Here's the question: Is college tuition going up to compensate for state cuts? Or do plentiful student loans encourage states to cut aid and colleges to raise tuitions?

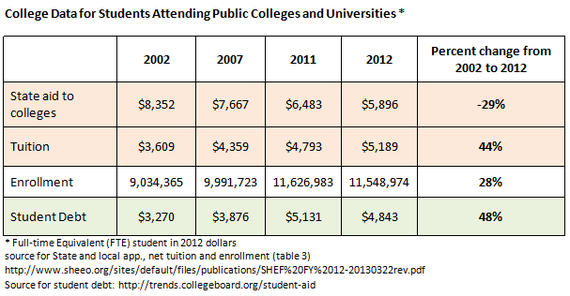

The table below offers some insight. Notice that the drop in state and local appropriations was 29 percent between 2002 and 2012, but the rise in tuition was 44 percent. The state drop can only explain the tuition rise partially. In contrast, the 48 percent increase in federal student loans track much more closely to the increase in tuition.

The availability of aid may also explain the 28 percent increase in enrollment. All things equal, a rise in price (tuition) should have lead to a cut in demand (enrollment). Only the easy availability of loans could explain how more and more students were able to cover the rising tuition prices that they could ill afford. Most of these students were given loans they barely understood by a system that taught them the road to a college degree was paved in debt.

These statistics suggest that the availability of loans enables colleges to push tuition up. It would be great if those involved would tell us. Imagine a state rep confessing, "Yeah, I knew going in that the feds would cover us when we cut aid to State College." Or what about a college administrator boasting, "every time we raise tuition we get a bigger pay check from Washington, just like clockwork!" But of course we will never hear such confessions. So how can we determine which one is driving the bus: tuition or aid?

Here is an example of the problem. Massachusetts has been steadily decreasing state-supported higher education, a 37 percent decrease in the last five years alone. For UMass schools, this led to a predictable chain of events: UMass reacted by raising tuition, thereby forcing students to take on more student loans. It's clear that increasing tuition caused student loan volume to go up. But here's the thing -- everyone knew that more student loans were available without any financial obligation to the state or UMass. So they passed the buck to the feds, who passed it on to students in the form of loans. In this case, it's clear to see that the ample availability of student loans did influence the hike in tuition.

A recent study compares the tuition of private universities in five states. They found that the schools where students have access to federal loans and grants are charging 78 percent higher tuition than the ones where students are not eligible for federal loans and aid.

There is an unspoken agreement between colleges and Washington that as long as annual tuition increases are kept to 5 percent or below, the government will keep student loans flowing. It's much harder for a taxpayer to figure out how much he is on the hook for this misguided policy. This is creating a larger and larger financial hole for all of us which will have to be closed somehow. Bet on bigger government deficits and a slower economy sure to hurt us and our children.