Federal Reserve Chair Janet Yellen might not know what is causing a massive income inequality problem in this country, or how to solve it. But at least she knows when it got started.

"I think the issues of income inequality, of rising income inequality, in this country really date back many decades -- probably to the mid-eighties, when we began to see a very substantial widening of wage gaps between more-skilled and less-skilled workers," Yellen said on Thursday during a Senate Banking Committee hearing on the economy. "And this is a trend that unfortunately has continued almost unabated for the last 30 years."

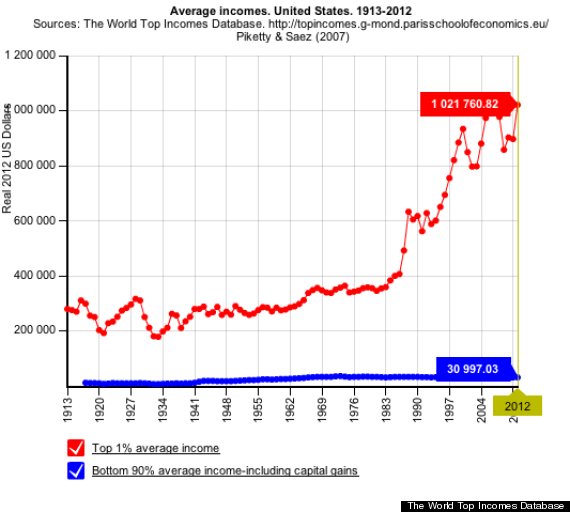

Yellen is right about the timing (which she has identified before): The rich really started leaving the rest of us in the dirt during the Reagan administration, as you can see from this chart, using data from the World Top Incomes Database (story continues after chart):

Like her predecessor Ben Bernanke, Yellen offered a couple of the usual stock explanations for widening inequality: technological change and globalization. But those two trends didn't just abruptly get much worse in 1987, leading to the sudden spike in inequality that is plain to see on the chart above.

Instead, President Ronald Reagan cut income-tax rates on the wealthy in 1986, directly contributing to the mid-80s spike in inequality, according to a 1999 Cleveland Fed study.

Reagan also raised tax rates on investment income, which helped keep some of the inequality boom in check. But Republicans in 1997 slashed those taxes, too, leading to another boost in inequality.

Then the Great Recession came along and hammered low-income Americans much harder than high-income Americans, driving an even bigger wedge between the haves and the have-nots, Yellen said.

"Households and segments of our population that had already been suffering stagnant or declining incomes for many years have seen the recession take a large toll," she told the Senate.

This is a real problem for economic growth, International Monetary Fund economists pointed out on Wednesday. Helping the economy grow is one of Yellen's responsibilities as Fed chair, so it behooves her to understand how to address this problem.

So far, aside from identifying the start date, Yellen's thoughts on the issue aren't very encouraging.

Asked what Congress could do to help, Yellen offered more stock solutions: More education and training for workers and kids. Those could help with the issues of technological change and globalization, maybe -- although more education sure hasn't helped raise the incomes of low-wage workers.

Yellen did not mention another approach that could also help with the problem: Rolling back those massive tax cuts for the wealthy that started the whole ball rolling back in the 1980s.