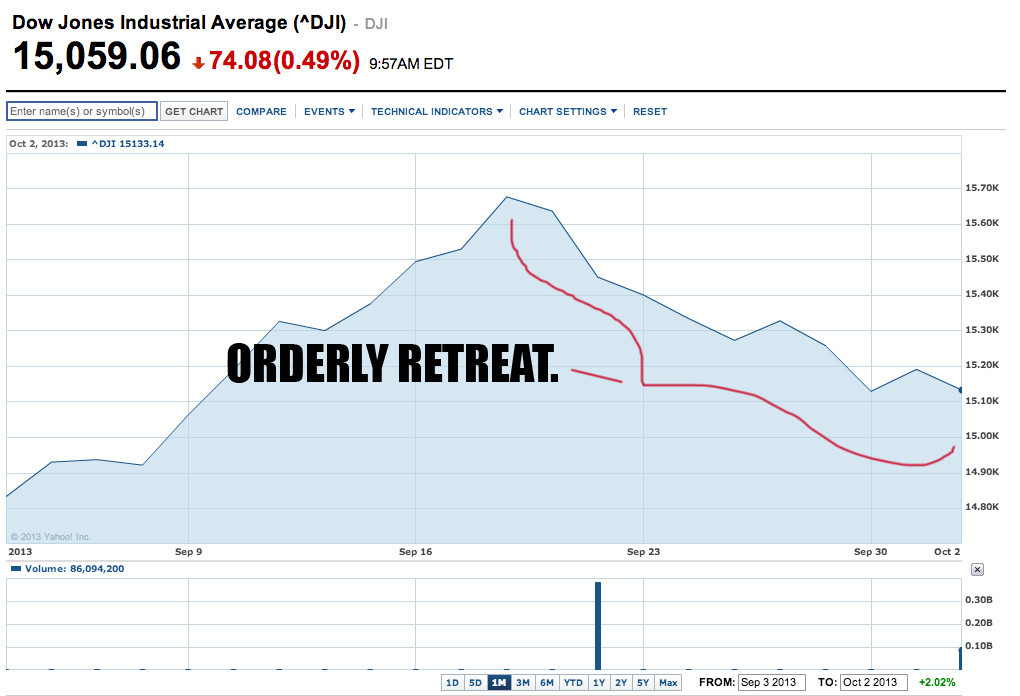

Stock and bond markets remained calm on Thursday, the third day of a government shutdown, with the U.S. just two weeks away from reaching its borrowing limit and risking a catastrophic default. In early trading, the Dow Jones Industrial Average was down about 100 points, or about 0.7 percent. The broader Standard & Poor's 500-stock index was also down by about 0.7 percent. Update: Around midday, the selling had picked up a little bit, with the Dow down about 160 points, or more than 1 percent. (Story continues after chart of non-panic.)

In the bond market, where investors often flee for safety, interest rates were steady, with the yield on the 10-year Treasury note holding at 2.62 percent. This is not what would be happening if traders were buying up bonds in a panic.

Though stocks have gently drifted lower over the past few weeks, the selling has been orderly. The Dow is down only 4 percent since September 18. Obama, in a CNBC interview on Wednesday, suggested Wall Street was too complacent about the risks.

"I think this time's different," Obama said when asked about investors' apparent nonchalance about the political battle in Washington. "I think they should be concerned."

His Treasury Department chimed in Thursday morning, warning that a "default would be unprecedented and has the potential to be catastrophic: Credit markets could freeze, the value of the dollar could plummet, U.S. interest rates could skyrocket, the negative spillovers could reverberate around the world, and there might be a financial crisis and recession that could echo the events of 2008 or worse.”

Wall Street CEOs are with the program, at least. After a meeting with Obama on Thursday, they joined him in warning that things could get hairy in a hurry.

"There is precedent for a government shutdown," Goldman Sachs CEO Lloyd Blankfein said. "There's no precedent for default. We're the most important economy in the world. We're the reserve currency of the world."

It is probably in Obama's interest -- and the economy's, really -- for markets to raise a much bigger fuss about the risk of a default. As long as markets remain calm, the Tea Party caucus in the House will feel emboldened to keep holding the debt ceiling hostage, and Republican leadership won't feel pressured to bring them in line.

The problem for the freak-out-now crowd is that most of Wall Street still can't believe that Republicans would ever be so crazy as to let the government default on its debts.

“We will go right up to the point of extreme idiocy, but we won’t cross it,” Warren Buffett, America's grandfatherly investing guru, said on CNBC on Thursday.

Morgan Stanley economist Vincent Reinhart, formerly with the conservative American Enterprise Institute, predicted in a note to clients on Thursday that Obama or the Federal Reserve would break the law to avoid a default.

There are small signs that investors are bracing for impact, but you have to squint to find them. Yields on one-month Treasury bills have spiked in the past few days, as money market funds have dumped bills that mature right after Oct. 17, the date of the expected debt-ceiling breach, notes Ken Sweet of the Associated Press. And the cost of insuring against a U.S. debt default is slightly higher.

Still, it seems that some people are only going to seriously consider the threat of a crisis-causing debt default until the very last minute. But when they do, watch out.