Not long ago, while we were out shopping, my 3-year-old daughter asked if I would buy her a book about Elmo. I said we couldn't afford it, and pried it from her tiny hands.

I've recently determined that this was a big fat lie. An accounting of my spending, conducted in a fit of attempted financial responsibility, reveals that when I told my daughter we couldn't afford the book, what I meant was that I'd rather spend that money on something else. That something, in most instances, is beer.

The week I turned down my daughter's request I bought two rounds of drinks at a bar ($30), two six-packs of beer at a deli ($24) and a growler of craft beer at a local specialty shop ($13).

If you are like me, you might be thinking that beer is a magic and delicious elixir that helps one manage the stresses of parenthood. And for sure, this is not an excess on the level of a $75,000 strip club Bacchanalia.

The problem is that my penchant for pricey IPAs and local craft brews has come at the expense of my daughter's future.

Using sophisticated graphing technology, I created this chart that shows the disparity between how much my wife and I (mostly me) spent on beer, and how much we deposited into our daughter's college savings fund, over the first three weeks of January:

To date, we have deposited exactly $326.77 into her college savings fund. And I think that money came from her grandmother.

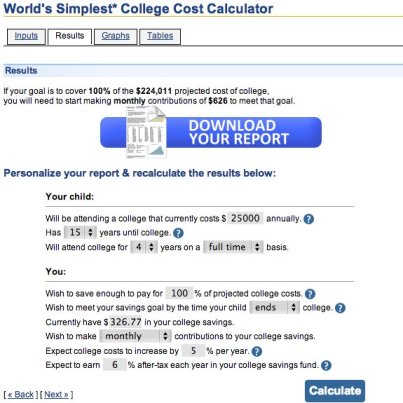

It's not all bad news: my daughter does have a separate college savings account funded by a family friend. But with costs soaring, we are going to need much, much more. The cost of a four-year education that currently runs $100,000 will swell to $224,000 in 15 years, assuming prices increase at the present clip.

And that calculus assumes she enrolls at a mid-priced state university, such as Auburn University or the University of Missouri, the two schools I attended.

Assuming a 6 percent return on investment, we would need to put away $626 a month to afford either of those colleges. Here's the breakdown:

At this point, my wife insists that I also mention the following: that she has packed her own lunch every day for 12 years, that she doesn't own a smart phone and that we eat dinner out only once or twice a month. Aside from my beer habit, we are otherwise relatively frugal people.

Still, we can obviously do better. Our new budget calls for cutting in half spending in two categories -- alcohol and coffee (line item: "stimulants and depressants") and putting that money into a college fund.

We also plan to save more for retirement and put more money into a home buying fund.

The reality for our family, like many others, is that saving as much as we would need to fully fund our daughter's college education, while also tending to other long-term savings goals, doesn't seem feasible. There's a reason why the total amount of outstanding student debt in the U.S. now exceeds $1 trillion.

It's enough to make one want a strong drink. Too bad that I can't afford one until May.