We will not know for six months or even for six years whether or not this G20 Summit has been a success. But what we can be sure of is this: it will not create a 'new world order.' Indeed I believe it could be worse. I am willing to bet that the Group of 20 leaders will very likely fail in their aim of stabilizing the global economy.

The Summit Communique makes plenty of fine noises about being kind to the poor. Once again there are promises of $1 trillion for boosting lending to poor countries and export support for these countries. There were similar sound-bytes, and similar commitments made at the Edinburgh G8 Summit in 2005 - commitments yet to be fully honored.

Second, and as if to hide their disagreement over the really big issues (a global fiscal stimulus, and more stringent regulation of the financial system) much was made by Gordon Brown of the re-financing of the IMF -- the most loathed and marginalized of international financial institutions.

The motivation is clear: the IMF is a Euro-Atlantic institution, and the Europeans want its finances bolstered so that the economies on the fringe of Europe -- like Hungary, Latvia, Ireland, Iceland and Greece -- can be prevented from bringing down the whole of the European project, and with it the Euro.

The IMF is largely irrelevant and shunned by Latin American and particularly Asian countries. Many of the countries I have worked with struggled to get out from under its inflexible economic austerity, and abhorred its double standards. (Fiscal stimulus for the rich countries, austerity for the poor.)

Especially after the disaster of the 1998 financial crisis, in which the IMF's approach and policies accelerated the collapse of banks, the rise in jobless numbers and the impoverishment of millions. When Mexico, Brazil, Singapore and Korea recently needed financing - they did not go to the IMF, but to the US Treasury, as Devesh Kapur and Arvind Subramanian noted recently.

So propping up an institution that is largely marginal to this crisis does not convince me that G20 leaders are serious about salvaging the international financial system.

But then how can we expect them to be?

Asking the G20 to fix the international financial architecture is counter-intuitive. Like asking a bunch of cowboy builders to re-build the gutted kitchen, illegal loft conversion and rumbling extension of a collapsed McMansion home.

They just can't do it. The McMansion that is globalization -- or global financial de-regulation -- was built on shaky foundations by these and previous G20 leaders and their central bankers. After thirty years, it has collapsed and left behind piles of rubble, financial angst and heartache.

This is because of the way it was designed, project-managed and constructed -- by most of the political leaders arrayed before us at the Summit in London.

They cannot remedy the calamity of its collapse. All they want to do is to cover up the botched building works. They are all working hard to rebuild the existing, dodgy, financial McMansion while making sincere efforts to help the poor - and at the same time doling hand-outs to their 'mates' in the financial sector.

The fact is that our unstable, global financial and trading system can't be rebuilt. We need to downsize the system. To break it down into smaller pieces. We need to re-structure banks, and fire their managements -- just as the President fired CEO Wagoner of General Motors.

We need to separate deposit-holding institutions from gambling outfits. To make banks and financial institutions, and capital, more localised and accountable. It will be easier to keep an eye on them if they are small and local.

Big and global is hard to monitor, to hold to democratic account and to regulate.

We need to remove the moral hazard caused by encouraging and subsidizing the cowboys of the banking system -- so that they may smash up more banks, business and individual lives.

We must end the expropriation of taxpayer funds, and stop flushing taxpayer money into bonuses and dodgy off-shore bank accounts.

Above all we need to regulate the cowboys. And where appropriate, prosecute those that have acted criminally.

All this is needed, but cannot be done by these particular G20 leaders, their Treasury Ministers and their economic advisers. They are too responsible for the current mess. They lack the vision to make democracy meaningful.

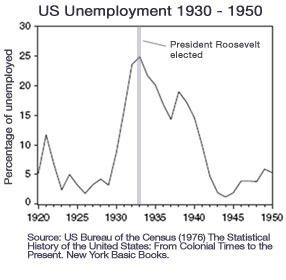

So the failure of this expensive Summit may be a good thing. Why? Because then, just as the failure of the 1933 World Economic Conference brought good news and a renewed world leadership (Roosevelt) so it might be possible for a new leadership to begin to work for a real transformation of the global economy.

Back in 1933 the World Conference of political leaders fought desperately to prop up the pre- 1929 financial architecture -- in particular the 'barbaric relic' that was the Gold Standard. They failed. Roosevelt had boycotted the World Conference, and soon after it approved the dismantling of the Gold Standard.

Immediately unemployment fell, and prospects improved. See the chart below, courtesy of Geoff Tily (Keynes, Policy and The General Theory 2009).

The likely failure of the G20 Summit may therefore give us hope: that there will soon be intellectual and political space for a renewed leadership -- and for the building of a new, more sustainable, accountable and ethical financial architecture. That will green our economy, stabilize our financial system, create jobs and restore peace and security.

A global economy that will once more make democracy meaningful.