People have been buzzing about a new study suggesting the U.S. job market is in better shape than we think. If that doesn't sound right to you, that's because it's probably not.

The alarming shrinkage of America's labor force since the Great Recession is mainly just a function of Baby Boomers retiring, according to a paper by economists at the New York Federal Reserve.

If these economists are right, then that means the recent swift drop in the official unemployment rate is a real sign of job-market health and not a function of people giving up on finding work. It also means that "slack" in the labor market could disappear more quickly than anybody expects. That could cause inflation pressures to rise suddenly, forcing Fed policy makers to raise interest rates to cool down the economy much sooner than they expected.

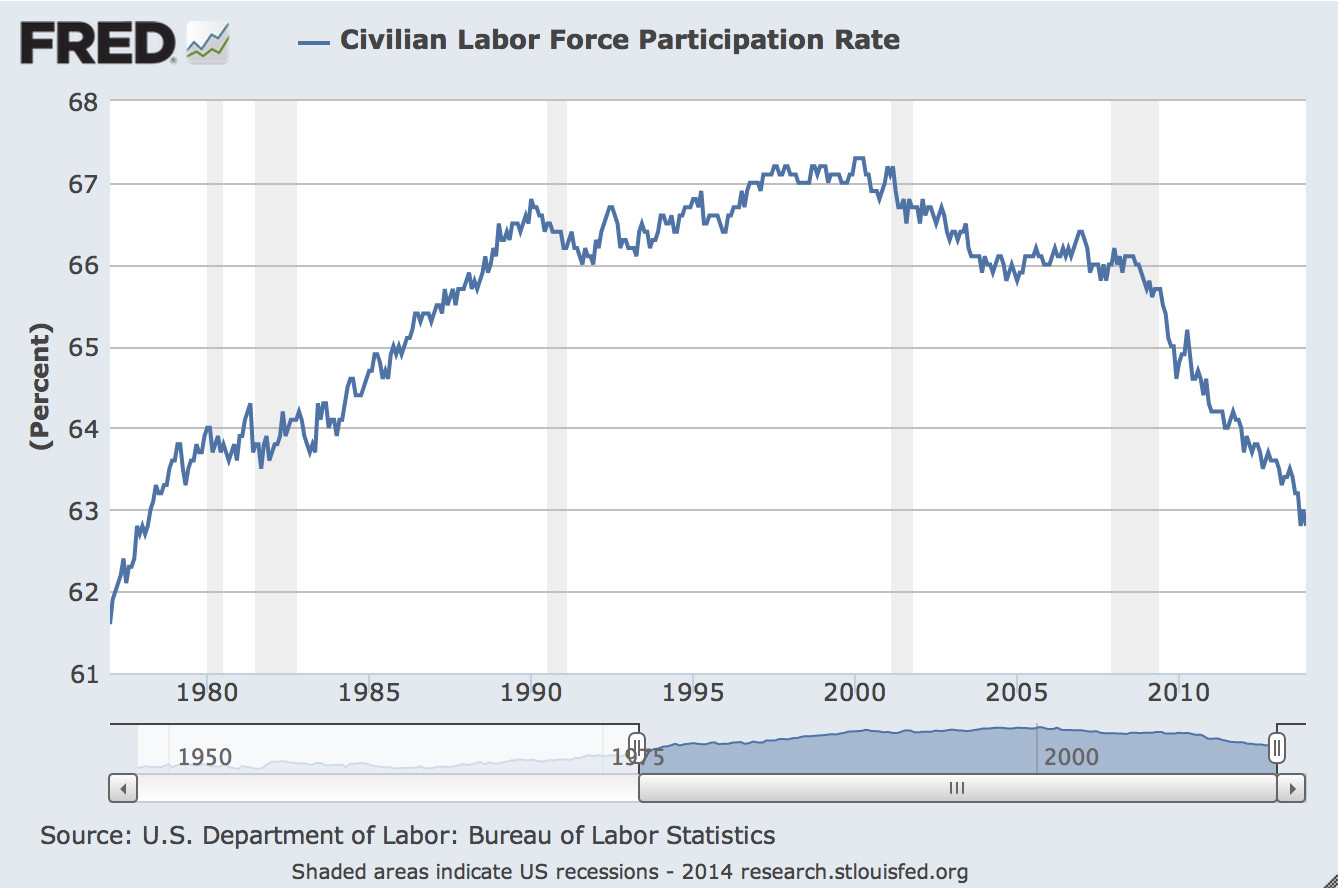

Before we break down why this is wrong, let's look at what we mean by labor-force shrinkage. Here's a chart of the labor-force participation rate, the percentage of working-age Americans either working or looking for work. (Story continues after chart of shrinkage.)

As you can see, labor-force participation has been falling since the start of the 21st century, but really collapsed after the recession, to the lowest levels since 1978. It has seemed obvious -- and previous studies have shown -- that a big reason for the dizzying drop in the labor force was a weak recovery and a lack of good job opportunities. Labor-force participation is trending down anyway because of Baby Boomer retirements, sure, but clearly something else happened after the recession.

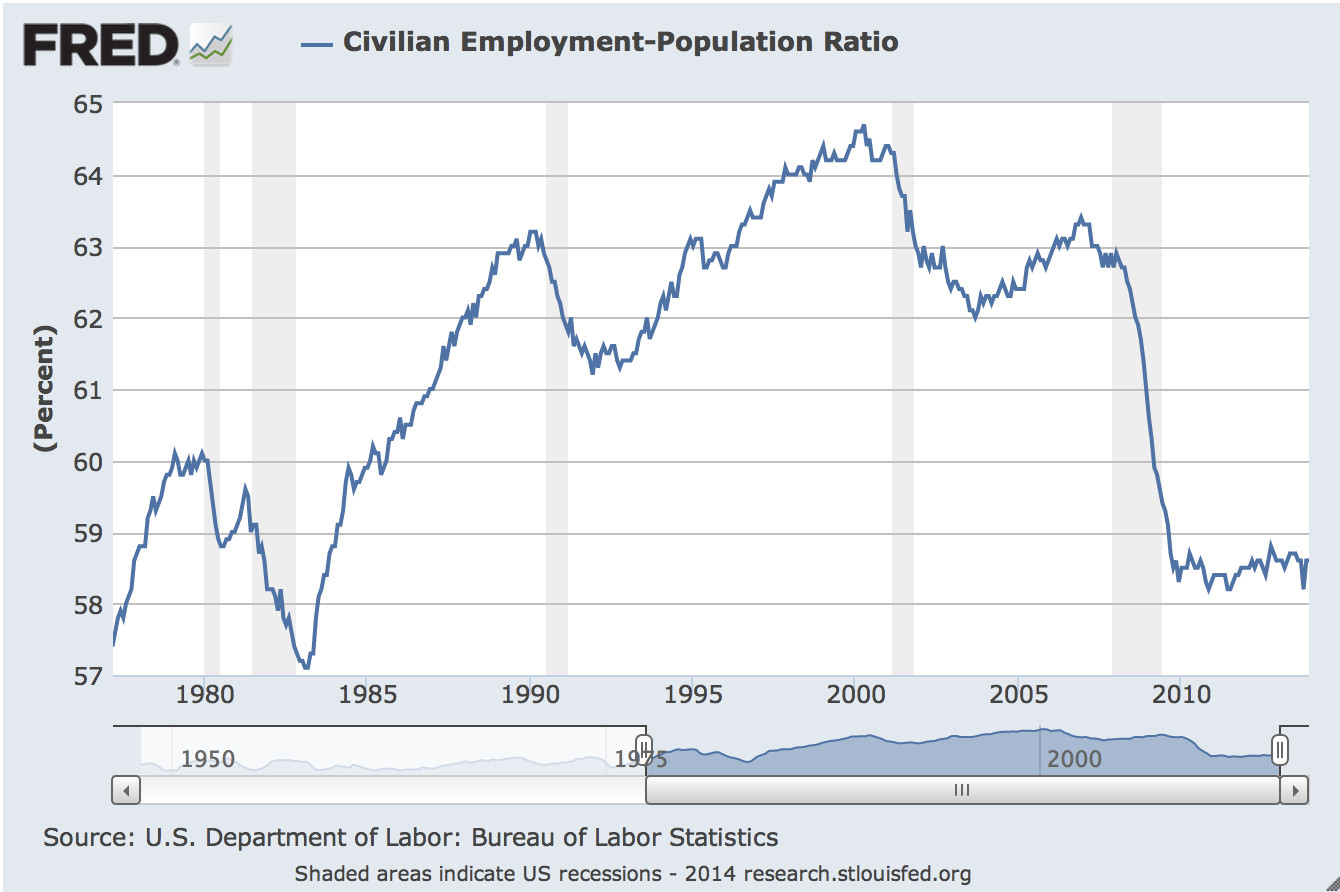

Here's another way of looking at it: This is the employment-population ratio, the percentage of adult Americans with a job. As you can see, it collapsed to 30-year lows during the recession and has never recovered. (Story continues after chart.)

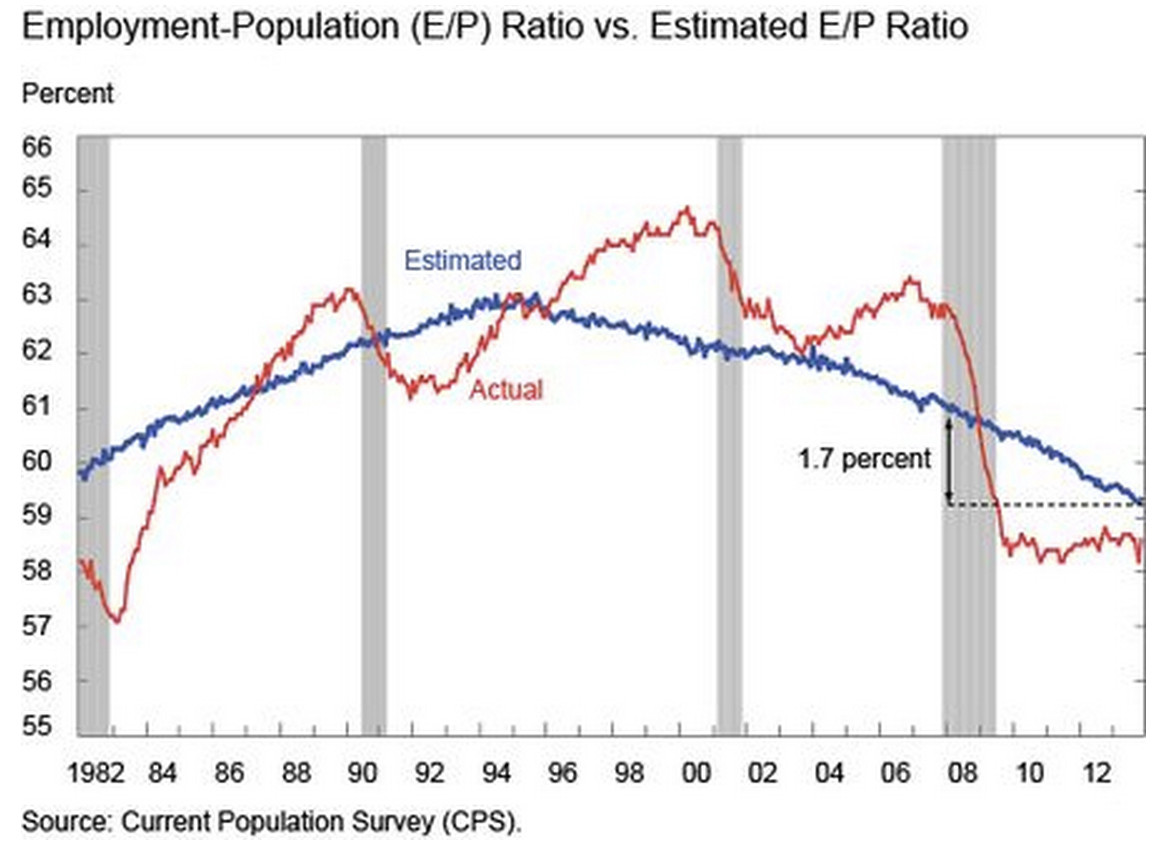

The New York Fed economists say this particular chart is misleading because it doesn't account for a mass of retirees. To fix this, they built a model, like economists do. And the model decided that waaaay too many many people were working just before the recession, demonstrated by the red line in the chart below. (Story continues after the New York Fed's chart.)

The current state of the job market, in other words, is more less as it should be, like it or not.

"What this does is in effect build the Lesser Depression into your definition of normal," Paul Krugman wrote in a blog post in response to the study.

But if the job market was overheated before the recession, as the New York Fed's model says, then inflation pressures should have been rising. Instead, they were falling, Krugman noted. Krugman suggested that Baby Boomer retirements account for only about 40 percent of the drop in labor-force participation since the recession. Chalk the rest of it up to sluggish demand.

An even bigger problem with the study, which both Krugman and Bloomberg View's Matthew Klein pointed out: It fails to account for the fact that young people's share of the labor force has shrunk since the recession, while older people have taken a bigger share.

"Americans 55 and older didn’t lose their jobs during the recession to the extent that younger ones did," Klein wrote. "In fact, the proportion of older Americans with a job is higher now than in 2006, partly because it is harder to retire than in the past when asset prices were high and rising."

The New York Fed study will be unusually influential because it emerges from, you know, the Fed. It will almost certainly be read closely by Fed Chair Janet Yellen and other people with the power to move interest rates and the economy. Are they willing to bet the recovery on it being right?