Austerity is the opposite of the gift that keeps on giving: It just keeps taking and taking.

Germany, the world's homeland for austerity obsession, is learning this firsthand. Its economy has hit a rough patch lately, likely worsened by its adamant refusal to spend just a little bit more money to keep things moving. This has Europe on track for its third recession since 2008, which has raised the threat of a global economic slowdown, which has rattled financial markets from Hong Kong to New York. Thanks, Germany! Thanks, austerity!

Germany last week reported its biggest one-month plunge in factory orders since the bad old days of the 2009 recession/depression, as you can see from this chart from TradingEconomics.com:

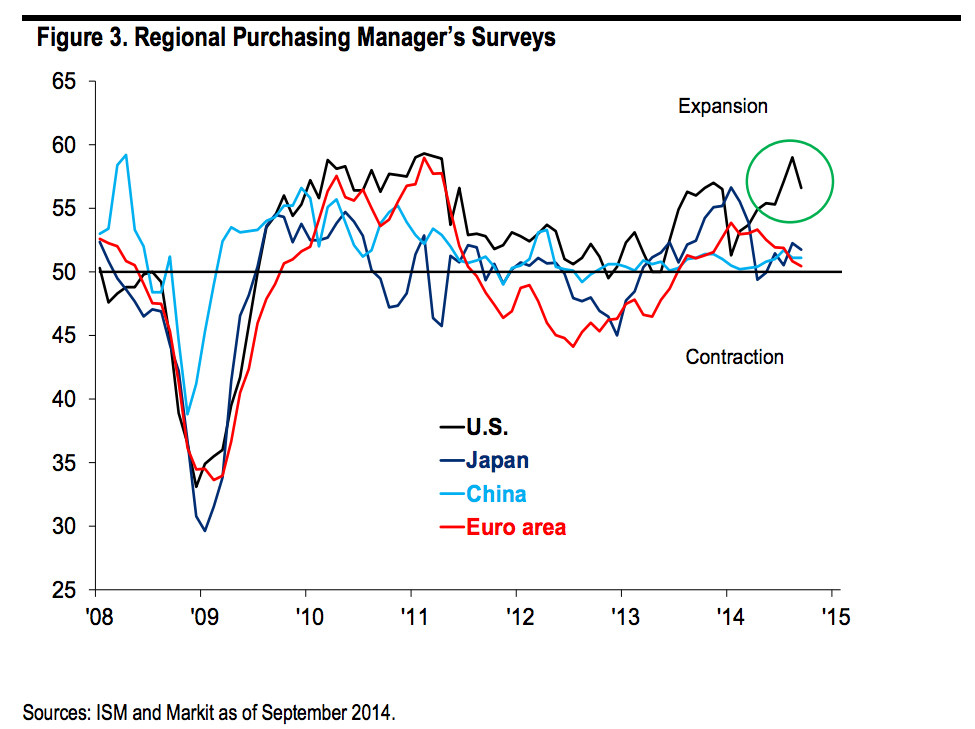

Germany also posted its biggest one-month drops in industrial output and exports since 2009. Germany is Europe's economic engine, and it appears to be driving the continent right into a recession. Take a look at the red line on this recent chart from Citi Private Bank showing how corporate spenders in various parts of the world feel things are going:

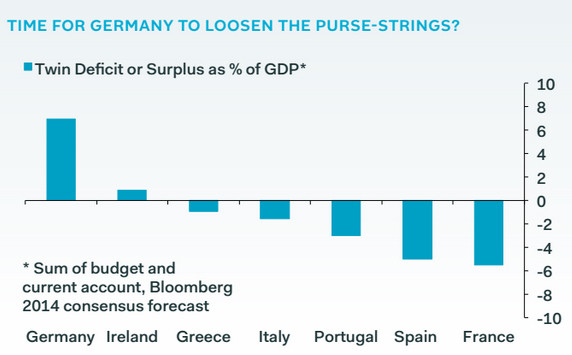

After decades of pinching deutsche marks, Germany is pretty much the only country in Europe with the spare cash to throw at this problem, as you can see from this chart by research firm Pantheon Macroeconomics (h/t Business Insider):

Global economic leaders at International Monetary Fund meetings in Washington this past weekend hammered on Germany to spend some of its money, already.

But German Finance Minister Wolfgang Schaeuble declared that "writing checks" won't fix economies and even urged France and Italy to take on more austerity.

Schaeuble's refusal to change is the latest example of a long-lasting German fetish for austerity, tracing back to the years after World War I, when inflation got so bad that Germans toted cash in wheelbarrows. Germany's economic psyche was so scarred that it vowed to avoid inflation forever. Sounds reasonable, and that approach has worked out well for Germany -- until recently. For the past several years it has resisted using its cash stockpile to help itself or its neighbors, despite an ongoing depression, and it has insisted that its neighbors be just as austere as Germany, plainly worsening the depression. It's a pathology that pretty much everybody else in Europe and the world now sees, but Germany refuses to admit -- even though its infrastructure is starting to crumble along with its economy.

So it falls on the European Central Bank to try to keep Europe's economy afloat -- but Germany is fighting that, too. ECB chief Mario Draghi wants to try out some Federal Reserve-style bond-buying soon, but the head of Germany's Bundesbank is kicking and screaming against the idea, causing a distracting rift at the top of the central bank.

Austerity fever -- egged on by a now-discredited research report that claimed government debt is bad for economies -- has been hurting economies around the world since the Great Recession.

Countries on Europe's periphery like Greece and Italy have been forced to swallow painful economic reforms, worsening their depressions. In the U.S., the harshest government-spending cutbacks since the end of the Vietnam War have hurt growth, too, though the effects haven't been nearly as strong as in Europe. Still, a lack of funding for medical research in the U.S. is a big reason we don't already have an ebola vaccine, the Huffington Post's Sam Stein reported.

Austerity just keeps finding imaginative new ways to be terrible.