The Forbes 500 is still, as The New York Times described it in 1987, "a gossipy ranking of the country's richest people." Increasingly, those people are from the financial industry.

Finance -- banking, investing, hedge funds and private equity -- accounted for 14 percent of the world's 500 richest people in 2015, as listed by Forbes on Monday.

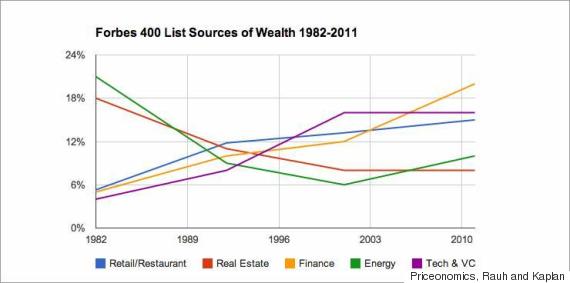

Finance has not always had such a big share of the uber-wealthy. Of the 400 Americans on Forbes' first rich-people list in 1982, just 4.4 percent derived their wealth from finance, according to an analysis by Joshua Rauh of the Stanford Graduate School of Business and Steven Kaplan of the University of Chicago's Booth School of Business. That share jumped to 20 percent by 2011, according to Rauh and Kaplan.

Priceonomics charted that rise –– look at the light-orange line below:

That's a chart of what is known as "financialization" -- the term that describes interlocking and reinforcing trends: the rise in size and importance of the financial sector relative the the rest of the economy and the fact that non-finance companies increasingly make money from finance-like activities.

The result is an ever-decreasing connection between the prosperity of the financial system and the economy as a whole.

And the trend continued after 2011, where Rauh and Kaplan's research left off: In Forbes' 2014 list of the 400 richest Americans, 26 percent derived their wealth from finance.

And the share of wealthy Americans coming from finance is much greater than the 14 percent of the world's wealthy coming from finance in 2015 -- America is ahead of the world, it seems, in financialization.

The Washington Post's Lydia DePillis has a great primer on how one aspect of financialization -- putting shareholder rewards above other interests -- is changing the economy. It's a huge trend (The Roosevelt Institute is starting a new project to study it, if you're interested), and one that started in the early 1980s -- right around the time when Forbes began tracking the richest of rich people.

It's gossipy, sure, but Forbes' catalogue of the giga-wealthy is useful gossip. It's what financialization looks like, in list form.