It's a painful question that we all have to ask ourselves. Most of us have heard the horrifying statistic that one third of Americans are one paycheck away from being homeless. As the economy shifts from industrial to informational and from local to global, we will see more workers displaced. What are you doing to safeguard yourself and your family? September 22nd was Business Women's Day so this topic should be top of mind for women.

This question hits very close to home for me right now. I recently quit my job as a corporate attorney to become a full-time author, publisher, speaker, educator, and entrepreneur. I need financial help to deal with the feast and famine aspect of business ownership now more than ever.

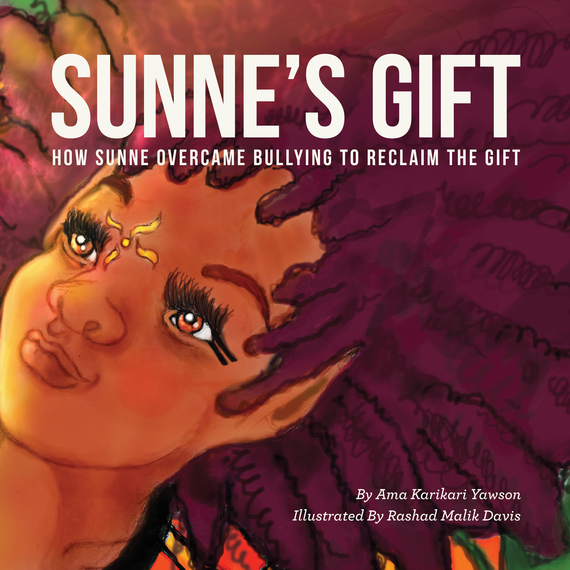

My TEDx talk on the most important lesson to teach children.

I polled a bunch of friends, including Tiffany "The Budgetnista" Aliche who is a budgeting guru who empowers tens of thousands of women to take control of their finances. This is what they had to say.

1. Do Something

Tiffany "The Budgetnista" speaks to tens of thousands of women and says that many of them feel paralyzed financially. They think that they make too little to save, too little to invest, and have costs that can't be reduced. Her advice is to start somewhere -- no matter how small such as a dollar a month. I could not agree more, before I became determined to save in order to get some cushion before leaving my job, I also thought that there was no way to save. But where there is a will,there is a way. Once I became determined and openly expressed that determination, other things started falling into place. My husband saw an ad on the subway for student loan refinancing and then I refinanced my hefty student loans. A neighbor told me about a less expensive home-based preschool. My parents moved around the corner and could help take care of my kids, thereby reducing my need for high-priced night babysitting. Become determined and things will happen.

2. Get Help

World famous author and motivational speaker Lisa Nichols often says that wealth is a team sport. I agree and I try my best to speak to my tax accountant and financial planner pretty often, in addition to keeping up with the sage advice of Tiffany "The Budgetnista." There are so many tools out there that you have no excuse. Personal Capital, for example, has apps for you to engage in financial planning from your phone. They even have a retirement calculator. There is no excuse for you not to get help.

3. Think Long Term When Making Every Day Decisions

Women entrepreneurs, Tamecca Tillard, Dr. Lexx James, Desiree Lyle and Nadira Branch all advise to think long term about everyday decisions and purchases. When you invest in quality products you eventually save both time and money. The next time you make even a clothing purchase, you should ask yourself whether the item will last and continue to bring you joy in the future, and whether it actually can be monetized through a resale in the future. Before you make purchases for home goods, think about whether you already have spent money on products or services that can achieve the same result. Money is a tool, so use it wisely.

I hope that this helps. Read more articles like this on my blog purchasinglove here.