If the U.S. breaches the debt ceiling, Halloween is going to be truly terrifying this year.

Though everyone is focused on October 17, the day the U.S. will no longer be legally able to borrow money, the country still should be able to meet its financial obligations after that date. Using a combination of revenue coming in from taxes and various fees plus $30 billion cash on hand, the federal government likely will carry on for about 10 days.

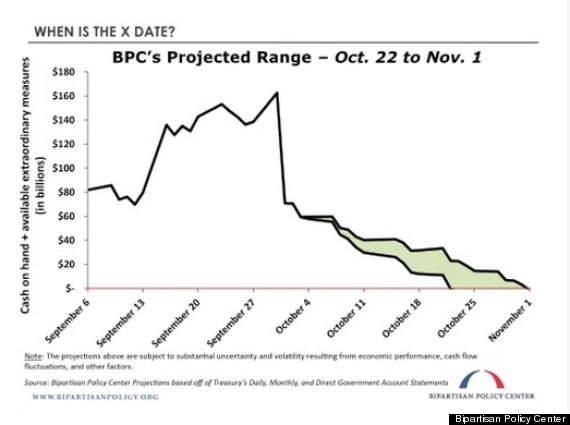

Then the the U.S. hits the "X-date" -- likely between October 22 and November 1 -- and will no longer be able to pay its obligations in-full and on-time.

David Ader calls it the "go to hell" deadline. He's the head of U.S. government bond strategy at Stamford, Connecticut-based CRT Capital Group, a financial services firm.

Check out this chart from the Bipartisan Policy Center.

After the X-date, “it becomes much less certain what would happen because that’s a point -- at least in the modern era -- that we’ve never gotten to,” Shai Akapas, a senior policy analyst at BPC, told HuffPost

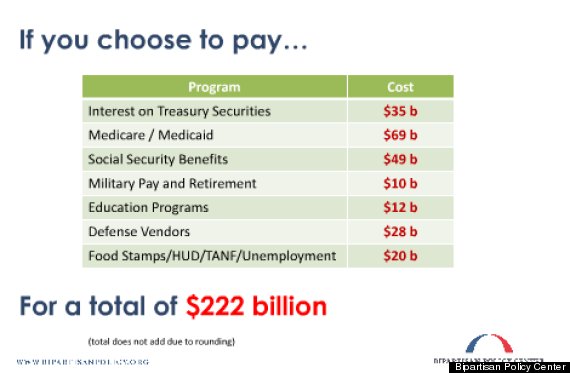

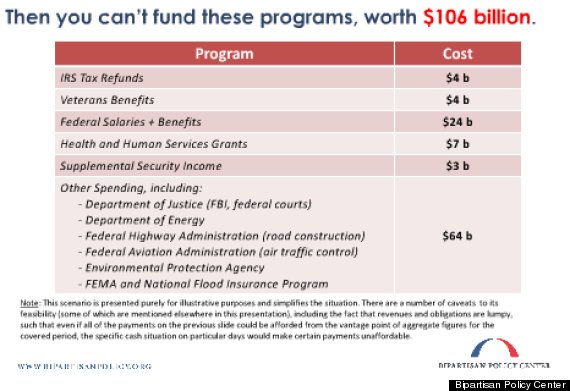

The country will have to make some unprecedented decisions about who gets paid, said Akapas.

One option would be to prioritize payments and pick certain bills to pay over others. As BPC notes, Treasury likely doesn't have the legal authority to do this -- and the government could be facing a swath of lawsuits from "stiffed" beneficiaries after the stalemate ends. In addition, it would be logistically difficult given that Treasury makes millions of payments per day, which go through a simple computer check that likely isn't smart enough to prioritize payments.

Here's a hypothetical dilemma officials would face under this scenario, according to BPC.

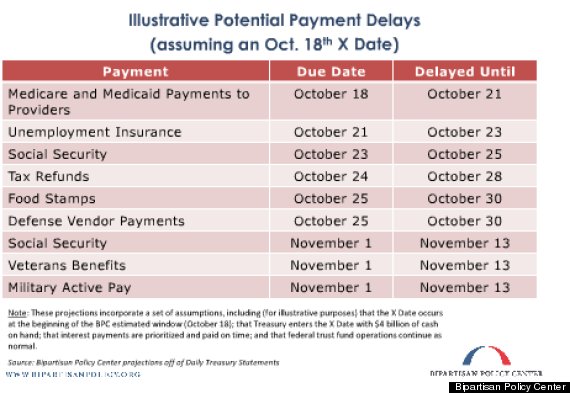

Another option would be to delay the payments until Treasury has enough money to pay each day's worth of bills. Though the Office of the Inspector General found in a 2012 report that this would likely be the least harmful option, it would still mean the government would have to pay higher interest rates on that debt because they would have paid the bills late.

Here's a hypothetical of that scenario from BPC.