For many years, I have been studying marriage from the point of view of a theologian, convinced that the Church's understanding of marriage is historically and presently one of its weaker endeavors.

One thing I have learned is the intimate connection between marriage and economics: all societies practice marriage, and all societies have an economy. Since Aristotle, marriage has been considered the most basic unit of the economic life of any human society. Being a business in its own right, a household needs income to meet the demands of survival, both in the short-term, Spenglerian sense of civilization -- three meals away from collapse, and the long-term nurture of the next generation.

Homo economicus is therefore not the invention of Marxists. We are all actors in some economy. What kind of actors is, of course, one perennial and very personal question. What kind of economy is the other perennial question.

In a set of previous articles for The Huffington Post, I argued for a moral dimension of capitalism, but ended with a basic and not at all original complaint: the inability of present macroeconomic theories to help us predict as individuals, firms, central banks, etc., what to do in order to promote the flourishing of all. I put forth the need to consider a truly scientific approach to macroeconomics, as opposed to the fashions of... well, central bankers, schools of business and economics, advisers to political leaders. The enduring crisis post-Lehman Brothers has brought forth a good deal of commentary asserting the collapse of all those theories, as none has been of any help either in predicting the 2008 disaster or in giving sound advice for the future to ordinary people, ordinary people including our political and business and finance leaders, of course.

Science moves forward by leaps and bounds, earlier incomplete theories being corrected and augmented by better theories, giving rise to new unanswered questions accounted for in higher viewpoints. Consider, for instance, the development of Babylonian astronomy with its remarkable descriptions of planetary movements, superseded for centuries by Ptolemy's complex calculations of the planets in their courses, completely corrected by the Copernican revolution, giving rise to Kepler's three laws of planetary motion, set in much wider perspective by Newton, and, so far nowadays, needing Einsteinian relativistic considerations to get really accurate predictions.

We have had no such development in the dismal science of economics. We have fashions, politically fashionable abstractions rather than genuinely scientific theories that build upon the work of previous generations and incorporate their achievements into a wider horizon accounting for more and more (and engendering new questions, new avenues of research that eventually force yet more development). Little wonder that we seem to have made no progress since the Great Depression in improving the overall management of the economy.

There is one such theory, however, little known because this theory actually seeks to give a truly scientific account of how a modern capitalist economy works, and how it should work best for the benefit of its society. In my articles, I pointed to two books by Bernard Lonergan, Macroeconomic Dynamics and especially, For a New Political Economy. He presents in these texts -- difficult texts, you should know, scientific texts -- a general theory of capitalist economies that provides "imperatives to practical men." (This quote tells you that he did not write this yesterday.)

How to give you an appetizer, Gentle Reader, so that you will venture further? Well, first of all, what have we got to lose? All the major macroeconomic theories have shown their clear limitations. Might as well take the time to consider something fresh...

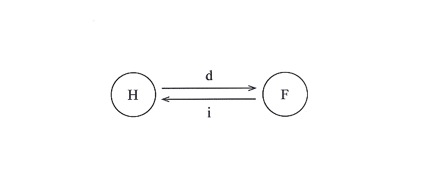

Look at this diagram.

This type of diagram is a basic fixture of economic texts. But it hides a problem. You can see the essential relationship between households H and firms F. The firms provide an income i, which engenders a demand d. Call this the "basic economy" of goods and services that we all depend upon. But firms F require themselves goods and services to make them viable. An industrial bakery, for instance, needs replacements of ovens, delivery vans, etc. They also need to avail of innovations in industrial baking techniques and materiel, but let us leave that aside for the moment. Also eventually we would need to add financing, taxes, etc., but not yet.

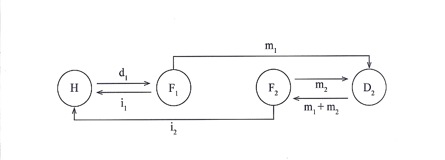

So: let us call this second economy the "surplus economy." We diagram it as follows:

m1 stands for the need for e.g., replacements, which creates demand D2 for the firms F2 providing the necessary goods and services for the producers of the basic economy's goods and services. Let m2 fill the same need for F2, and m1 + m2 be the sum of what F2 firms need to provide. Finally, for this diagram, i2 is the income that F2 firms give to households H.

This is an ugly diagram, and it can be re-shuffled to arrive at the diagram that follows:

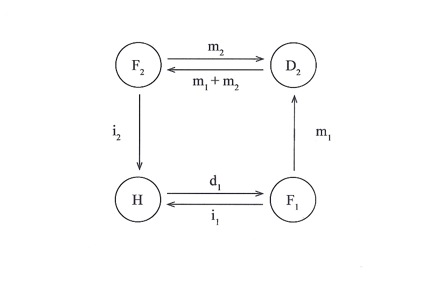

We got into this by starting with marriages, which create the households that are the basic unit of any economy in any society, pre-industrial, industrial, or post-industrial. In a contemporary household, for instance, the owners may decide they need a tablet computer like the Apple iPad. Apple has through advertising created this demand, by showing people the advantages to them of using an iPad. From the wider basic economy, the householders earn enough to buy an iPad. Apple in turn purchases them from suppliers according to its proprietary designs. There is a complex interaction between the producers of components and suppliers and Apple in order to make and improve the iPad. Eventually all this activity benefits the household (especially those who have waited to buy an iPad2).

Now that you see how simple and obvious this diagram is, its genius is that unlike any other macroeconomic description, it recognizes that there are always two, not one, economies at work, because there are two types of firms. Furthermore, they are interrelated by flows of goods and services -- and money. From this fundamental insight into the real workings of modern economies, Bernard Lonergan was able to develop a general theory of economics that is truly scientific, i.e., not just fashionable theories that are essentially commonsense observations dressed up in elaborate statistical garb. Like any truly scientific theory, Lonergan's approach concerns the real world, and seeks to give those "practical imperatives" that will enable the participants in both economies, and the governments and financial institutions that are an integral part of them, the clear understanding of what needs to be done in order for all to be able to flourish in the long run.

Philip McShane's book, Economics For Everyone, gives a basic introduction to Lonergan's macroeconomic theory (and I am indebted to him for help with the above diagrams). There are communities of thinkers learning how to implement it. It is time for this theory to be seriously considered and put to the test in the public square. It is way past time, indeed. There is nothing else like it at present.

Am I being overly dramatic? Imagine you are marooned on a desert island. The only way to survive long-term is to rehabilitate an old one-engine Cessna you have found and fly it to the mainland. And you also have to learn how to fly the plane.

OK, so you are mechanically inclined and the plane is in basically good shape. The fuel is still viable. You can get the engine to turn over and you've figured out how the controls work. You vaguely remember something about lift and drag from high school. By the seat of your pants, you are able to get off the island and crash-land back in civilization. You write a book about your experiences. It becomes a bestseller, in fact.

But could your masterpiece ever become a textbook about how to build and fly airplanes? And that your disciples could improve to reach new heights of aerodynamic science? Of course not -- it's amazing you survived at all. But this silly story illustrates where we are today with the typical macroeconomic theories.

We need the textbook. Bernard Lonergan wrote it. Flying by the seat of your pants can save your life, but sooner or later it will get you killed -- in an airplane or in the global economy.