With the stock market hitting new record highs, the "b" word has begun to surface again in those "serious" conversations that news programs like to have. For the uninitiated, that's "b" word as in "bubble."

But if today's conditions do represent a bubble, it is one that has quite different characteristics than those of its ancestors, so much so that we really need to invent a new term for it.

Not a Run of the Mill Hysteria

For one, bubbles are usually characterized by irrational optimism, such as the belief in the late 1990s that the internet was going to quickly shake up every industry, or the belief in 2006 and 2007 that housing prices would continue to go up 20% a year forever.

Should it in fact exist, today's bubble might go down in history as the first in which the majority of participants were pessimistic while it was happening.

For most of the past few years, for instance, retail investors - popularly thought to be the classic suckers who cluelessly buy at the peak of the market - have actually pulled money out of equity funds. Even in recent weeks when inflows have turned net positive, more money continues to flow into lower-risk taxable bond funds than to equity funds. There is hardly a rush to the proverbial punch bowl.

Meanwhile hardly a day goes by without an "expert" somewhere loudly and publicly warning that markets are doomed. Former Reagan budget-chief David Stockman, fund manager John Hussman, and hedge-fund superstars like Jim Rodgers and Stanley Druckenmiller are a few recent examples.

Of course the relative absence of irrational exuberance does not prove by itself that we are not living in a bubble. What should really matter is whether financial assets are selling for a crazy valuation, as was the case with stocks in 1999 (when they had a cyclically-adjusted P/E of near 50 vs. a long-term average of around 15) and housing in 2006 (when homes nationwide sold for 400% of median incomes vs. a historical average of 250%).

Here too, today's bubble looks a little different.

Whereas in the past it has been the riskier or more novel assets that are the first to turn "frothy," today the assets that are most obviously trading at eye-gauging levels relative to their fundamentals are some of the oldest and supposedly safest assets of them all: government bonds. The thirty year long-bond has a lower yield than in 98% of all periods since 1950, while the fundamental ability of the US government to repay its obligations in non-inflated dollars would seem to stand at a post-war low, given the combination of deficits and unpaid future obligations that stretch as far as the eye can see, and the complete lack of political will to do anything meaningful about them.

The roaring stock market looks only moderately insane by comparison.

The S&P 500 is currently trading at a sober 14 times estimated 2013 earnings. On longer term measures such as the "Shiller PE" (which averages earnings over the past ten years to remove cyclical effects), the market is trading at a richer 23x earnings, vs. a historical average of 15x. But even this metric shows potential for a 100% return from here before we get back to 1999 levels of overvaluation.

Somewhat paradoxically, the most compelling case for a bubble in the equity markets might be the record health of US corporations. Corporate profits in 2012 represented a post-war high of 12% of the economy, almost twice their long-term average. Basic economic logic suggests an eventual reversion to the mean.

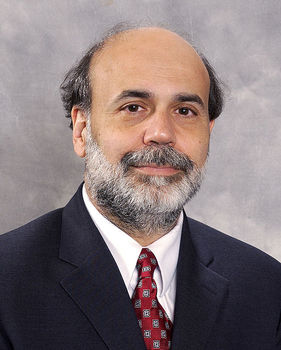

Blame it on the Bernanke?

If "bubble" is not quite the right word to describe conditions today, perhaps there is a better one-word description that conveniently also starts with a "B": Bernanke.

Whereas in a bubble, risk assets are bid up on irrational optimism and speculation, in a "Bernanke" they go up because in a world of zero-interest rates and massive growth in the monetary base that fuels fears of an eventual inflation, there are few other good places to store long-term capital.

In fixing short-term interest rates at 0% and repeatedly purchasing long-dated Treasury bonds with printed money, Federal Reserve Chairmen Ben Bernanke and his colleagues have taken away the luster of the traditional safe-havens and forced investors - somewhat against their will - back into the equity markets.

The result is rising asset prices and stretching valuations. But not because there's a bubble so much as because there is a Bernanke.